Choices, Choices, Choices: iPhone 6, iPad 4 Or A Long-term iNvestment?

Table of Contents

This article is sponsored by Securities Commission Malaysia, under its InvestSmart initiative.

Are you admiring the look and feel of your new iPhone 6? Or perhaps you are currently contemplating whether or not to get your hands on the much-anticipated iPad 4? Whatever your decision may be, keep in mind that owning these gadgets will mean forking out at least RM2,000 — are you willing to part with your hard-earned money just to become the proud owner of an electronic gadget that will lose its value over time? Consider taking the more sensible route by investing the RM2,000 in a long-term asset that will appreciate over time and give you considerable returns!

We are all guilty of succumbing to peer pressure and the lure ‘wants’ every now and then. Keeping up with the Joneses when it comes to technological trends (or anything else for that matter) could possibly be one of the worst ways to spend your money and is certain to deplete your cash reserves. Tech giants such as Apple and Samsung are constantly offering new products to remain relevant and grow their profits, but as a result, the value of their creations depreciate rapidly. Your new iPhone 6 begins depreciating the moment you remove it from its pristine white packaging — it will not fetch the same price that you paid upon purchase if you decide to sell it in the near future. To add insult to the injury, what if we told you that this habit is costing you more money than you realise?

How Apples Lose Their Shine

Yes, we know that Apple products come with their signature sleek designs and ground-breaking features that may be hard to resist at first glance.

From the rounded-edges and crisp screen displays of the iPhone 6 to the premium look and feel of the latest iPad, there is no doubt that these pieces are a work of art.

However, consider the price tag that comes attached: is it befitting the product?

Table 1: Price list for Apple’s latest offerings

Table 1: Price list for Apple’s latest offerings

A 16GB iPhone 5s was selling for RM2,399 when it was first launched in 2012. Today, three years after its launch, the second-hand value of the iPhone 5s is RM1,450. If we apply a similar depreciation rate of 65% to a newly launched 16GB iPhone 6, it will also only be worth RM1,450 three years later. Remember: RM1,450 in 2018 would also be worth less than RM1,450 today due to inflation.

The 65% depreciation rate is not the only loss you incur when trying to keep up with the latest gadgets offered in the market. Regardless of whether you are a salaried worker or a business-owner, it is a common assumption that most people work hard in hope of growing their earnings to fulfill their dreams and create a better future for their loved ones. Therefore, if you had forgone the purchase of this new gadget and chosen instead to invest the amount that you had set aside for the purchase, consider the opportunity cost that you would have saved! If you are unfamiliar with the term ‘opportunity cost’, the following explanation will illuminate you further.

Making sense of opportunity cost

An opportunity cost is ‘the cost of an alternative that must be forgone in order to pursue a certain action’. In other words, it is the benefits you could have received by taking an alternative action. By making smart investment decisions for the same amount of money, you give yourself the opportunity to make more money rather than a definite loss in the form of depreciation.

The same concept applies to the choice of whether to purchase that glossy new gadget, or to channel that money into a well-informed investment. The main takeaway from this is that the money spent on a depreciating asset (in this case, an iPhone) could be put to better use through an investment product that will give you more returns in the long run, being an appreciating asset.

On that note, do remember that when deciding on your choice of investments, it is important to carefully consider the amount of investment capital you are willing to pay, your risk tolerance levels, time horizons, personal financial goals and purpose. These considerations will have a strong bearing on the type of investment instruments purchased.

Illustrated below are some examples of the opportunity costs of that iPhone:

1. Fixed deposits

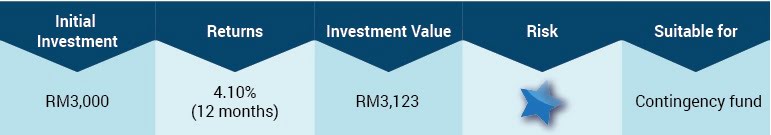

A fixed deposit, or commonly referred to as ‘FD’ in Malaysia, is a type of bank savings or investment account that promises the investor a fixed rate of interest. In return, the investor agrees not to withdraw or access his / her funds for a fixed period of time. In a fixed deposit investment, interest is only paid at the very end of the investment period. Keeping your money in an FD account is an investment that involves minimum risk. Its yields may not be enough to combat inflation, but you can be sure that there will be no damage to your initial investment capital. FDs will also give you the liquidity you need in case of an emergency. The returns on an FD are usually much clearer if you invest large sums of money due to the relatively low interest rate.

Consider this illustration:

You may have only gained about RM100 in a year but you would definitely have secured your money against depreciation in the form of an iPhone and the erosion of the value of your money through inflation!

2. Unit trust

If you had invested in a unit trust fund which offers an average return of 7.36% annually, your total investment value at the end of three years would be RM3,712 by reinvesting your annual returns.

Another plus point of unit trusts is its affordability. Investors can start with an investment amount as low as RM100. Unit trusts can also be bought and sold easily, effectively mitigating illiquidity as a risk factor.

3. Equities

Equities (or shares) are a form of ownership; they represent participation in a company’s growth. Share trading is often regarded as among the riskiest of investment options, due largely to its price volatility and complex nature. The profitability of a share investment depends almost entirely upon the share price, which in turn, is directly related to the performance and profitability of the company. Additionally, investors are required to consistently monitor the performance of their shares and some consider this need to keep track rather time consuming.

When investing your money, it is important to practice due diligence by carrying out research on the possible risks and potential rewards. Understand the dividend policy of any company you are considering investing in and read up on the company’s past and current performance to get a good idea of its sustainability. Making the effort to know your investment will bring you gains in the long run.

The appeal of share trading lies in its long-term growth potential. By compounding your returns and dividends over a period of time, you should be able to observe a considerable growth in your initial investment. If you bought the shares of a local telecommunications company with an initial investment of RM2,600 and sold it three months later when the share price has increased by RM0.50, you would have gained RM200:

Investing in your future

Investment vehicles come in many forms and each product offers different rewards and carries various risks. Understanding what you want out of your investments, the risks you are willing to take and the technicalities involved will go a long way towards ensuring profitability in the long run. With investing, there is equal opportunity to make, as well as lose, money.

However, the surety of investing is that you will at least have a chance of seeing returns, or recouping your losses. Compare that to if you were to spend the same amount of money on a gadget that will surely depreciate.

When it comes to investing, nothing is more rewarding than the act of educating yourself. Do the necessary research, analyse and study the products available before settling on an investment decision. To quote Benjamin Franklin, one of the Founding Fathers of the United States, ‘An investment in knowledge pays the best interest’.

Bogged down by inflation or GST? No sweat! Here’s how you can make your money work for you to keep you ahead of the game!

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: admin@investsmartsc.my.