10 Properties In The Klang Valley For Middle Income Earners

Table of Contents

- 1. Town Villa, Taman Tasik Puchong, Puchong

- 2. I Residence, Kota Damansara, Petaling Jaya

- 3. Ritze Perdana 1, Damansara Perdana

- 4. Main Place Residence, Subang Jaya

- 5. Magna Ville, Selayang

- 6. Seri Baiduri, Setia Alam

- 7. Mahkota Residence Apartment, Cheras

- 8. Taman Kinrara, Puchong

- 9. Subang Andaman, Indah Alam, Shah Alam

- 10. The Palm Garden, Bandar Baru Klang, Klang

The middle income trap makes owning a home near impossible in the Klang Valley. This has been a major issue for this group of people who makes up 27.8% of the households in Malaysia in 2012, prompting the federal government to come up with several affordable housing schemes.

Where can the middle class afford to buy a home today? Affordability has worsened in the past year, as home prices have climbed faster than income.

It’s still possible but something’s got to give. In order to afford a house in the area, you need to re-prioritise your criteria – location, size, price?

We have scoured the property listings and here are a few properties in this sought after area that you could purchase if you are earning below RM4,000.

1. Town Villa, Taman Tasik Puchong, Puchong

Homeownership is made to seem like it’s completely out of reach for the middle class in the Klang Valley. However, if a home buyer can compromise on the location, they can still find a landed property right under their noses.

In an interview Star Property last year, the principal of MegaHarta Real Estate Sdn Bhd, Clement Ong predicted at least 10% increase in hot spots like Puchong, USJ, Shah Alam and Kepong. Due to property prices in prime areas like Petaling Jaya skyrocketing to beyond most buyers and investors’ budget, they have started looking elsewhere to invest in – making Puchong one of the fastest growing developing areas in Selangor.

Town Villa may be one of the few rare landed properties (townhouse) that is still below the half a million mark.

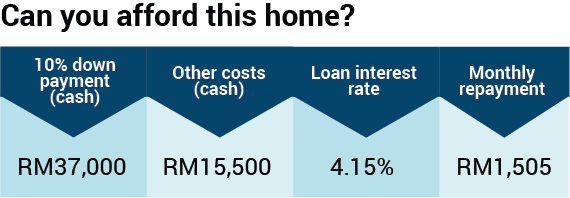

You will most likely be eligible for a loan amount of RM333,000 (90% margin of finance). However, you will need to commit to paying RM1,505 a month for the next 35 years, and come up with cash of at least RM15,500 for documentation cost and RM37,000 for down payment. That’s RM52,500 in cash!

2. I Residence, Kota Damansara, Petaling Jaya

If the most important criteria for you in finding your dream home is location, this one would top your list. It is perfect for both first time homebuyers and investors as the property prices in Kota Damansara have increased tremendously as more people are migrating into the area due to the abundance of amenities offered.

Furthermore, with the construction of six MRT stations in the township, property owners can expect the rental yield and property price to go up in the next few years.

This makes I Residence a good starter home.

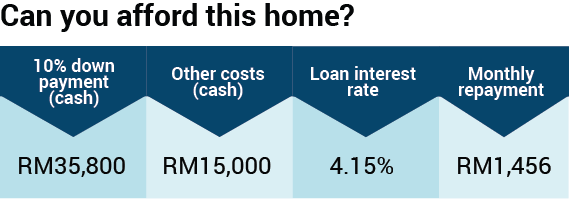

Buying this property will mean paying RM1,456 a month for the next 35 years plus upfront cash of RM51,000 for down payment and other miscellaneous cost.

3. Ritze Perdana 1, Damansara Perdana

Started development in 1996, Damansara Perdana has since flourished into a bestselling township in Petaling Jaya, and has proven to have good capital appreciation and investment returns.

Ritze Perdana 1 offers one of the best bachelor pads in the Golden Triangle of Petaling Jaya. Conveniently situated near the exit to LDP and Penchala Link, staying in Ritze Perdana 1 is great for social butterflies who are constantly on the go.

However, will you be able to pay for a condo here in your current financial situation (perhaps, missing a few nights out will be worth it)?

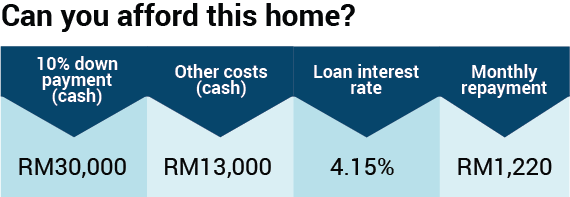

Forking out RM1,220 every month may be worth your while in this up and coming town. With various developments mushrooming around you, you can be assured of the appreciation of your property in years to come.

