Bank Negara Malaysia Increases OPR To 3.00%

In a surprise move, Bank Negara Malaysia’s (BNM) Monetary Policy Committee (MPC) has once again raised the overnight policy rate (OPR) by 25 basis points (bps), raising the OPR to to 3.00% as of Wednesday, 3 May.

This brings the ceiling and floor rates of the corridor of the OPR up to 3.25 percent and 2.75 percent, respectively.

This also marks the first 25bps increase this year, a move which was largely unexpected as BNM had chosen to maintain the rate at the two previous policy meetings. This is after back to back increases in 2022 which raise the OPR by 100bps.

BNM’s Monetary Policy Committee in a statement to the media today said that that headline inflation continued to moderate, but core inflation has persisted above historical averages with downside risks remaining.

“For the Malaysian economy, latest developments point towards further expansion in economic activity in the first quarter of 2023 after the strong performance in 2022. While exports are expected to moderate, growth in 2023 will be driven by domestic demand.

“Household spending remains resilient, underpinned by better labour market conditions as unemployment continues to decline to pre-pandemic levels. The pickup in tourist arrivals is expected to lift tourism-related activities.” BNM said in a statement.

BNM also noted that core inflation will remain at elevated, highlighting that existing price controls and fuel subsidies will continue to partly contain the extent of upward pressures to inflation.

“The balance of risk to the inflation outlook is tilted to the upside and remains highly subject to any changes to domestic policy including on subsidies and price controls, financial market developments, as well as global commodity prices.

“With the domestic growth prospects remaining resilient, the MPC judges that it is timely to further normalise the degree of monetary accommodation. With this decision, the MPC has withdrawn the monetary stimulus intended to address the COVID-19 crisis in promoting economic recovery,” said BNM.

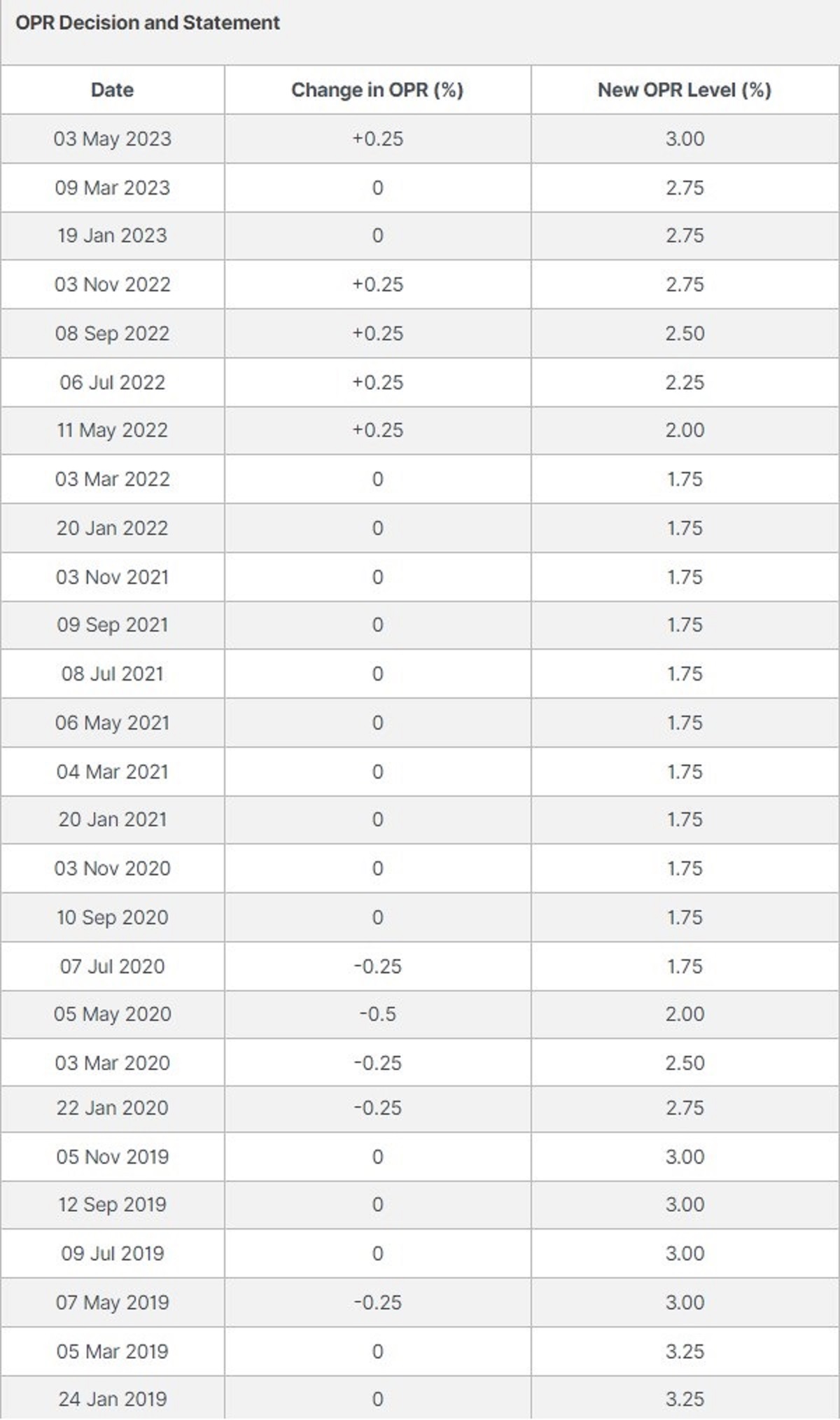

Here’s a snapshot of the OPR decisions since January 2020.

Source: BNM OPR decisions

Read more: OPR Hike: How Will The OPR Increase Of 0.25% Affect You?