Sidestep These Common Myths And Realize Your Retirement Goals

Table of Contents

Setting yourself on the path to financial freedom in your golden years can be everything you have ever dreamt of, but it can also turn into a nightmare if you end up not meeting your financial goals.

Even when you think you may have set aside a good portion of your assets for retirement, it may well remain insufficient if you have not factored in changes such as the cost of living or inflation.

Miscalculations in terms of your retirement fund can be caused by common misconceptions such as these:

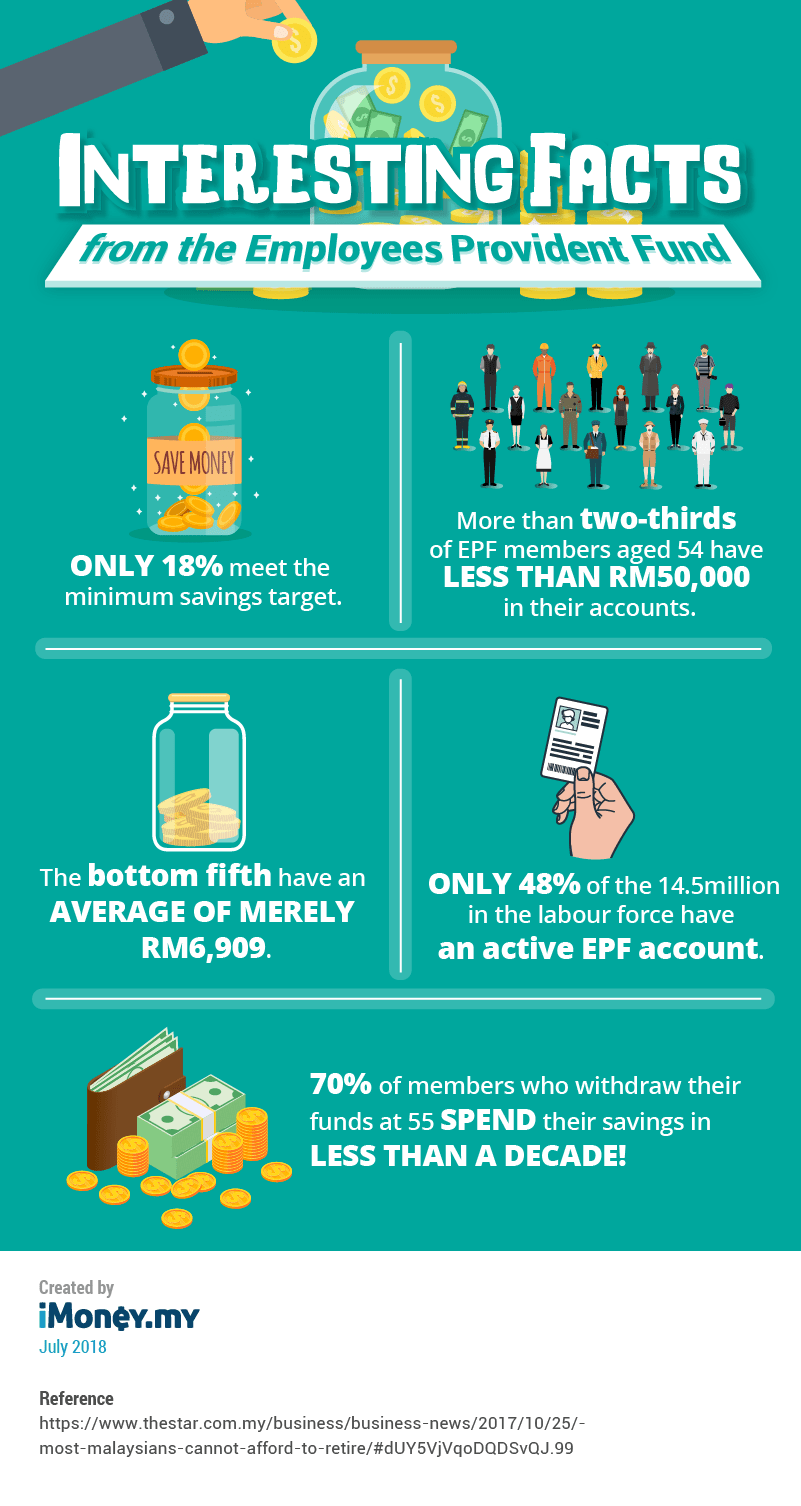

So, is your retirement fund sufficient? Last year, the Employees Provident Fund (EPF) raised the minimum savings target to RM228,000 by the age of 55. This means a monthly retirement income of the only RM950 per month (assuming a life expectancy of 75 years old). If that’s not shocking, there are other alarming statistics reported last year.

How do I address the future?

