4 Things I Don’t Miss About Paying My Car Loan

Table of Contents

Almost everyone in Malaysia needs a car. It’s an accepted cost. Fresh out of college, and earning about RM2,500 a month, you can see about 40% of it goes to maintaining your car — in the form of monthly repayment, petrol, toll, parking and maintenance. We don’t recommend spending that much but when you’re just starting out it can be unavoidable!

In Malaysia, we are allowed to take up a car loan, also known as hire purchase loan, for up to nine years, and if we are not careful, the vehicle we are driving may not even last the whole tenure of our loan. However, if you happen to be a good driver and you maintain your vehicle impeccably, you may see yourself driving a vehicle that has been fully paid off.

And let me tell you, as a fellow driver who has paid off her car loan, you will notice that the road is slightly clearer, the sun is shining brighter, the honk of other drivers more melodious and an unbreakable affinity to the piece of machine that cost you an arm and a leg for years and still stand by you to this day.

Then, you quickly put these four dreaded things behind you… until you get another shiny car, of course!

1. Low disposable income

When you have to pay a few hundreds, or thousands for your car loan, you find yourself counting every sen towards the end of the month. Don’t worry, you are not alone. Most people find themselves living with a very low disposable income due to the high car loan they have committed themselves to.

For example, a fresh graduate earning RM2,500 may get a Perodua Axia G (AT), and this is how much he will be paying every month — just on the repayment.

Deducting 11% for Employees Provident Fund (EPF) contribution, he will only have RM1,796 left for his other expenses, such as petrol, rent, food, entertainment, and others.

Eating out two nights in a row? Maybe not.

2. High debt service ratio

Working hard and saving up to buy yourself a new crib only to find yourself rejected for the mortgage? One of the culprits driving up our debt service ratio (DSR) is probably our hire purchase loan. The DSR is used to show how much of a person’s income is used to service debt repayments, and is represented as a percentage of income.

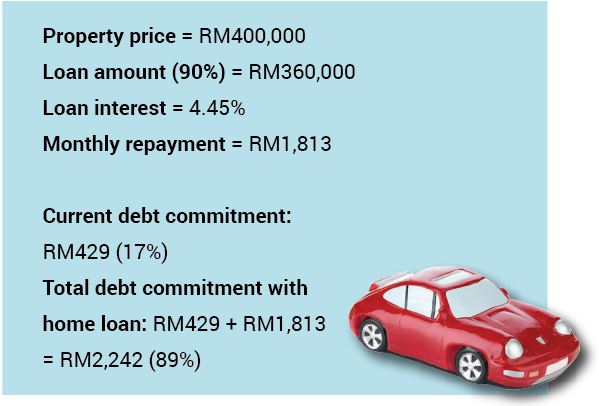

If you think you can afford a RM400,000 property (let’s face fact, it’s getting easier to find a white elephant than a property selling below RM400,000 that can fit a normal size human being in the Klang Valley), you can have another think again:

Based on the calculation above, you will most likely not be able to get a loan as your DSR is higher than 70%. Most banks in Malaysia has a threshold of DSR of not more than 60% to 70%.

With my car loan out of the way, I just need to concentrate on saving up for a down payment now!

3. High opportunity cost

The RM429 you use to pay your car monthly repayment can probably be used for investment. In five years, that’s RM25,740 that can be invested instead.

If you are not much of a risk taker, you could have opt to put that cold hard cash in investment like medium risk unit trust fund. Here’s what you could have pocketed if you didn’t have a pesky car loan to repay:

* Performance figures are absolute returns based on the price of the fund as at January 14, 2015 (Last updated on January 16, 2015), on NAV-to-NAV basis, with dividends being ‘reinvested’ on the dividend date.

Due to your car loan commitment, instead of investing RM25,740 over five years and potentially see your money grow to RM29,180.80, you now just see an opportunity cost of about RM3440.80! It’s actually a little more once you factor in the depreciation of your car’s value but I think you can see the point with just this simplified calculation.

4. Cost of depreciation

Vehicles are some of the fastest-depreciating assets consumers can buy. Many times, the vehicle loses value quicker than the loan is paid off, resulting in a car that’s worth less than what is owed on it.

Car depreciation is the highest part of cost of ownership — regardless of the brand or model. There is no way around that. Which is why, I try to keep my car running until well after my loan settlement (at least that’s what I plan to do)!

If you have the habit of changing your car every two to three years — here’s a piece of advice for you — don’t. Your car depreciates at a much faster rate in the first few years, 20% the moment you get the key, and then it slows down gradually.

After you’ve paid off your car, you can probably sell it off and still get back a decent sum (depending on your brand, model and the condition, of course), which you can use to pay for the down payment of your next car — and watch the vicious cycle begin all over again.

Regardless of how many years you hold on to your car or whether you consider depreciation an important variable cost, car ownership represents a substantial and continuing financial commitment. There is no controversy about that.

If you’ve just bought a car, be patient, and you will finally enjoy car-loan-free days ahead. And when the day comes, you will definitely not miss these things! Let’s see how long I can last without slapping myself with another hire purchase loan.