5 Ways You Can Be Healthy And Still Save Money

Table of Contents

Healthy eating on a budget is possible, it just takes a game plan and a little creativity. Here are some practical, and life-changing ways to jump-start your healthy lifestyle (and saving money is just a bonus)!

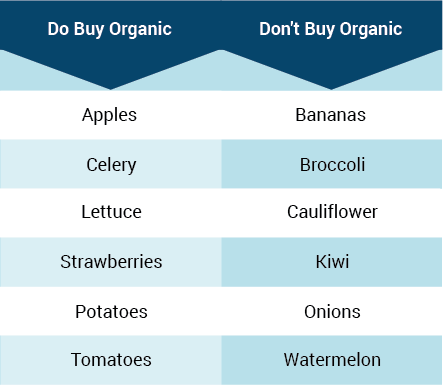

Be choosy when going organic

Buy organically grown, but not necessarily certified organic food. Some farmers use organic farming practices (no chemical and pesticides) but have chosen not to become certified organic because of the added expenses. This means you can often buy organic fruits and veggies from these farmers for cheaper than what the certified farmers charge.

On top of that not every produce you buy needs to be organic. Here are what you should buy organic and what you don’t have to.

For fruits and vegetables with a protective layer that you don’t eat (like bananas and watermelon), you don’t need to spend more to buy organic, or produce that is unlikely to be sprayed heavily with pesticides (like broccoli and cauliflower).

Sweating’s free, you don’t need a gym!

Can’t afford a membership at the trendy gym? You don’t need to pay hundreds of ringgit every month for half the facilities you don’t use. Here are some budget-friendly ways you can still keep fit:

1. Get your own dumbbells for a full-body workout at home. You spend: RM300

2. Download free health and fitness apps on your smartphone. There are about 3,000 iTunes apps designed to boost your health and fitness with exercise routines that don’t need any equipment. You spend: RM0

3. Jog around your neighbourhood for free and still burn the same amount of calories on a treadmill in a fancy gym. You spend: RM0

If you choose to take up all the options above, it will cost you about RM300, which is RM2,000 cheaper than an annual gym membership of about RM2,300. You’ll also save on travel time and parking!

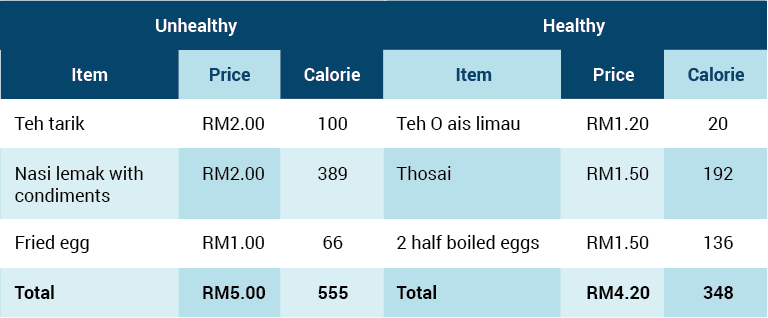

Eat out healthily on a budget

Unhealthy food is indeed often more accessible and can be cheaper than healthy alternatives. Unfortunately, it’s these very foods that make us unhealthy and overweight, causing all sorts of incredibly expensive medical problems down the road – but there are ways to be healthy while eating out – you just need to be aware.

Here’s how you can still stick to a healthy diet at your neighbourhood mamak with just RM5 in your pocket:

Just like that you’ve cut down on your calorie intake by almost 40% not to mention the other health benefits from reduced sugar, carbohydrate and oil intake. All from just one meal and you even ended spending less – not more!

Keep these in mind and you’ll be able to stay healthy and still save money even when eating out.

Stop smoking, start saving

Kick-start your saving by quitting tobacco. As soon as you stop, the savings start – in more ways than you might think.

If you are a one-pack-a-day smoker, you will be spending RM12 a day on cigarettes. By quitting, you will be saving RM4,380! If that’s not enough to put out the lights, this might!

Avoid financial meltdown on medical bills

Most people don’t have a stash of emergency funds saved up and this can lead to dire consequences in the event of sickness. It makes sense to protect yourself with adequate medical insurance for instances like that.

Just a common kidney stone treatment in a private hospital can cost at least RM5,000! The fact is that the cost of medical healthcare goes up every year, and it usually outpaces the general inflation rate. Therefore, a simple surgery can set you back significantly. By purchasing a medical insurance of about RM700 a year (depending on your age, medical history and other factors), you can save your wallet from bleeding when your body is already weak.

This World Health Day, start living healthily, not just for your body but for your wallet as well.

How do you save money without compromising on health? Share your ideas.