Protect Your Little Ones With Child Medical Insurance

Table of Contents

As responsible parents, you do everything you can to give the best to your children at all times. While you go the extra mile to give them the best basic necessities, education and personal development opportunities, great healthcare and protection should be on the priority list too. To achieve that, you need a comprehensive protection plan that covers your children from the time they started crawling up to their adulthood. Child medical insurance ensures that your precious ones’ healthcare needs are always taken care of at all times. This has become even more important with the rising cost of medical treatment.

Here are three child medical insurance that you can invest in:

1. A-Life SuperJunior by AIA

A-Life SuperJunior provides you with the privilege of protecting your child medically from baby to 75 years of age — that’s almost their entire life.

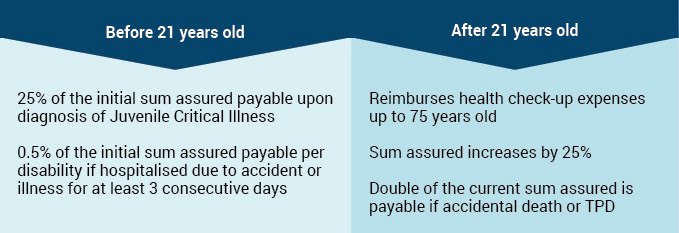

The coverage benefits of this plan includes:

Other benefits include paying the premium payment for only 20 years and upon maturity 125% of the initial sum assured is payable. The premiums for this plan are guaranteed and qualifies you for a personal tax relief.

A-Life SuperJunior would certainly be a good choice if you want to ensure that your child is medically covered for life, even after you are no longer around. This plan is best for families who have known heredity critical or juvenile critical illness (that is covered in the plan). By buying the insurance plan early on, before the symptoms are known, you can protect your finances, if your child really does fall victim to the illnesses.

This will ensure that your child is still insurable even if he or she is diagnosed with any of the illnesses covered.

2. PRUmy Child by Prudential

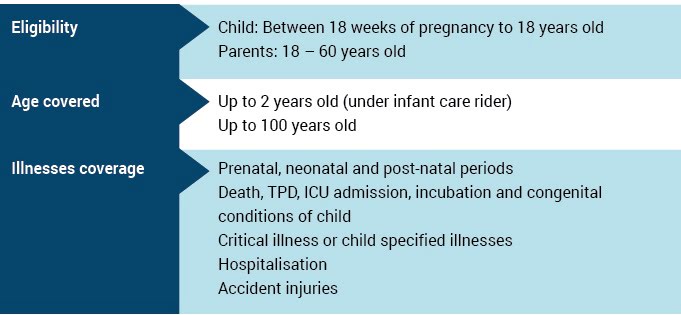

PRUmy Child is an investment-linked insurance that provides you with the privilege of protecting your child even before they are born.

Benefits under this plan include:

Upon maturity of the plan, value of all units in policy is payable when your child reaches 100 years old. You will also receive a Loyalty Bonus of 5% of annualised premium upon completion of the 10th policy year and every 3 years thereafter. Premium is payable throughout the whole term until the expiry of the policy.

Upon maturity of the plan, value of all units in policy is payable when your child reaches 100 years old. You will also receive a Loyalty Bonus of 5% of annualised premium upon completion of the 10th policy year and every 3 years thereafter. Premium is payable throughout the whole term until the expiry of the policy.

PRUmy Child is especially suitable for couples who are starting their family late and are having their first child above 30. Some couples could have been trying for a child for years, experienced miscarriages and when the mother finally conceived, the parents can cover most bases with a comprehensive insurance coverage that starts from pregnancy.

Pregnancy complications are more likely to happen when it is a late delivery or if the mother has experienced such complications with the previous child. The couple would then want to ensure that their child is medically well-covered if things do not go as smooth as expected.

3. Flex Junior CI and Flex Maternity Care by Zurich Insurance

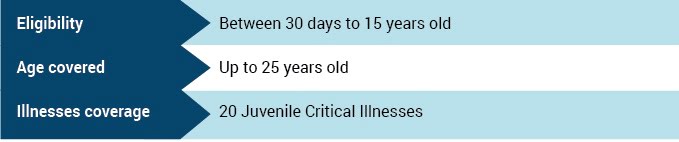

Flex Junior CI caters to your junior’s healthcare needs till they are an adult and able to survive on their own.

Under this plan, you are entitled to two claims on different critical illnesses – up to 100% of the sum assured.

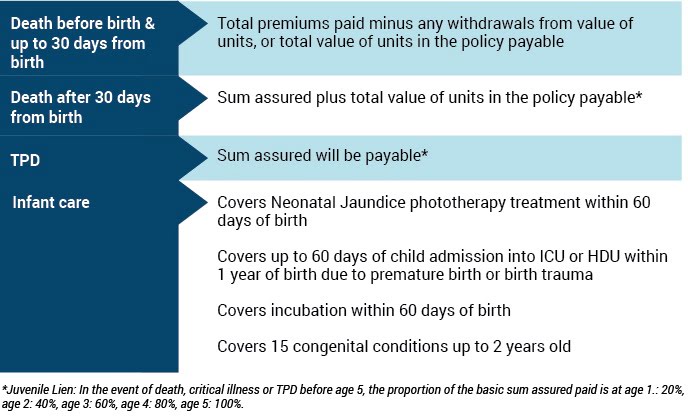

Flex Maternity Care protects your little one primarily during pregnancy, childbirth and other childcare benefits.

Under this plan, the mother can benefit as follows:

- Daily benefit payable if admitted into ICU or HDU

- Lump sum benefit payable due to pregnancy complications

- 200% of sum assured if mother dies

- Receive allowance upon delivery of the child

Under this plan, the child is entitled to the following benefits:

- Lump sum benefit payable due to congenital illnesses

- Daily benefit payable if:

- Admitted to ICU or HDU due to premature birth, hand foot mouth disease, dengue fever, pneumonia, bronchitis and jaundice

- Incubation

However, if you wish your child to be continually protected, you can later convert these plans to an adult insurance plan when your child is between 18 to 21 years old.

Flex Junior CI and Flex Maternity Care could be the best insurance coverage plan for single parents (divorced or widowed). The first plan protects the child while the second plan protects both the child and mother. With having both these plans, the parent can ensure the child is well covered through pregnancy, delivery and until the child is an adult and able to manage things on his or her own. The parent can also ensure that the child or other dependents like aged parents are compensated and financial covered if the mother dies during the child birth.

When choosing medical insurance for your child, ensure the plan best serves your personal circumstances and needs. You should assess the affordability and suitability of the insurance plan in relation to your financial goals and risk appetite. If you have chosen the wrong one, then terminating or switching policies creates room for several disadvantages. If you terminate this policy earlier than scheduled, you may get back less than the amount you have paid in. When you switch plans, you may be subject to new underwriting requirements, full waiting period, exclusion of illnesses and conditions of the new plan. Always read and understand the insurance policy before you invest.