All The Updates About e-Invoicing Implementation In Malaysia

e-invoicing is a requirement by the Malaysian government that all companies must issue their invoices in a digital format starting from 2025. Every invoice issued by businesses will first go to LHDN for validation. Once validated, the e-invoice can then be issued to the buyer. The purpose of this system is to address the tax revenue leakage issue.

The aim is to improve the efficiency of tax administration management in Malaysia. When fully implemented, e-Invoicing will enable near-real-time transaction verification and storage, catering for business-to-business (B2B), business-to-consumer (B2C) and business-to-government (B2G) transactions.

The LHDN MyInvois portal has also been made available to users since July 2024. In 2025, LHDN has also launched a Tax Identification Number (TIN) search service via the MyTax Portal at mytax.hasil.gov.my. Furthermore, to facilitate the implementation of e-Invoices, the TIN search function is also provided through the Mylnvois portal; and Mylnvois Application Programming Interface (API).

Implementation timeline

The first phase began on 1 August 2024, but only for companies with annual sales that exceed RM100 million. The second phase began on 1 January 2025. This phase involved e-invoicing for companies with annual sales between RM25 million and RM100 million.

Phase 3 will now begin on 1 January 2026, instead of the previous 1 July 2025. MSMEs with annual sales between RM150,000 and RM500,000 will have until 2026 to implement the e-invoicing system for their businesses.

Overview of e-Invoice

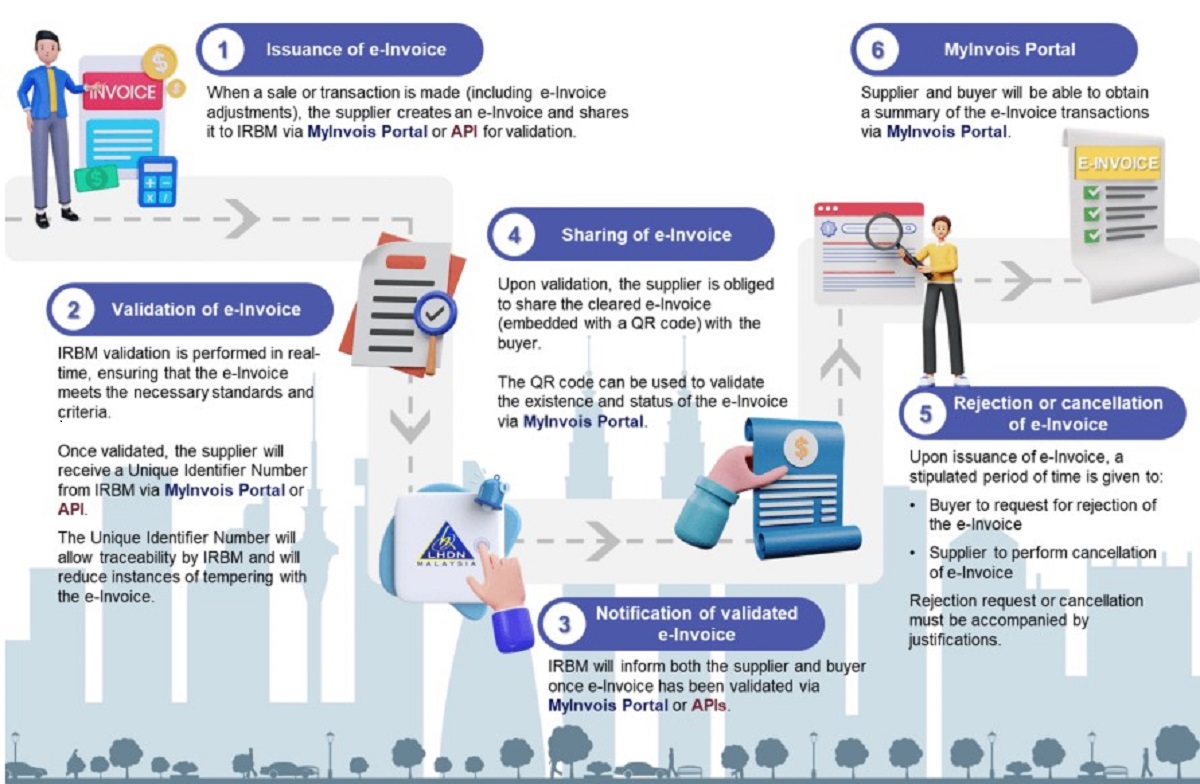

Following is an overview of the e-Invoice workflow. It provides a step-by-step walk through from the point of sale up to the point of storing cleared e-Invoices on LHDN’s database.

Source: LHDN

In order to accommodate tax certainty, LHDN has put in place the Tax Corporate Governance Programme (TCG). This allows both tax administration and taxpayers to collaborate in an open and honest manner to enhance the organisation’s corporate tax compliance affairs

2 ways to transmit e-invoice to LHDN

LHDN provides two e-invoice transmission mechanism:

1. MyInvois Portal hosted by LHDN

2. Application Programming Interface (API)

The process to submit e-invoice using MyInvois Portal or API is shown below.

The process to submit e-invoice using MyInvois Portal is shown below.

In order to use the MyInvois Portal, users will need to login to MyTax Portal first. For more information on this system, business owners can refer to LHDN’s e-Invoicing guideline.

Prefer an audio recap? Listen to our podcast on Implementing LHDN’s e-Invoice.