Kad Kredit Zero-Annual-Fee

Kami menjumpai 59 kad kredit untuk anda!

Inilah kad yang paling popular untuk rujukan anda!

Alliance Bank Kad Kredit Visa Platinum

*Tertakluk pada terma dan syarat

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Alliance Bank Kad Kredit Visa Infinite

*Tertakluk pada terma dan syarat

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

OCBC Titanium Mastercard (Pink)

Tertakluk pada terma dan syarat

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- 12X OCBC$

OCBC Titanium Mastercard (Blue)

Tertakluk pada terma dan syarat

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- 12X OCBC$

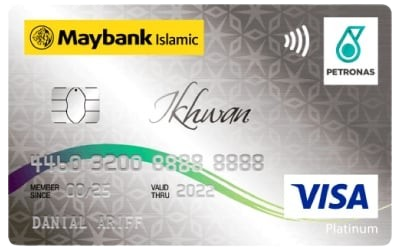

Maybank Islamic Kad PETRONAS Emas-i

Kad kredit patuh Syariah yang memperoleh sehingga 8x TreatsPoints apabila anda berbelanja di mana-mana stesen perkhidmatan petrol di seluruh negara.

- Gaji Minimum Bulanan

- RM 2,500

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 8%

Maybank PETRONAS Visa Gold

Nikmati sehingga 8x TreatsPoints pada hujung minggu dan 5x TreatsPoints pada hari minggu untuk setiap perbelanjaan di Stesen PETRONAS.

- Gaji Minimum Bulanan

- RM 2,500

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

HSBC Kad Visa Platinum

Sesuai untuk perbelanjaan dalam talian, barangan runcit & perbelanjaan luar negara dengan memperoleh sehingga 8x Mata Ganjaran untuk setiap RM1 untuk perbelanjaan tanpa sentuh, perbelanjaan dalam talian (Lazada, Shopee, Grab) dan perbelanjaan Luar Negara.

- Gaji Minimum Bulanan

- RM 3,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

BSN MasterKad/ Visa Kredit Platinum

Nikmati apa sahaja yang anda mahukan dengan lebih tawaran, lebih ganjaran dan lebih kelebihan hanya dalam satu kad kredit.

- Gaji Minimum Bulanan

- RM 4,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Maybank Kad Manchester United Visa

Nikmati 10x TreatsPoints di Stor United Direct, 5x TreatsPoints jika Man Utd memenangi perlawanan EPL dan 5x TreatsPoints untuk perbelanjaan runcit.

- Gaji Minimum Bulanan

- RM 2,500

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

CIMB Cash Rebate Platinum Kad Kredit

Berbelanja dalam talian atau untuk keperluan harian dan dapatkan sehingga 5% rebat tunai untuk barangan runcit, petrol, telefon bimbit dan utiliti.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 5%

AmBank Islamic Kad CARz Visa Platinum

Dapatkan 1 mata AmBonus untuk setiap RM1 perbelanjaan dan rebat tunai sehingga 20% untuk perbelanjaan di seluruh dunia.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- RM80/bln

CIMB Kad World MasterCard

Terima 1.5% rebat tunai tanpa had untuk perbelanjaan di luar negara dan diskaun 15% di mana-mana peniaga bebas cukai.

- Gaji Minimum Bulanan

- RM 7,500

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

HSBC Amanah Kad Kredit-i MPower Platinum

Jimat sehingga 8% bonus pulangan tunai untuk perbelanjaan eDompet, petrol dan perbelanjaan runcit yang dilindungi oleh Perlindungan Perbelanjaan E-Dagang.

- Gaji Minimum Bulanan

- RM 3,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 8%

HSBC Kad Visa Signature

Sehingga 8x mata ganjaran untuk perbelanjaan luar negara dan tempatan dengan liputan Perlindungan Pembelian E-Dagang sebanyak USD200.

- Gaji Minimum Bulanan

- RM 6,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

CIMB Kad VISA Infinite

Teman makan dan perjalanan anda yang memberi anda 5X lebih ganjaran dan 8 kali akses lounge lapangan terbang.

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 5%

Maybank Kad 2 Platinum

Nikmati sehingga 5x TreatsPoints pada hari bekerja dan sehingga RM700,000 Perlindungan Insurans Perjalanan apabila tiket dicaj ke Kad Platinum Maybank 2 anda.

