New RHB Home Loan: Really That Flexible?

Table of Contents

Buying a home is a huge commitment that will take most people a maximum of 35 years to pay off. Hence, it makes sense to have a mortgage that allows home buyers as much flexibility as possible, to brace for any uncertainties in the future.

Effective August 5, 2014, RHB Bank has launched a new home loan product, MY1 Full Flexi Home Loan (HLFF), to fulfil home buyers’ needs for flexibility. This new home loan is an extension of their current MY1 Flexi Home Loan (HLRD), providing their home loan customers with greater convenience.

What are the requirements?

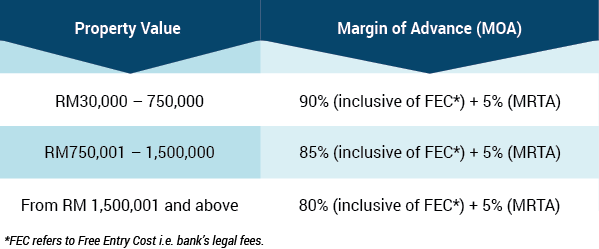

HLFF offers loan for purchase and refinance of both completed and under construction residential properties. Customers are entitled to a minimum loan amount of RM30,000 (inclusive of MRTA) with a loan tenure of between five years to 35 years or till the age of 70, whichever earlier. For the margin of advance, HLFF follows the following schedule:-

Note: For properties under construction, MOA is based on the purchase price as per the Sales and Purchase Agreement (SPA). While, for completed properties and property refinancing, MOA is based on open market value or purchase price as per SPA, whichever is lower.

It is compulsory to have 100% MRTA coverage for loan amount below RM100,000. For loans above this value, MRTA coverage is optional. For joint application (only with immediate family members) of up to four applicants, at least one of the applicants must be 100% MRTA covered.

What’s different?

Similar to HLRD, HLFF offers customers with the flexibility to make excess payment on top of their regular loan monthly repayment. Customers have the option to redraw the excess repayment paid anytime during the tenure of the loan.

However, unlike HLRD, customers can redraw from their loan via over-the-counter, internet banking and ATM. Redraw is allowed on any excess payments made and funds are available immediately for withdrawal. Customers will now have more flexibility and convenience as they can manage their loan accounts on the go, which enables them to save time and reduce hassle.

Customers who currently have their home loans under MY1 Flexi Home Loan cannot convert it to MY1 Full Flexi Home Loan. However, if this is a feature that will make a huge difference to you, you can opt to refinance your mortgage to HLFF.

If you are not on a fixed income and you are confident that you have the ability to make prepayments, getting the HLFF for your new property will save you more money in the long run.