5 Simple Ways You Can Save Cash & The Environment

Table of Contents

Contrary to popular belief, saving the environment doesn’t always involve spending a lot of money. You may get made fun of for being a tree hugger but there are even more benefits to being environmental-friendly and it can actually help you save money.

There are few simple actions that you can indulge in that would inadvertently contribute to environmental safeguarding and saving some bucks.

Save water

Here is a terrifying fact on water consumption: “A dripping tap can waste 24,000 litres of water a year, and usually all that is wrong is a washer which needs replacing,” says a resourceful site. It literally means RM54.72 going down the drain per person in Selangor every year! And that’s just one thing you can do.

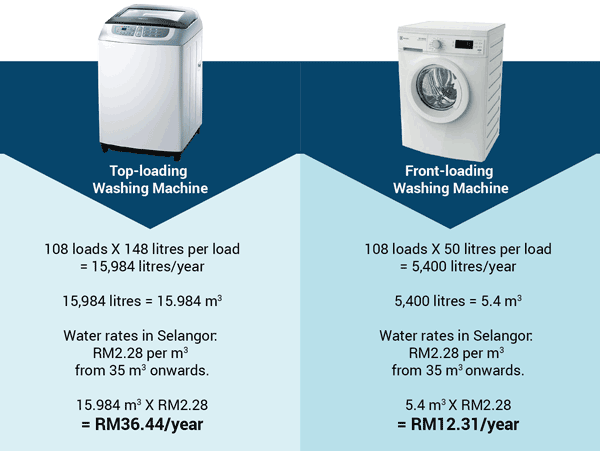

Consider getting the pipe fixed or switch to a good washing machine. Though an 8kg top-loading washing machine (about RM1,000) is much cheaper than a front-loading kind (about RM2,000), the difference in water usage is really significant.

The front-loading machine only needs a third of the water (50 litres) compared to a top-loading machine (148 litres). And while a top-loading machine will empty the soapy water and refill for a rinse agitation cycle, a front-loading machine just sprays clean water on the load as the drum continues to turn, saving litres of water.

If you wash two loads every week, you will be washing at least 108 loads in 2014. Here’s how much it will cost using a top-loading versus a front-loading machines.

With the right washing machine, you can potentially save RM24.13 in water and thus tightening the taps’ control over the flowing water and cash.

Go paperless

Yes, it is important to plant more trees and use less paper to be kind to Mother Nature. However, you will also be saving some money by going paperless. Here’s how:

Opt for online banking instead of using cheque. Starting January 2 next year, each cheque transaction will cost RM0.50, whereas interbank transaction online only cost RM0.10 per transaction. That’s RM0.40 you save for every transaction!

If you are a mobile phone user, choose to have your monthly bill sent electronically can save you RM5 every month – RM60 a year that can be spent elsewhere.

Saving paper should be made a habit, especially in the office. For people who love to print everything, consider this. According to GreenBiz.com, an average office worker uses about 10,000 sheets of paper in a year. That’s about RM166.65 worth of 70gsm A4 paper.

If your office has about 10 employees, that will come to RM1,666.50 a year just on paper alone. It definitely makes sense to go paperless at work, whenever possible. Do the environment a favour because 10,000 pieces of paper is about one whole tree worth of pulp!

Reduce, reuse and recycle

The habit of recycling should be inculcated in everyone since young. Recycling is about doing the right thing for the environment, but it is also a decision between spending money and making money. Everything can and should be recycled.

Think it won’t hurt to just throw an empty can of soda instead of recycling it? Perhaps you should consider that during the manufacturing of cans, recycled aluminium requires 96% less energy compared to manufacturing new aluminium from its source material, bauxite.

This allows the country to save enough energy each year to be used to power close to one million homes and also in reducing water pollutants by more than 21,000 tons. To take it a step further, you can consider making some money by selling unused items. There are forums, Facebook groups and websites that cater to swapping and selling pre-loved items.

Money is a strong motivation to start recycling. If you are having trouble closing the doors to your wardrobe, it’s time to go through everything and sell whatever you don’t want to wear anymore (provided they are still in good condition).

Carpool to reduce your carbon footprint

It’s important to carpool whenever possible because it helps to save the environment as well as keeping cash from leaving your pocket. The benefits are not only economically awesome, it also helps to develop fantastic relationships with your friends, neighbours or (if you’re a risk taker), in-laws.

You are not only looking at shared fuel cost, but also reducing parking costs. According to University of Ottawa, you can actually cut your expenses by nearly 50% or more simply by carpooling.

If you have been spending RM300 a month on petrol and RM200 a month on parking, you could easily save RM250 or more depending on the number of people in your carpool!

Make Earth hour, days, months and years

Saving electricity should not be done for just an hour every year. It should be second nature to us. With the 15% electricity tariff hike beginning of this year, everyone should really put more effort into cutting down on electricity usage.

Some effective ways to save on electricity at home are to turn the lights off (yes, your mum was right), change to energy saving bulbs, and get solar panels.

The regular old incandescent light bulbs (with filament wires) waste up to 98% of the energy as heat, and not light. By changing to compact fluorescent light bulbs, you might cut your electricity bill by 75%.

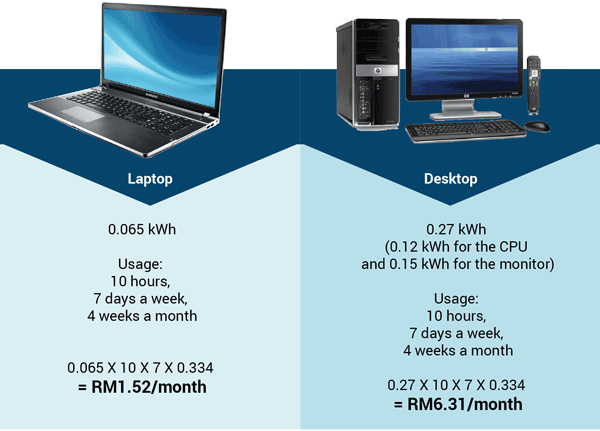

And for those who can’t part with their computers, here is the difference in electricity usage between a laptop and a desktop computer:

* Using the second tier rate of 33.40 sen/kWh, 201 – 300 kWh usage per month, for simplicity purposes.

* Using the second tier rate of 33.40 sen/kWh, 201 – 300 kWh usage per month, for simplicity purposes.

By switching to a laptop, you can save about 75% on energy every month. So, why not?

Once you get the hang of making these small changes, you’ll realise that there are a million other ways to help the environment while helping your finances at the same time.