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 5%

BSN Kad Kredit Emas

Nikmati ganjaran apabila anda melancong atau hanya duduk di rumah. Gunakan kad ini untuk membeli-belah, makan atau melancong pada bila-bila masa.

- Gaji Minimum Bulanan

- RM 3,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Maybank PETRONAS Visa Platinum

Dapatkan 8x TreatsPoints pada hujung minggu dan 5x TreatsPoints pada hari biasa apabila anda sambungkan kad anda dan bayar untuk petrol melalui CardTerus dalam aplikasi Setel.

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Maybank Kad American Express Emas

Nikmati 5x Ganjaran Keahlian untuk barangan runcit dan 2x Ganjaran Keahlian untuk perbelanjaan yang lain.

- Gaji Minimum Bulanan

- RM 2,500

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 1.5%

BSN Kad Kredit Klasik

Dapatkan ganjaran Happy Rewards dengan pelbagai jenis perbelanjaan di 29 juta penyedia sambil menikmati kad Touch 'n Go BSN Zing PLUSMiles PERCUMA.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Maybank 2 Kad

Nikmati pulangan tunai dan ganjaran eksklusif untuk perbelanjaan minimum RM300 dan sehingga 5x TreatsPoints untuk perbelanjaan hujung minggu.

- Gaji Minimum Bulanan

- RM 2,500

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- RM50 sebulan

BSN Kad Kredit-i 1 TeachersCard MasterCard

Kad patuh Shariah yang ditempa khas untuk para pengajar di Malaysia. Terima ganjaran setiap kali anda berbelanja sambil mencarum sebanyak 0.2% kepada YGMB!

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

BSN Kad-i Klasik

Dapatkan ganjaran Happy Rewards dengan pelbagai jenis perbelanjaan di 29 juta penyedia sambil menikmati kad Touch 'n Go BSN Zing PLUSMiles PERCUMA.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

BSN Kad 1 TeachersCard MasterCard

Kumpul dan tebus hadiah menarik melalui BSN Happy Rewards Programme - baucar, gajet, perkakas rumah dan banyak lagi!

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

BSN UUM-BSN Platinum Kredit Kad-i

Gunakan di lebih 29 juta peniaga dan 1 juta ATM di seluruh dunia dan nikmati Happy Points and pelbagai lagi kemudahan kad ini.

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Maybank Kad Visa Signature

Nikmati sehingga 5x TreatsPoints untuk perbelanjaan di luar negara dan sehingga 5% pulangan tunai bagi perbelanjaan petrol dan runcit.

- Gaji Minimum Bulanan

- RM 5,833

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 5%

Maybank Shopee Visa Platinum Credit Card

Terima 5000 Welcome Shopee Coin selepas perbelanjaan RM300 dan sehingga 5x Shopee Coin untuk perbelanjaan di Shopee, makanan, hiburan dan Pembayaran Tanpa Sentuhan.

- Gaji Minimum Bulanan

- RM 2,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Maybank 2 Kad Premier

Tebus 1,000 AirMiles dengan 5000 TreatsPoints sambil memperoleh 5 TreatsPoints untuk setiap RM1 perbelanjaan di dalam dan luar negara.

- Gaji Minimum Bulanan

- RM 8,334

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Maybank FC Barcelona Visa Signature

Nikmati imigresen pantas di lebih daripada 280 lapangan terbang antarabangsa DAN diskaun 5% di kedai rasmi FCBotiga di Camp Nou.

- Gaji Minimum Bulanan

- RM 4,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 1%

Maybank Islamic Kad-i Emas Ikhwan MasterCard

Nikmati sehingga 5% pulangan tunai pada setiap Jumaat dan Sabtu, dan 10,000 Maybank TreatsPoints untuk perbelanjaan KALI PERTAMA anda dengan kad ini.

- Gaji Minimum Bulanan

- RM 2,500

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 5%

Maybank Islamic MasterCard Ikhwan Kad Platinum

Nikmati 1x TreatsPoints untuk setiap perbelanjaan RM1 dalam dan luar negara dan 5% rebat tunai untuk perbelanjaan petrol dan barangan runcit pada setiap Jumaat dan Sabtu.

