What’s The Payment Schedule Like For Under Con Property?

Home buyers are always on the lookout for the best deal they can find with the time and resources available to them.

Buying property while they are still under construction (under con), or also known as buying-off-the-plan, is one of the most popular ways of buying a home. The developer announces a new housing project through newspapers, social media or other networking platforms.At the same time, property agents will start going around the market, in companies and in malls to spread the word about the project. The goal is, of course, to sell as many units as possible before the project is even built.

The process of buying an under con property is slightly different from buying a completed sub-sale unit.

The contract for purchasing off-the-plan will be much more detailed because there is no tangible unit to inspect or check against. The loan settlement process is also different, as the payment for under con home loan will be progressive.

Purchasing off-the-plan allows more time (approximately 12 to 18 months or more) between contract date and settlement. Investors often use this to their advantage as it provides them with more time to ensure they are in a strong financial position.

It is a well-known fact that many projects built by reputable developers tend to get snapped up even before a single brick is laid. And developers are often clever enough to launch the development in phases. If you buy a unit in the first phase, you can automatically see the increment in the next phase. Usually the price would have gone up by 20% to 30%.

How much would you gain (if any) before the development is completed would depend on the developer, which is why buyers should always check the reputation and history of the developer of the project that they are keen on buying. If they’ve had a good track record, there is a good chance that they’ll be able to deliver the same, and vice versa. Track record of a developer is paramount.

You want to take your time when you do this because if the developer abandons the project, you will still be required to service your interest and instalment payments based on the loan agreement between you and the financial institution (bank).

However, since the bank has vested interest in the property, you could discuss a repayment plan with the bank.

The latest amendment made on Section 8A of Housing Development (Control and Licensing) Act 2012, will provide protection to house buyers to terminate the Sales and Purchase Agreement (SPA) under certain conditions.

You can avoid facing these complications by first conducting a background check on the developer and their CTOS profile. Also check if the housing developer is blacklisted by the Ministry of Urban Wellbeing, Housing and Local Government.

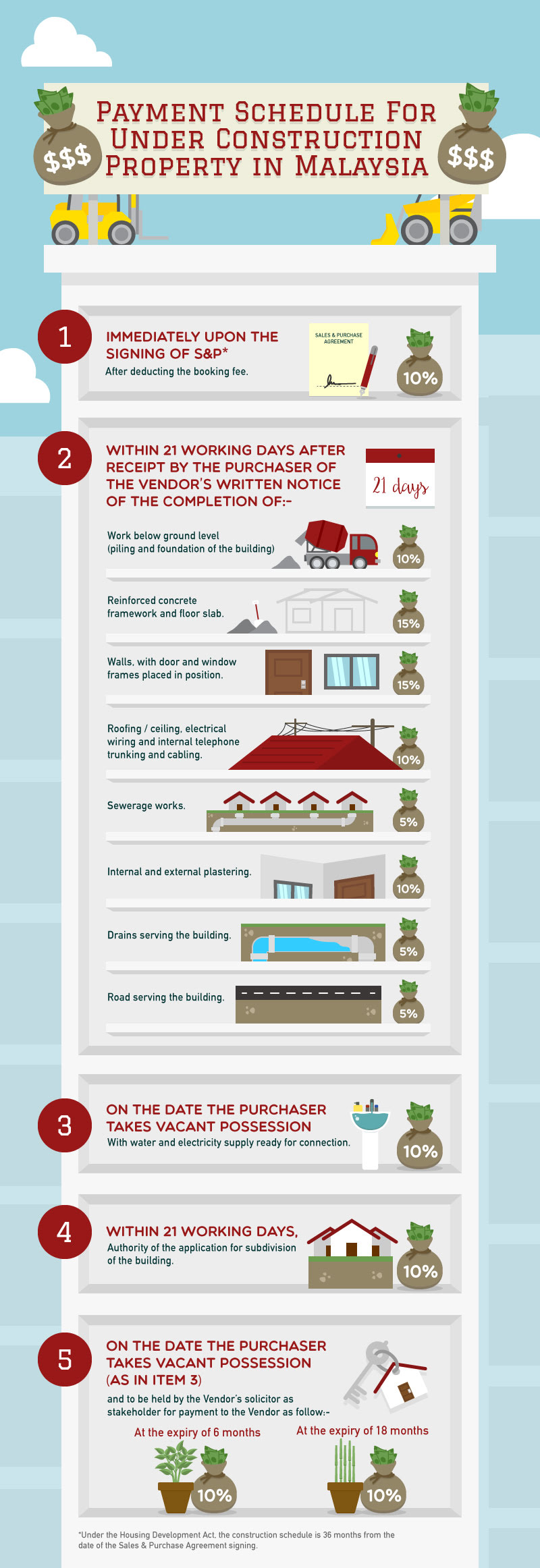

Once you’ve got all the details sorted, a typical payment instalment schedule for purchase of under con property in Malaysia will look like this:

Progressive payment makes it easier for buyer to manage their cash flow running up to the completion of the development. As you will be taking higher risk than buying a completed unit, it will require more work from you, as the buyer, to ensure the development is progressing according to plan.

Monitor the work progress through the Ministry of Urban Wellbeing, Housing and Local Government website, and you can also sound the alarm to the Ministry when things are not right. The Ministry will then step in to conduct inquiry and will also monitor the payments in the developer’s account. Ministry can stop all payments if the developer abandons the project.

Buying an under con property can make great financial sense, but only if you do your due diligence to ensure your investment will be profitable.

Owning a property can be simplified by engaging our home loan calculator to get the best home loan rate for your budget.

Saving a deposit for your home loan? Make the best of your hard-earned money by using a credit card that is tailored to your lifestyle.