The Best Rewards Credit Card In Malaysia Exposed!

Table of Contents

Love the idea of being rewarded for shopping? The one thing you are missing is the right rewards credit card. But do you know which rewards credit card is the best for you?

It is always easier to compare cashback credit cards – the one with the highest cashback rates and the least restrictions obviously is the winner. However, it’s tougher to gauge reward points as more often than not card issuers use point systems to disguise poor rewards.

Here are a few tips and tricks to evaluating rewards cards and identifying the best one.

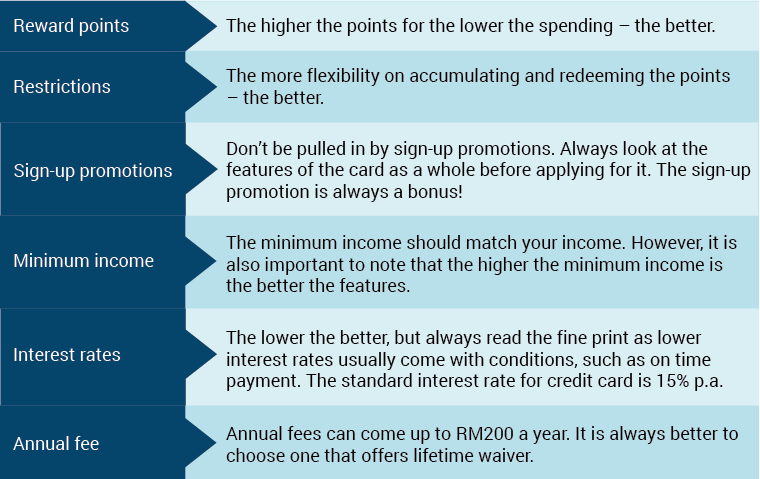

What makes a rewards card great?

You can judge if a rewards card is good by asking these questions:

- What the value of a reward point is?

- How many points are given for your spending?

- How useful are these points?

Here are some of the features to consider before signing up for a rewards card.

Let’s put some of the rewards cards in the market on an acid test and see how they fare:

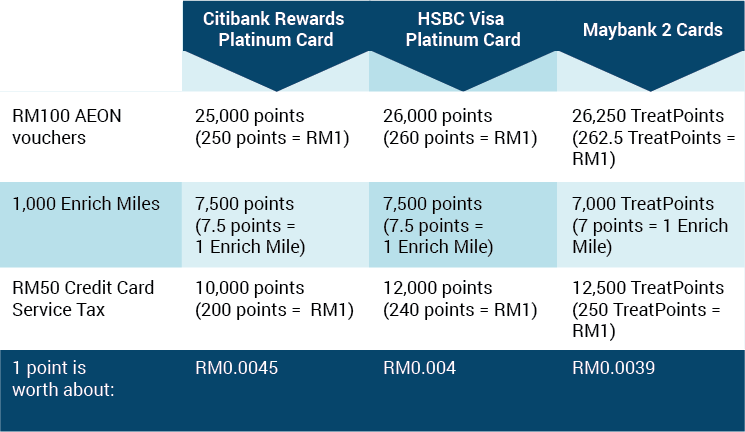

Round 1: How much is a point worth?

To calculate the value of each point, first find out what you can redeem or purchase with the points. The best gauge is check against redeemable vouchers. How many points do you need to redeem a RM100 voucher (petrol or department store vouchers are useful for this)?

The winner of round one goes to Citibank with the highest value for each point.

Round 2: How many points can you redeem for every Ringgit spent?

Once we know what a point is worth, it is a question of establishing how many points you get when you spend.

* For subscribed categories only. Terms & conditions applied.

* For subscribed categories only. Terms & conditions applied.

Though HSBC offers the highest points for every RM1 spent, it is restricted only to the two shopping malls to benefit from it, and Maybank only offers 5x TreatPoints for every RM1 if you use the American Express card, which does not have nearly as many participating merchants as Visa.

Citibank is the most flexible in terms of earning reward points as it is not restricted to locations and card.

Want to see other rewards credit card available in Malaysia? Go to credit card online application page to compare all cards.

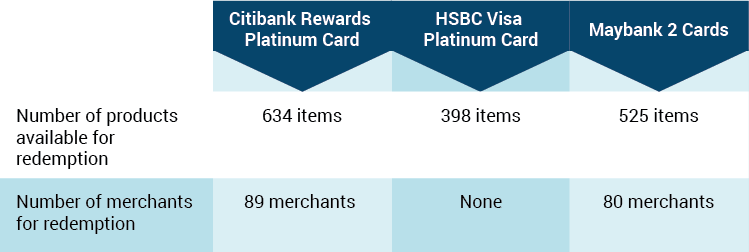

Round 3: How useful are your points?

Tired of exchanging your reward points for another kettle? Make sure you can truly be rewarded with the accumulated points by choosing a card that offers the most flexible redemption system with the most useful rewards.

Some cards offer more redemption products and even using the points for purchases at participating merchants. You are bound to be able to use the points for something that you want!

With the highest number of items available for redemption and the most number of merchants to make purchases with the accumulated points the Citibank Rewards Platinum card has the edge.

The verdict

We’ve found that the Citibank Rewards Platinum is the most flexible rewards point card for both earning and redeeming.

However, at the end of the day, choosing a credit card is as personal as finding your life partner. A card may offer poorer points or number of redemption products, but it matches your lifestyle in other ways that better benefit you. For example, if you always hang out at Gardens Mall, then it is best to take advantage of the 8x reward points offered by HSBC Visa Platinum.

Picking a credit card is all about matching it with your lifestyle.

The truth is, most people are sold with the idea of earning reward points but fail to see the value of each point and what they can use it for. It sounds great – everyone loves something for nothing but unless you’re careful, your card will actually deliver nothing for something!

Getting charged interest almost always dwarfs even the very best rewards schemes. Regardless of which card you choose, to really enjoy your reward points, always ensure you pay your credit card in full each month, so you get the best out of the card and not the other way round!

Wondering how credit card issuers are able to offer you rewards for your spending? We have revealed the secret of reward points.

Other than keeping track of your reward points, credit card statements reveal so much more. Here’s why you need to check your statement every month.

Disclaimer: This content is not provided or commissioned by the credit card issuer. Opinions expressed here are iMoney’s alone, not those of the credit card issuer, and have not been reviewed, approved or otherwise endorsed by the credit card issuer.