- Gaji Minimum Bulanan

- RM 3,333

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- Sehingga 5%

HSBC TravelOne Kad Kredit

Penebusan ganjaran segera dengan pilihan luas syarikat penerbangan dan rakan kongsi hotel.

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- -

Maybank Islamic PETRONAS Ikhwan Visa Gold Card-i

Dapatkan 8% pulangan wang tunai pada hujung minggu dan 1% pulangan wang tunai pada hari biasa (maksimum RM50 pulanganh wang tunai setiap bulan) apabila anda menetapkan kad anda untuk bahan api melalui CardTerus di aplikasi Setel.

- Gaji Minimum Bulanan

- RM 2,500

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- 8%

Maybank Islamic PETRONAS Ikhwan Visa Platinum Card-i

Dapatkan 8% pulangan wang tunai pada hujung minggu dan 1% pulangan wang tunai pada hari biasa (maksimum RM50 pulanganh wang tunai setiap bulan) apabila anda menetapkan kad anda untuk bahan api melalui CardTerus di aplikasi Setel.

- Gaji Minimum Bulanan

- RM 5,000

- Yuran Tahunan

- Percuma

- Pulangan Tunai

- 8%

Kategori Kad Kredit lain

Masih tidak pasti produk yang sesuai untuk anda?

Sila tinggalkan butiran dan khidmat pelanggan kami akan berhubung dengan anda!

Cara membuat permohonan dalam talian untuk kad kredit

Langkah 1

Gunakan Smart Search Kad Kredit kami untuk mencari senarai kad yang sesuai dengan keperluan anda! Pilih yang anda minati.

Langkah 2

Setelah anda mengisi maklumat anda, kami akan menghubungi anda untuk membantu anda memohon!

Baca lebih lanjut mengenai Kad Kredit

Soalan Lazim Kad Kredit Tanpa Yuran Tahunan Terbaik di Malaysia

Dengan peningkatan permintaan untuk penyelesaian kewangan yang fleksibel, kad kredit tanpa yuran tahunan semakin popular di Malaysia. Kad ini menawarkan pelbagai faedah, termasuk pulangan tunai dan mata ganjaran, tanpa beban yuran tahunan. Memilih kad kredit tanpa yuran tahunan yang sesuai dapat memberikan manfaat yang berharga, membantu anda berjimat sambil menikmati kemudahan pembayaran tanpa tunai. Panduan ini akan mengupas kad kredit tanpa yuran tahunan terbaik di Malaysia untuk 2025, termasuk ciri unik, ganjaran, dan kelemahannya bagi membantu anda membuat pilihan yang tepat.

Mengapa Pilih Kad Kredit Tanpa Yuran Tahunan?

Kad kredit tanpa yuran tahunan direka untuk individu yang mahukan manfaat kad kredit tanpa komitmen bayaran tahunan. Berikut adalah sebab ia menjadi pilihan utama:

- Penjimatan Kos: Kelebihan utama adalah penjimatan daripada yuran tahunan, yang boleh mencecah RM600 untuk kad premium.

- Perbelanjaan Fleksibel: Pengguna boleh menggunakan kad ini secara berkala tanpa perlu risau untuk "membuat kad berbaloi" dengan kekerapan penggunaan.

- Sesuai untuk Pemula: Kad ini sesuai untuk mereka yang baru menggunakan kad kredit atau yang ingin membina sejarah kredit tanpa beban yuran tahunan.

Dengan pelbagai pilihan kad tanpa yuran tahunan yang ada, setiap satu mempunyai kelebihan tersendiri. Penting untuk mengetahui mana yang terbaik untuk anda berdasarkan corak perbelanjaan dan gaya hidup.

