EPF Withdrawal: Utilise The Savings Wisely

Table of Contents

Treating your Employees Provident Fund (EPF) account like an ATM is a bad habit that may hurt you in the long run.

EPF is a scheme for working adults in Malaysia to automatically set aside funds for retirement. Members are allowed to withdraw money from their account for certain reasons. However, by not withdrawing, you are allowing your money to grow and compound over time, based on the rate of return that is guaranteed to you. This is the dynamic that will help your retirement nest grow into something large over time.

EPF earns a healthy dividend every year, which helps contributors grow those savings over their working years, to fund their retirement years.

Therefore, withdrawing EPF savings is not advisable as this savings are primarily meant for retirement, one of the most important financial goals in your life. Compounding of the fund works best if the fund is left uninterrupted to compound every year until it matures when you turn 55.

When can you make withdrawals?

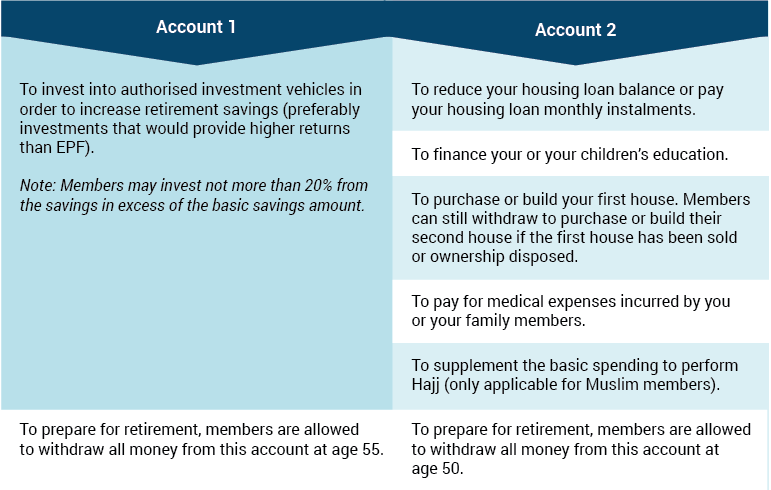

Your EPF account is divided into two – Account 1 and Account 2. Out of the contribution to EPF, 70% goes into Account 1 while 30% goes into Account 2. Members can make withdrawals from both of these accounts for these purposes as stated by EPF:

Misusing EPF withdrawals can be fatal for your retirement

While there may be times where you need funds for various purposes, simply withdrawing from your EPF should be best avoided. Raiding your EPF can have the following consequences:-

- Any premature withdrawal from EPF will reduce the amount of your retirement savings. EPF savings is for retirement, not for present-day needs. If you are planning to withdraw your EPF savings by age 50 or 55, just because you can, you need to rethink your financial strategy. If you don’t have a good reason to withdraw the money, or a solid plan to invest the money, it is better to keep the money in your EPF account for a few more years and earn more returns.

- Retirement planning would be disrupted as withdrawals will affect the fund accumulation process. By constantly withdrawing from your EPF you are adversely obstructing the funds in these accounts from snowballing into a big amount that can fund your retirement.

- By making withdrawals from our EPF to fund other goals, you end up pushing your retirement age further or forcing yourself into making higher contributions during the last few years of your employment. Saving for old age is a marathon, not a sprint – one that takes decades to complete.

- You may start spending uncontrollably as it would be cultivated in your mind that “I still have money in EPF”. There is a tendency for you to take it for granted. Don’t treat the money as a windfall – you will inevitably suffer in your golden years.

Avoid depleting your EPF savings

According to EPF’s statistics, 93,914 members have withdrawn RM500.8 million under the health withdrawal scheme, since its implementation in 1994.

By pushing your retirement planning further down your priority list, you are taking a huge risk with your finances. There are various ways to avoid depleting your EPF savings, such as:

- Purchase adequate medical insurance with the appropriate riders to ensure coverage is enough in times of sickness. Then, you won’t have to withdraw from your EPF. Let’s be clear; EPF savings is your retirement fund, not your emergency fund.

- Your child’s education should be planned way in advance – either through education-linked insurance policies, or other investment vehicles. EPF savings should not be used to fund your child’s education.

- All big financial decisions should be planned and saved for in advance, instead of grappling to afford something by using funds saved for other reasons.

If you use your EPF funds for any of the above purposes, you could be losing thousands of Ringgit in returns by interfering with the process of compounding your capital. This will affect your financial freedom attainment at the end of the day.

Every time you are tempted to withdraw money from your EPF account, ask yourself if raiding your savings is the best and only option you have. Unless you plan on working until you are 70 or 80, it behoves you to leave your savings untouched so you can attain retirement as close to when you plan it.