The Real Cost Of Moving Out Of Your Parents’ House In Malaysia

Leaving the family home is a big step, and your bank balance will feel it. In the Klang Valley, the monthly outgoings for a first place usually start with rent and continue with electricity, water, broadband, transport and a fuller grocery bill than you might expect. The upfront hit can surprise new tenants too because renting in Malaysia typically involves several deposits and stamp duty before you even collect the keys.

This guide unpacks the cost of living Malaysia realities that matter, sets out a realistic one-bedroom budget for the Klang Valley, and highlights the small extras first-timers often overlook, from utility set-ups to furnishing a bare unit.

The aim is simple: help you decide if now is the right time to move, what you can comfortably afford each month, and how to keep costs down without sacrificing the independence you are working towards.

Cost of living Malaysia: One-off moving costs you should expect

Before your first night on the sofa, a landlord will usually ask for deposits. In practice, renting in Malaysia often means a two-month security deposit plus a half-month utilities deposit, on top of the first month’s rent in advance. That is a common market norm highlighted by local property guides, though individual terms can vary by landlord and building.

You must also budget for stamp duty on the tenancy. Malaysia calculates this based on annual rent and tenancy length after an RM2,400 annual exemption. For agreements of one year or less, it is RM1 per RM250 of annual rent above the exemption, and RM2 per RM250 for one to three years. Banks and property portals explain this formula and provide worked examples for tenants.

Setting up utilities can involve separate deposits with providers. Tenaga Nasional Berhad (TNB) says the electricity security deposit is calculated from an average of six months’ expected usage, while Air Selangor notes that a deposit is collected when you open a water account. These are refundable if your account is in good order when you close it.

Renting in Malaysia: What landlords will ask for

Beyond rent and deposits, plan for small but real admin costs. Tenancy stamp duty must be paid via LHDN stamping. If you use an agent, the landlord usually pays the commission, but practices vary, so confirm who pays which fees before signing. The summary above reflects common arrangements seen on Malaysian property platforms and bank explainers.

Price check your internet and decide early if you want a home line. A baseline fibre plan such as unifi 100 Mbps is currently advertised from about RM89 per month, which suits most single-occupier flats.

Cost of living Malaysia: Your monthly budget in Klang Valley

Rents vary by location and unit type, but recent sources give you a ballpark. A national rental index put Kuala Lumpur’s average asking rent near RM2,863, while consumer guides suggest a one-bedroom flat in the city centre often lands around RM2,300, with cheaper options outside the centre. Treat these as guide rails when you benchmark listings.

Malaysia’s headline inflation is relatively low at the moment, but food prices still matter to your basket. DOSM data shows overall inflation at about 1.1% year-on-year in June 2025, with food and non-alcoholic beverages up 2.1% year-on-year. That is relevant if you are switching from family meals to cooking for one.

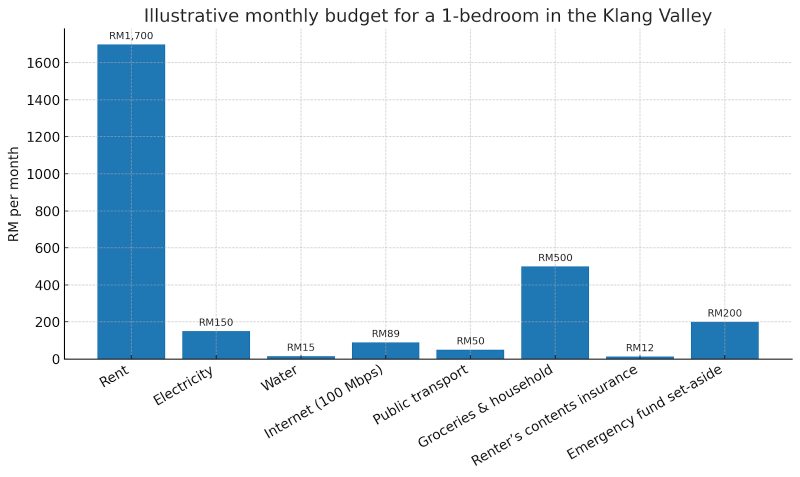

Illustrative monthly budget for a 1-bedroom in the Klang Valley

Assumptions: Mid-range 1BR rent, modest electricity usage, entry-level fibre, public transport commuter. Actual costs vary by neighbourhood, building, and lifestyle.

Renting in Malaysia: Hidden and variable costs to plan for

Electricity bills depend on your usage tier. TNB’s tariff structure and calculator show how charges step up with higher kWh, plus an 8% service tax if monthly residential consumption exceeds 600 kWh. If you run air-conditioning most nights, plan a higher figure than our illustrative RM150.

Transport costs can be optimised. If you commute mainly by train and bus, the My50 monthly pass keeps travel at RM50. If you drive, remember that fuel, tolls, parking and maintenance can easily push your transport budget well above RM400, even before any car loan.

Furnishing a bare unit is another trap for first-timers. A basic bed, mattress, fridge, fan and curtains can run into the low thousands if bought new. Consider renting a partially furnished unit or mixing new and second-hand to keep cash flow healthy in month one.

Cost of living Malaysia: Can you afford to move now?

Use the 30% rent-to-income rule as a quick sense check. With Malaysia’s updated minimum wage of RM1,700 per month now enforced nationwide from 1 August 2025, 30% comes to RM510, which will not cover a typical one-bedroom flat in Kuala Lumpur. If you earn RM4,000 monthly, 30% gives you RM1,200, which may fit a room rental or a further-out one-bedroom. This is why many first-time movers start with a room in a shared unit before graduating to a full place.

One-time cash flow checklist

- Upfront to landlord: 2 months’ security deposit + 0.5 month utilities deposit + first month’s rent. Example on RM1,700 rent: RM1,700 × 2.5 + RM1,700 ≈ RM6,800 due at signing.

- Stamp duty: Use the RM1 or RM2 per RM250 annual rent formula depending on tenancy length, after the RM2,400 annual exemption.

- Provider deposits: Electricity and water account deposits payable when you open accounts.

Practical ways to bring the bill down

- House-share first- Renting a room cuts deposits and utilities.

- Pick value internet- Entry-level fibre is often enough for solo living.

- Use the My50 pass- Fixed RM50 a month beats volatile e-hailing spends.

- Watch energy use- Fans over AC where possible and energy-efficient appliances help keep you below costly tiers.

Conclusion: Renting in Malaysia is doable with a clear plan

Moving out is not just a lifestyle milestone, it is a cash flow decision that rewards planning. Add up the true entry cost, from deposits and stamp duty to utility set-ups, then stress-test your monthly numbers against realistic rent, transport and grocery spends in your chosen neighbourhood. As a quick check, keep housing near 30% of take-home pay and start with a room in a shared unit if a full one-bedroom strains the budget. This keeps deposits lower and gives you time to build an emergency fund.

Prices vary by city and even by LRT stop, so treat “cost of living Malaysia” as a range, not a single figure. Shop around, negotiate where possible, and use fixed-price options like the My50 pass to keep transport predictable. If you can cover three months of rent upfront, two months of living costs as a buffer, and still save a little each month, you are in a good position to move.

Independence has a price tag, but renting in Malaysia can be sustainable when you enter with eyes open, a realistic budget, and a small contingency. Do the maths now, choose a starter option that fits your income, and you will enjoy your first place without money worries crowding out the win of having a home of your own.