-

- Tabiat Perbelanjaan

Memahami corak perbelanjaan anda adalah penting. Sesetengah kad mungkin menawarkan ganjaran lebih tinggi untuk kategori tertentu seperti barangan runcit, makan, atau beli-belah dalam talian. Pilih kad yang selaras dengan tempat anda kerap berbelanja. - Keperluan Pendapatan Kelayakan

Setiap kad mempunyai keperluan pendapatan berbeza, dari RM1,500 hingga RM3,000 atau lebih. Pastikan anda memenuhi kriteria untuk layak dan bahawa ia sesuai dengan bajet dan matlamat kewangan anda. - Pulangan Tunai vs. Mata Ganjaran

Pertimbangkan sama ada anda lebih suka pulangan tunai atau mata ganjaran. Kad pulangan tunai menawarkan penjimatan segera, manakala mata ganjaran boleh terkumpul untuk ditebus bagi perjalanan, alat elektronik, atau baucar beli-belah. - Faedah Tambahan

Walaupun kelebihan utama kad ini adalah tiada yuran tahunan, banyak juga yang menawarkan manfaat tambahan seperti diskaun makan, insurans perjalanan, dan tawaran rakan kongsi eksklusif. Cari kad yang menawarkan faedah yang anda akan gunakan.

- Tabiat Perbelanjaan

-

CIMB e Credit Card

Pilihan ideal untuk pembeli dalam talian yang kerap. Direka untuk pengguna digital dengan ganjaran pulangan tunai yang tinggi bagi transaksi e-dagang.

- Yuran Tahunan: Percuma seumur hidup

- Pulangan Tunai: Sehingga 12% pada transaksi dalam talian pada hari tertentu

- Faedah Lain: Pulangan tunai untuk barangan runcit dan penghantaran makanan

- Kelayakan: Pendapatan minimum RM2,000 sebulan

- Kelebihan:

- Pulangan tunai tinggi untuk pembelian dalam talian

- Tiada yuran tahunan, sesuai untuk pengguna yang jarang menggunakan kad

- Kekurangan:

- Pulangan tunai hanya pada hari tertentu

HSBC Amanah MPower Platinum Credit Card-i

Kad kredit patuh Syariah ini menawarkan pulangan tunai untuk barangan runcit dan petrol, sesuai untuk keluarga dan pengguna harian.

- Yuran Tahunan: Tiada yuran tahunan seumur hidup dengan perbelanjaan tahunan minimum RM12,000

- Pulangan Tunai: Sehingga 8% untuk barangan runcit dan petrol

- Faedah Lain: Diskaun eksklusif di kedai rakan kongsi terpilih

- Kelayakan: Pendapatan minimum RM3,000 sebulan

- Kelebihan:

- Patuh Syariah, sesuai untuk pelanggan perbankan Islam

- Pulangan tunai tinggi untuk kategori perbelanjaan praktikal

- Kekurangan:

- Keperluan perbelanjaan untuk mengekalkan status tiada yuran tahunan

Kad Maybank 2 Gold (AMEX dan Visa/Mastercard)

Kad Maybank 2 Gold menawarkan gabungan ganjaran tanpa yuran tahunan seumur hidup, sesuai untuk pengguna American Express dan Visa/Mastercard.- Yuran Tahunan: Percuma seumur hidup

- Ganjaran: 5x TreatsPoints pada hujung minggu dengan kad AMEX, 1x TreatsPoints pada kad Visa/Mastercard

- Faedah Lain: Diskaun makan, perlindungan insurans perjalanan

- Kelayakan: Pendapatan minimum RM2,500 sebulan

- Kelebihan:

- Tawaran dua kad tanpa yuran tahunan

- Mata ganjaran lebih tinggi pada perbelanjaan hujung minggu

- Kekurangan:

- Penerimaan AMEX yang terhad di sesetengah kedai, mengurangkan nilai penuh manfaat

Kad Kredit AEON Classic

Kad praktikal untuk perbelanjaan harian, Kad Kredit AEON Classic memberikan pulangan tunai yang munasabah tanpa yuran tahunan.- Yuran Tahunan: Percuma seumur hidup dengan minimum 12 transaksi setahun

- Pulangan Tunai: 5% pada pembelian AEON, sehingga 2x mata AEON

- Faedah Lain: Diskaun istimewa di kedai AEON, perlindungan insurans perjalanan

- Kelayakan: Pendapatan minimum RM2,000 sebulan

- Kelebihan:

- Kelayakan pendapatan rendah, sesuai untuk pengguna permulaan

- Pulangan tunai untuk keperluan harian seperti barangan runcit

- Kekurangan:

- Kadar pulangan tunai rendah untuk pembelian bukan AEON

-

Memilih kad kredit tanpa yuran tahunan boleh memberikan manfaat besar selain daripada penjimatan kos jelas:

- Alat Kewangan Kos Rendah: Tanpa kos tambahan yuran tahunan, kad ini sesuai untuk mereka yang memerlukan fleksibiliti tanpa kos tambahan.