The rule is to start planning for your retirement the moment you have gained a stable income because the earlier you start, the more funds you will have by the age of 55. Although you may have set your retirement funds in motion, will you have enough to meet your shortfalls?

The usual rule of thumb for budgeting-to-save is to save 20% of your income, but this is surely not enough when it comes to preparing for your retirement fund.

While it is impossible to determine the actual economic landscape in the future, you can predict several factors to gain a close estimate of how much you will really need to live your life.

Here are the current living wages of Malaysia, which refer to the income levels required to maintain a proper standard of living, according to figures tabulated by Bank Negara Malaysia.

However, these figures are based on the current Malaysian economy, which may change within the next few years. Moreover, this does not factor in the different lifestyles led by different families throughout the nation, so it may not be applicable across the country.

So how do you know how much you will need in the future? While it may be impossible to know for sure, there are ways to gauge your target by factoring in these changes:

Inflation

You cannot base your monthly budget using the current prices as the benchmark, because prices may rise in the future.

The inflation rate, however, will vary annually as it is influenced by economic indicators such as monetary supply, national debt, exchange rates, demand-pull effect and so forth.

The best way to keep tabs on the inflation rate, is through statistical data and, of course, keeping up with the current economic movements.

The best way to tackle this is to incorporate an average annual inflation rate into your calculations to avoid coming out short when you reach your golden years.

Lifestyle costs

Your expenditure is dependent on your lifestyle. However, lifestyle costs are also related to the inflation rate because your expenditure depends heavily on the prices of goods and services. For example, your monthly budget may revolve around dining out, leisure, entertainment, rental and so forth, but these rates will not stay consistent through the years.

So, it’s best you think about your retirement lifestyle, and determine how much you need to sustain that lifestyle. How many times do you want to travel in a year? Where will you live? Are you going to buy a house? Will you finish your mortgage payment?

Whichever lifestyle you choose, the ultimate question is: How much do you need to fund that lifestyle?

To determine that magic figure, it’s best you list down your priorities based on your current lifestyle. For example, if you dine out five times a week, will you be keeping to that routine or will you be downgrading when you retire?

Now, once you have the ballpark figure of your expenses, you can begin devising your game plan for retirement.

But I already have other investments…

You may have already flowed your money through different investments in preparation for retirement, but these remain the two most common investment products when it comes to achieving your retirement goals.

Insurance

There are numerous types of insurance product you can sign up for, but many will argue that life and health insurance products are the most important as they offer financial aid should you fall ill, and give you a lump sum of cash upon policy maturity.

Such insurance policies also provide death and Total and Permanent Disability payouts should any unfortunate situation befall you. Furthermore, your named beneficiaries, such as your spouse, will receive a death benefit should you pass away.

Furthermore, insurance products that are skewed towards retirement often have tailor-made options to help you honour your commitments in the event you lose your source of stable income.

Unit trusts

It is a well-regarded truth that focusing on one type of investment isn’t the smartest approach to growing your money.

A good investment portfolio is a diversified portfolio according to your risk profile, which means you invest in different assets to mitigate risk. An easy way to instantly diversify your portfolio is by investing in unit trusts.

In brief, a unit trust is a portfolio of different assets such as shares, bonds and real estate. When you invest in a unit trust, you are buying “units” which consist of these assets. This allows you to invest in different assets in one go.

Furthermore, they are also professionally managed by fund managers so that you don’t have to undergo the hassle of managing your own investments.

You can learn more about unit trusts here.

The above two products are just some of the common products used in retirement planning. There are various other products on the market that can help you work towards your retirement goals, depending on your risk profile and asset allocation.

Calculate your real retirement fund

Experts recommend having a monthly replacement income of two-thirds of your last drawn salary in order to sustain your current lifestyle through retirement. But how do we determine how much we will be earning in the future?

You can calculate your savings target manually, but you might miscalculate factors such as the inflation rate, your projected savings amount and so forth, which is why there are calculators that can do the work for you.

Here’s how you can do just that using the OCBC Retirement Calculator.

Calculate your target retirement fund OCBC Retirement Calculator.

Once you have your target calculated, you can choose between two investment paths – a disciplined approach (growing investments in a disciplined manner) or an optimised approach (an investment portfolio consisting of products such as unit trusts for potential capital and/or regular returns) so you know how much more you will need to achieve your goal.

It’s never too late to start

It starts with a goal, and then a game plan to achieve that goal. Like Walt Disney once famously said, “If you can dream it, you can do it.”

Of course, like any grand plan, a grand retirement dream does not happen overnight. It takes years to plan and strategise to be able to achieve your goals.

So, calculate your financial retirement target today.

Find out how much you need to boost your retirement fund with OCBC’s Retirement Calculator!

You can also review your options to achieve your retirement goals by making an appointment with OCBC’s Personal Financial Consultants!