Motor Insurance Premium Increase By 15%, Effective Feb 15, 2014

Auto insurance rates will be revised upward again by 15%, effective January 15, 2014. The latest revision will be the third revision under the new motor cover framework introduced in 2012.

Auto insurance rates will be revised upward again by 15%, effective January 15, 2014. The latest revision will be the third revision under the new motor cover framework introduced in 2012.

“The new revised rates do not come as a surprise as it is a continuation of the revision of the motor tariff premiums as part of the new motor cover framework,” announced Bank Negara on StarBiz.

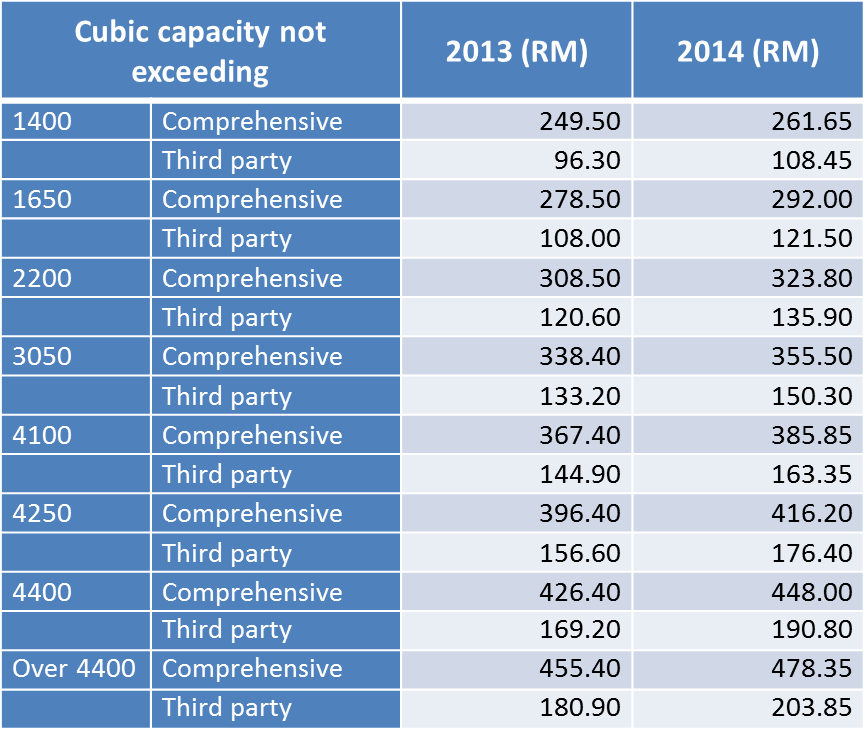

According to the General Insurance Association of Malaysia (PIAM), the premium adjustment for a private car of 1,400cc will be between RM6 and RM34 per year.

For motorcycles of 110cc, there will be a premium increase of between RM1 and RM3.50.

Comprehensive and third party insurance tariff for private cars comparison between 2013 and 2014

According to analysts, as quoted in a report published in The Star, the latest adjustment to motor insurance premium rates will not have a significant impact on insurers’ bottom lines.

Under the framework, premium adjustments take effect from Jan 1, 2012 over a period of four years. This year represents the third round of adjustments on motor tariff premium rates.

These yearly increases will continue until the planned detariffing of motor insurance premiums in 2016, when premium rates will be further differentiated in accordance to the individual risk profile of vehicles, owners, as well as potential pricing differences between insurers.

When the detariffing comes into effect, we might see the emergence of ‘full service’ insurers with higher rates but more perks such as complimentary tow truck service, as well as ‘budget no frills’ insurers.

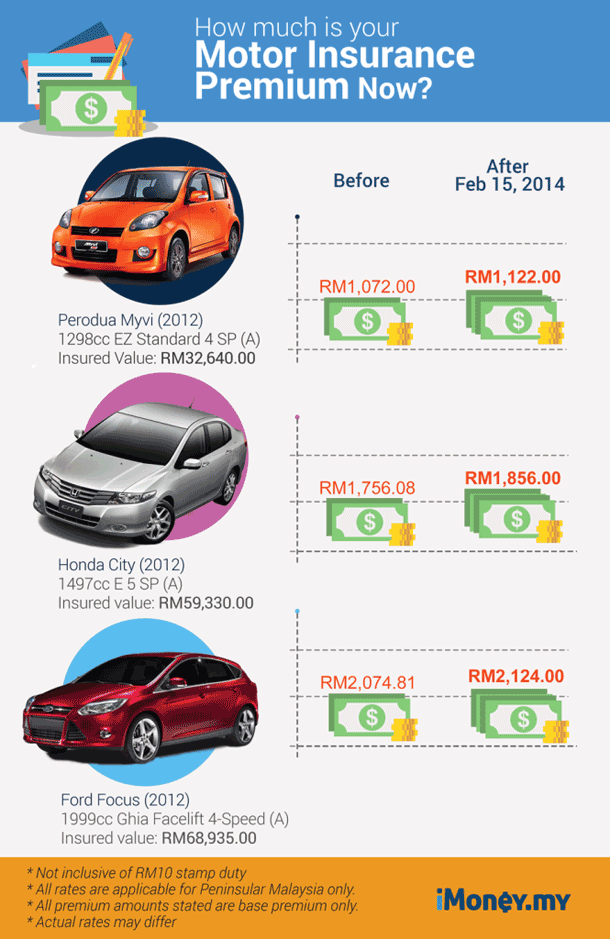

How much is Your Motor Insurance Premium Now?