- Sesuai untuk Kegunaan Kecemasan: Kad tanpa yuran tahunan boleh dikekalkan aktif sebagai pilihan sandaran untuk kecemasan atau pembelian besar yang jarang tanpa kos penyelenggaraan.

- Bagus untuk Membina Kredit: Untuk individu yang baru menggunakan kad kredit, ia boleh membantu membina sejarah kredit positif tanpa beban kewangan yuran tahunan.

- Tawaran Promosi: Banyak bank menawarkan promosi terhad masa seperti pulangan tunai tambahan atau mata ganjaran untuk pembelian kali pertama, menjadikan kad ini lebih berbaloi.

-

Walaupun banyak kelebihan, terdapat beberapa kelemahan yang perlu dipertimbangkan:

- Manfaat Terhad: Sesetengah kad tanpa yuran tahunan menawarkan ganjaran yang lebih sedikit atau kadar pulangan tunai lebih rendah berbanding kad dengan yuran.

- Keperluan Perbelanjaan: Kad tertentu memerlukan perbelanjaan tahunan minimum untuk mengekalkan status tiada yuran tahunan, yang mungkin tidak sesuai untuk pengguna ringan.

- Sekatan Kategori: Ganjaran dan pulangan tunai sering terhad kepada kategori perbelanjaan tertentu, yang mungkin tidak sesuai dengan semua gaya hidup.

-

- Pilih Kad Pelengkap: Jika anda mempunyai beberapa kad, gunakan setiap kad untuk kategori ganjaran tertinggi untuk memaksimumkan pulangan tunai atau mata.

- Sentiasa Kemas Kini Promosi: Bank sering mempunyai promosi khas untuk tempoh tertentu. Pantau kalendar promosi kad anda untuk memanfaatkan tawaran ini.

- Automasi Pembayaran Anda: Untuk mengelakkan yuran lewat, pertimbangkan untuk menetapkan pembayaran automatik untuk bil menggunakan kad kredit anda, memastikan anda tidak terlepas pembayaran.

-

Kebanyakan kad tanpa yuran tahunan tidak mempunyai kos tersembunyi, tetapi adalah penting untuk membaca terma bagi caj seperti yuran lewat, yuran transaksi asing, atau yuran pendahuluan tunai.

-

Ya, banyak kad di Malaysia, seperti Kad Kredit AEON Classic, mempunyai keperluan kelayakan pendapatan rendah, menjadikannya mudah diakses untuk individu berpendapatan permulaan.

-

Jika diuruskan dengan bertanggungjawab, kad kredit tanpa yuran tahunan boleh membantu meningkatkan skor kredit anda dengan membina sejarah kredit yang positif.

-

Sesetengah kad tanpa yuran tahunan menawarkan faedah perjalanan asas seperti insurans perjalanan atau akses lounge lapangan terbang, tetapi manfaat ini mungkin terhad berbanding kad premium.

-

Tetapkan pembayaran bil automatik atau peringatan untuk memastikan anda membayar tepat pada masanya dan mengelakkan yuran lewat, yang juga boleh menjejaskan skor kredit anda.

-

Memilih kad kredit tanpa yuran tahunan adalah langkah hebat untuk menikmati manfaat transaksi tanpa tunai tanpa kos tambahan. Dengan pilihan yang disesuaikan untuk pelbagai gaya hidup, anda pasti dapat mencari kad yang sesuai dengan matlamat kewangan dan tabiat perbelanjaan anda.

Kad kredit tanpa yuran tahunan boleh menjadi alat yang berharga untuk menguruskan perbelanjaan harian sambil memperoleh ganjaran dan manfaat tanpa kos yuran tahunan. Sama ada anda pembeli dalam talian yang kerap, pengguna harian, atau seseorang yang menghargai pulangan tunai untuk keperluan, rangkaian kad kredit tanpa yuran tahunan di Malaysia mempunyai sesuatu yang sesuai dengan keperluan anda. Dengan memahami ciri setiap kad dan menilai tabiat perbelanjaan anda sendiri, anda boleh memilih kad yang memaksimumkan penjimatan dan menawarkan faedah yang bermakna.