How Being Loyal To A Bank In Malaysia Is Costing You

How many of us got our first bank accounts opened by our parents or that first job and then never bothered to look into it? Sticking with your long-standing bank can feel safe, but that loyalty may be quietly draining your finances. With Malaysian banking fees adding up over time and outdated savings account Malaysia returns leaving your money stagnant, staying loyal could be costing you more than it saves.

In a country where 92% of Malaysians now rely on digital financial services, according to Bank Negara Malaysia’s 2024 survey, the market is more competitive than ever. Yet many of us still accept mediocre deals simply because switching feels inconvenient.

Why Malaysians overpay on banking fees

Remaining with one bank often means overlooking the fine print. Fees creep in through multiple channels- ATM charges, interbank transfer costs, dormant account penalties and even counter transaction fees. For example, what are often marketed as “free” ATM withdrawals may start incurring charges once you exceed a certain limit, such as RM0.50–1 per withdrawal after the eighth transaction. Over the course of a year, that can add up to RM8–24 just for accessing your own money.

Some banks also impose specific transaction costs: Alliance Bank charges RM1 per interbank cash deposit, while certain foreign remittances with conventional banks can incur RM5–RM10 per transfer. These may look small in isolation, but like many Malaysian banking fees, they quietly compound into hundreds of ringgit lost every year. The irony is that many Malaysians stick to these accounts out of habit, even though newer alternatives may offer more transparent or reduced charges.

Consider the case of Farah, a 35-year-old executive in Kuala Lumpur. She has banked with the same provider since her university days. Over the past year, she estimates paying nearly RM200 in assorted transaction and service charges. A colleague who switched to a digital-first bank, however, pays almost none of these fees. The difference could have covered two months of Farah’s phone bill, simply by being proactive.

How saving with loyalty undermines your savings account Malaysia potential

Beyond fees, loyalty also comes at a cost in terms of missed returns. Many Malaysians continue to keep their funds in basic accounts that yield as little as 0.2 – 0.5% per annum. At the same time, newer products offer significantly higher interest rates. The UOB One Account, for instance, provides up to 5.65% p.a. on balances of up to RM200,000 if certain monthly criteria are met, while Standard Chartered’s Privilege$aver can deliver up to 6.15% p.a. under the right conditions.

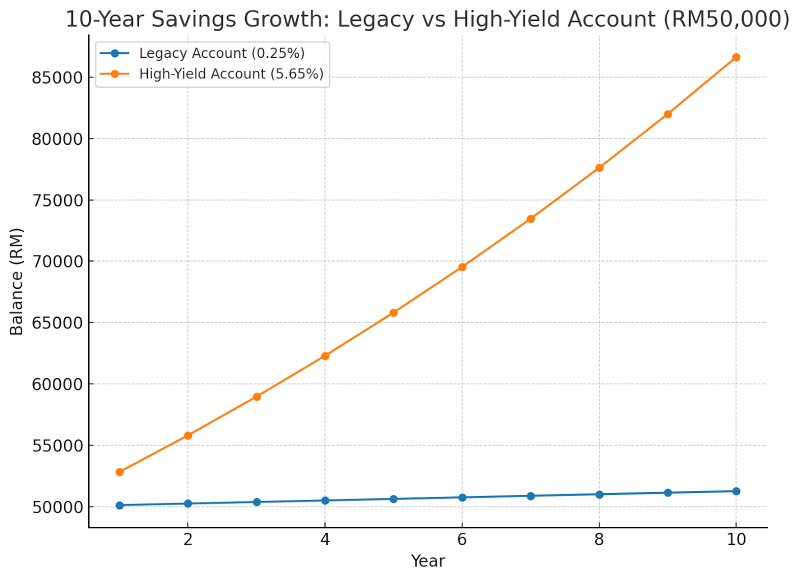

By contrast, legacy options such as Maybank’s Basic Savings Account pay only 0.25% p.a. on most balances, with CIMB’s equivalent accounts offering similarly modest returns. When you compare these against higher-yield savings account Malaysia alternatives, the gap is striking. If you had RM50,000 parked in an account at 0.25%, your annual interest would be just RM125. In a higher-yield account paying 5.65%, that same amount could generate more than RM2,800 in a year. Over a decade, that translates into more than RM25,000 in lost earnings, enough for a down payment on a car or even part of a home loan repayment.

What keeps Malaysians from switching?

Despite the clear benefits of moving, many Malaysians remain tied to their banks. Research suggests that factors like convenience, procedural hassle and trust outweigh pure financial logic. Customers often perceive the effort of updating payment instructions, learning new apps or dealing with paperwork as a burden.

In reality, most banks and digital-first providers now offer simplified onboarding, DuitNow transfers and even account opening through mobile apps. According to Bank Negara Malaysia, mobile banking transactions grew by 35% in 2023 alone, showing that Malaysians are already comfortable with digital finance. Yet when it comes to switching their core savings accounts, inertia still wins out.

There’s also the psychological factor of “loyalty.” Many customers believe their long relationship with a bank earns them better service or easier access to credit. While some truth exists- long-term clients may get preferential loan approvals: the benefits often don’t outweigh the ongoing costs of high Malaysian banking fees and low returns.

Comparing real-world bank options

When you look closely at the choices available, the cost of loyalty becomes obvious. Legacy savings products such as Maybank’s Basic Savings Account offer just 0.25% p.a. across most tiers, with CIMB’s equivalent product sitting at a similar rate of 0.25% p.a. for balances up to RM100,000.

Public Bank’s basic savings account structure is not much better, with limited promotions and little to reward long-term depositors. In contrast, newer products are designed to attract customers with competitive yields. The UOB One Account, for example, can deliver up to 5.65% p.a. if you meet certain conditions, while Standard Chartered’s Privilege$aver offers up to 6.15% p.a. under specific activity requirements.

For a young professional starting their career with RM10,000, the difference might not feel significant. But as savings grow over time, the opportunity cost of ignoring higher-yield savings account Malaysia options quickly becomes substantial.

Breaking free from the loyalty penalty

If you want to avoid the trap of Malaysian banking fees and low returns, the solution lies in being proactive. Review your accounts annually, compare interest rates across the market and calculate the true impact of fees and returns. Switching banks is no longer the complicated process it once was and even modest improvements in rates can compound into a meaningful difference in your long-term savings.

In today’s competitive financial landscape, loyalty without evaluation is expensive. By exploring better savings account Malaysia options and challenging unnecessary fees, you can ensure your money works harder for you instead of for your bank.

These include ATM withdrawal fees (RM0.50–1 after free limits), interbank transfer fees, dormant account charges and counter transaction fees.

Promotional rates vary, but UOB One Account (up to 5.65% p.a.) and Standard Chartered Privilege$aver (up to 6.15% p.a.) are among the most competitive.

Not anymore. Most banks allow online applications, DuitNow integration and even instant fund transfers, making the process far smoother than in the past.

In some cases, long-term relationships may support loan applications or credit card approvals, but the financial trade-off usually favours switching to lower-fee, higher-return accounts.

Here’s a visual chart comparing how RM50,000 grows over 10 years in a legacy account at 0.25% versus a high-yield account at 5.65%.