However, you have to make sure you are financially ready to purchase a unit here, with RM43,000 in cash.

4. Main Place Residence, Subang Jaya

Within weeks of news of the LRT station locations, property prices in Subang Jaya and USJ almost doubled. Property owners can expect even more appreciation on their properties once the train stations are in operation.

It’s still not too late to take a piece of the pie with the Main Place Residence, a serviced apartment above a retail mall.

Will this be the first home you’ve been dreaming of?

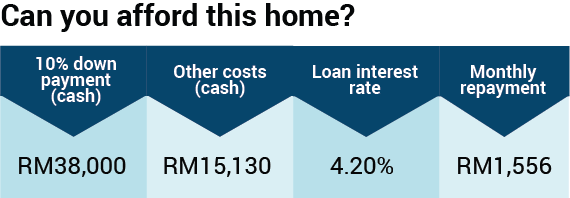

With the convenience it is set to offer, paying RM1,556 a month seems like a small price.

You will also need to have at least RM53,000 saved up in cash for your down payment and other costs, such as legal fees and stamp duty.

5. Magna Ville, Selayang

If you have a bigger family, space will be a priority in house shopping. However, with the current property market, a bigger family will definitely need to compromise on location. Magna Ville in Selayang may offer the housing that is within budget for the right size.

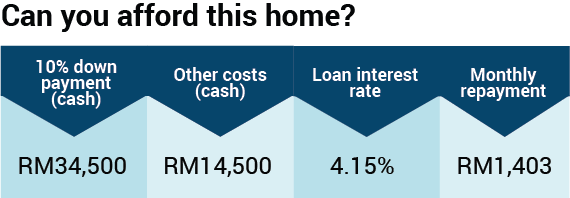

Here’s how much you need to afford it:

Prepare at least RM37,000 in cash for down payment and other costs to get your hands on one unit now.

6. Seri Baiduri, Setia Alam

A decade ago, when the CEO of SP Setia, Tan Sri Liew Kee Sin bought a huge oil palm plantation in Shah Alam, he was met with a lot of criticism. But he has since proven the naysayers wrong by developing this land into a township of award-winning communities with much appeal among homebuyers and investors.

Investing in Setia Alam can potentially see your returns doubled or tripled. It is now on its next phase of commercial developments such as office towers, the second stage of the Setia City Mall and a hotel that will be ready by end of 2014. It will definitely be worth your money to hit the market while it’s hot.

Here’s how the numbers look like:

Just 2 km away from the bustling Setia City Mall and 10 minutes away from the Setia Eco Park, this area offers up city living away from KL without that chaos of the capital.

You will need to be committed to paying RM1,403 every month and a total of RM49,000 in cash to own a unit here.

7. Mahkota Residence Apartment, Cheras

Located off 9th Mile Cheras, Mahkota Cheras is one of the hot spots in the Selangor part of Cheras. In 2010, Mahkota Cheras was still empty and home-owners were slowly moving in. However, when AEON Jusco started its operations in April 2010, the prices of units keep on rising.

The two highways – Silk Highway and Cheras-Kajang Highway, continue to make Cheras, Selangor appealing and convenient for people who need to travel to other parts of the Klang Valley. With the Sungai Buloh-Kajang MRT Line being constructed now, prices of properties will definitely continue escalating.

Put your money on one now before the price skyrockets in a year or two to rival places like Setia Alam and Kota Kemuning.

If you have RM53,600 cash and you are looking for comfortable home away from the city center, this is a good location to consider.

8. Taman Kinrara, Puchong

If condominiums are not your cup of tea, don’t worry. Double storey link houses under RM500,000 are not extinct yet. You can still find a rare one in Puchong every now and then.

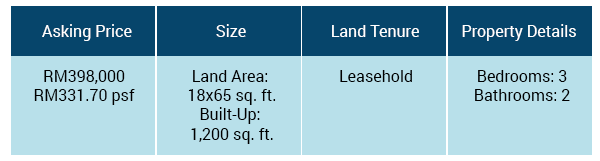

At RM398,000, it translates to this:

Paying RM1,618 every month for a two-storey landed home of your own, where you don’t have to pay for facilities you don’t even use (read: swimming pool and gym) – is definitely a good buy. You just have to come up with RM56,300 in cash to get it before it goes out of your budget.

9. Subang Andaman, Indah Alam, