Mortgage Loan – What Is It, Where And Who To Get One From

Table of Contents

What is a mortgage loan?

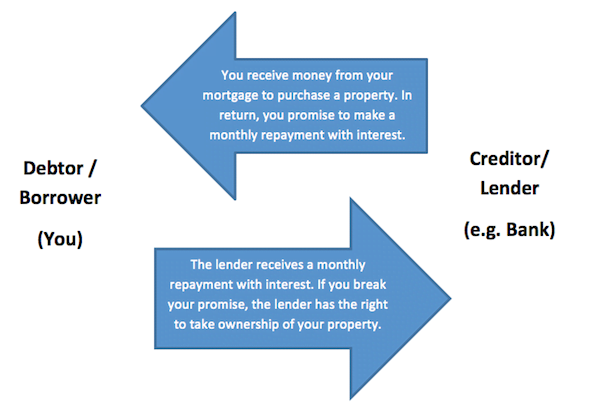

A mortgage loan (or often just known as “mortgage”) is a loan used to buy houses and other properties. In a this loan arrangement, you (the borrower) give the lender (often a bank) rights to a property until you completely pay off the required payments along with interest.

To put it in simple words, when you use a loan to buy a house, you are essentially taking out a loan to buy the house. This loan is secured by the same house i.e. your property is used as a guarantee for your loan. In the event you are behind in your monthly payment, the lender has the right to repossess your house.

Most people still rely on a home loan to help with the purchase of property (very few people can afford to buy a property outright with cash).

Where to apply for it?

If you are planning on purchasing a property, there are a number of ways you may obtain financing for your property. Examples include mortgage brokers, banks and building society. The key differences between these sources lie in the interest rate, loan amount and the maturity period of these loans.

From banks

Dealing with the banks is probably the most preferred option for most. A loan officer will usually assist you in the application process and procedures.

Generally, there are less added fees or commissions when you apply for a loan directly from the banks. Since there are no intermediaries working between you and the bank, the cost reduces (the people who work in the banks have less incentive to charge you extra, as they are often salaried staff who don’t earn (or earn very little) commissions from having your loans approved).

So, if you have a good credit history, a promising job with stable income and some financial assets, banks will generally have no problems in approving your loans.

From building societies

In Malaysia, you can obtain a home loan from the Malaysia Building Society Berhad (MBSB).

Home loans obtained from the MBSB are typically at a less favourable interest rate, although MBSB has traditionally been less stringent in their requirements (i.e. it is much easier to obtain a home loan from MBSB than banks). Most people with poor credit rating turn to MBSB after being rejected by banks – this is why MBSB is sometimes referred to as the “lender of last resort”.

From a broker

Mortgage brokers play the role of a “middle man” in a loan application transaction and advise you on the best loan product for you. They don’t directly lend you the money, but act on behalf of the lenders. Hence, a broker is different from a lender such as a bank or building society.

If you are looking for a broker, bear in mind that the best ones are usually those who work with a large number of lenders. It is also important that you check for experience and track record. Good brokers are often those with knowledge about the industry and are familiar with different types of home loans. Finding a good broker can help you understand the best deal based on your financial situation and credit history.

A broker can also assist you in the application process – it is sometimes easier to apply for a loan through a broker since brokers often have better network and relationships with banks and other lenders. This is particularly so if you have poor credit history, or income that is unstable, as brokers can sometimes help you obtain a loan even when the banks have turned down your application. Keep in mind though that loans of this nature usually have higher interest rates.