5 Things To Consider Before Selling A Property

Table of Contents

Property has always been a popular investment vehicle for most Malaysians. However, with tighter regulations and restrictions already rolling out beginning of this year, the Malaysian Institute of Estate Agents (MIEA) opined that the secondary residential property market will start to appear more attractive now compared to the primary ones.

With property prices expected to still remain high (many have appreciated substantially over the years) and the potentially higher number of prospective buyers in the secondary real estate market, perhaps it’s time to sell and reap the profit while the market is hot.

Nevertheless, there are still several areas that should be considered before selling a property:

1. Evaluate your decision

With booming entry of properties throughout the nation, oversupply is bound to happen. According to data collected by Global Property Guide, there has been a gradual increase in the numbers of unsold properties since 2008. This has resulted in it being clearly a buyer’s market in the property arena, where sellers may not have the upper hand on the negotiation table now. Therefore, the question is, are you really adamant of selling off your property now?

Unless you are a property flipper, it is advisable to re-evaluate your intention of putting up your property for sale:

- Has your property become a liability instead of being an asset like it should be?

- Are you facing difficulties in sourcing for tenants and continuously paying for maintenance fees and other miscellaneous fees for your vacant property?

- Is your property located in a disaster-prone area, such as floods and landslides?

- Are you having difficulties in servicing your mortgage or in need of liquidity for certain circumstances?

- Has your property’s value appreciated sufficiently to give you good returns?

2. Your asking price

Before setting your asking price, you can conduct the valuation on your own by checking the market price for similar units in the same residential area or development. However, bear in mind other factors that may increase or decrease the value of your unit – such as renovation and furnishings.

With the abundance of sales information available online nowadays, you can easily look up some of the recent sale prices of similar houses recently and identify trends to roughly gauge the value of your own. Sites like iProperty and PropertyGuru can provide relevant information that you need.

However, by hiring a property agent, you can leave all the number crunching work to them.

3. Professional help

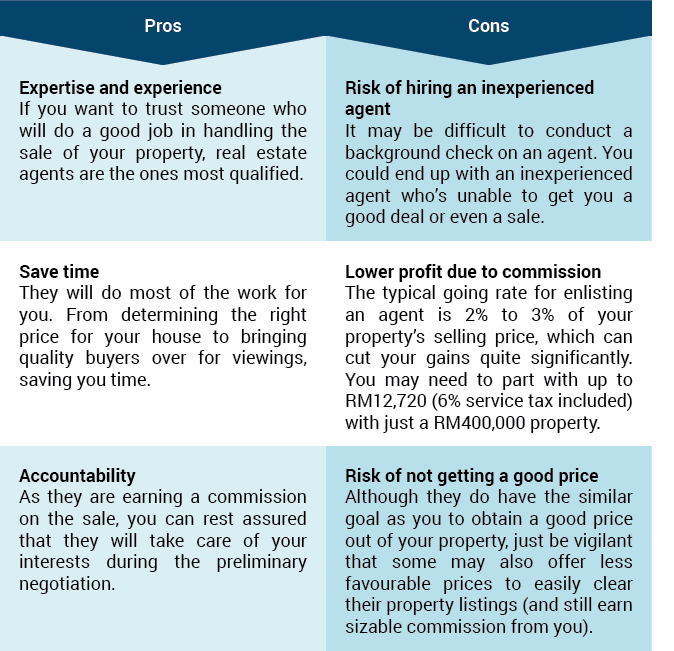

Usually, most would just enlist an agent to facilitate the sale of their properties. But you do have the option of doing it alone. Here are some of the pros and cons of hiring an agent to oversee the sale process:

If you plan to secure the services of an agent, here are the five things that you need to know about engaging one.

4. The charges and fees

Selling your house can be an exasperating experience as you need to go through a rigid process to do so. You could easily get a surprise finding out that there are plenty of charges and fees (also taxes!) that will come along in the process, which can cut into your gains significantly.

One of the biggest costs that you may incur is the Real Property Gains Tax (RPGT). If you decide to dispose of your property in the first five years (for Malaysians only), then you’ll be liable to pay for RPGT. Find out how the new tax structure looks like now.

Some of the other charges that you may incur are as follows:

- Real estate agent fee: Typically 2% to 3% of the property’s selling price.

- Legal fee for Sale and Purchase Agreement (SPA): Calculated based on your property’s selling price but can be passed on to the buyer if he or she engages the lawyer instead.

- Other miscellaneous fees (e.g. Stamp duty, disbursement fees, transfer of ownership, processing fees, etc.)

- CKHT 1A form to file for RPGT: RM300 will be charged upon submission (RM600 will be charged if the property is jointly owned).

On top of that, you still have to fork out extra for the 6% government tax on your legal services and penalty charge on early settlement of your housing loan, if it applies.

5. Renovation or refurbishment

In order to make your property more attractive to your prospective buyers, you may consider upkeeping or refurbishing the property. Some buyers may also request sellers to have the property revamped. If your house is old, perhaps it will be wise to give it a light cosmetic touch. Focusing on reconditioning essential parts of your house may give you a significant improvement on your prospects’ impressions (and the likelihood of a higher asking price too).

However, bear in mind that you may not be able to recoup all your investment into renovating your property as depreciation of the property will still be factored in.

These are some of the major considerations (with significant financial implications) that you may need to ponder upon before putting the sale tag on your property. The question that you need to answer at the end of this exercise is, will there still be a handsome return despite the above?