Visit Malaysia 2026: Key Industries Investors Should Watch As Tourism Returns

2026 is fast approaching! While most people might be trying to put together their new year resolution or scrambling to prep their kids for the new school year, certain enterprising individuals are likely wondering what the next big investment opportunity is.

With the Visit Malaysia 2026 (VM2026) campaign just on the horizon, tourism is likely to be a key driver in the nation’s ongoing road to economic growth. And with this expected surge in tourism, many related industries such as aviation, medical tourism, and hotel accommodations are likely to see huge growth as well.

With this in mind, Moomoo Malaysia has prepared a list of industries that investors should keep an eye on in the coming year.

Aviation: More Visitors Mean Fuller Planes

Airlines are direct beneficiaries of a tourism rebound. AirAsia X, which focuses on medium- and long-haul international routes, is already seeing strong demand. In its latest quarter, flights were about 82% full, and average ticket prices rose around 5% year-on-year, a sign of improving pricing power as travel demand builds.

For investors, Capital A offers broader exposure to travel-related services, while AirAsia X provides a more direct play on rising international passenger numbers heading into VM2026.

Gaming & Integrated Resorts: Tourist Spending Matters

Tourism is a major revenue driver for Malaysia’s gaming and resort operators. Genting Malaysia, for example, earns over 40% of its income from international visitors.

As tourist arrivals increase, higher hotel occupancy, theme park visits, and gaming activity at destinations like Genting Highlands could lift overall earnings. Genting, as the holding company, also benefits from increased activity across its tourism-linked businesses.

REITs: Steady Income from Busy Malls

REITs owning prime shopping malls and commercial properties in tourist hotspots offer a more defensive way to ride the tourism wave. Malls such as Pavilion KL, Sunway Pyramid, and Suria KLCC typically see stronger foot traffic when tourist numbers rise.

More visitors can support higher retail sales, better hotel occupancy, and stable rental income, making REITs an attractive option for investors seeking income rather than high volatility.

Consumer Staples & F&B: Small Purchases, Big Volumes

Tourists also drive everyday spending. Breweries like Heineken Malaysia and Carlsberg Malaysia benefit as their products are widely consumed in hotels, bars, and restaurants.

Meanwhile, cafe chains such as Oriental Kopi, with outlets in transport hubs and city centres, are well positioned to capture daily spending from both tourists and locals. Individually small purchases add up when visitor numbers rise.

Medical Tourism: Fewer Visitors, Higher Value

Medical tourism is a smaller segment by volume but higher in value. Major healthcare groups such as IHH Healthcare and KPJ derive roughly 7–15% of their revenue from medical tourists.

As international patients return for elective and specialised treatments, the sector could see steady growth, supported by longer stays and higher per-visitor spending.

The Big Picture

Visit Malaysia 2026 is more than a branding exercise, it’s a national growth driver. From fuller flights and busier resorts to steady rental income and higher consumer spending, the tourism ripple effect is expected to be felt across the economy.

For investors, VM2026 presents a multi-sector opportunity, making the lead-up to 2026 an important period to watch for Malaysia’s market momentum.

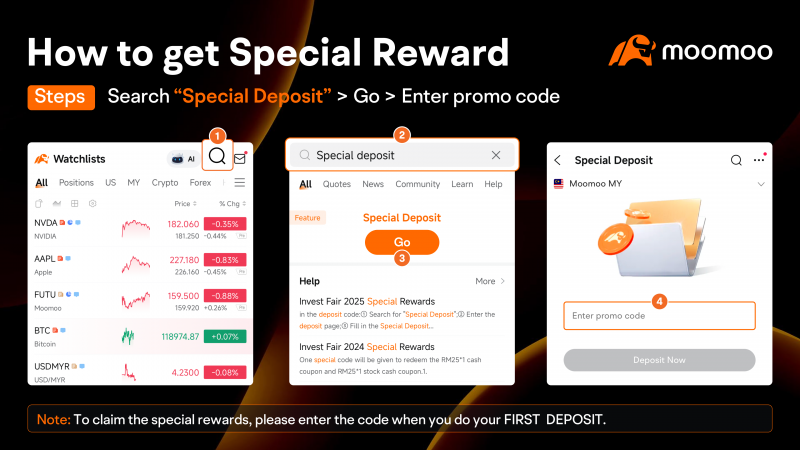

Join Moomoo with Me! Free Apple Shares await* Before making your first first deposit, search for “Special Deposit” and enter your Exclusive Code “IM25” on the deposit page.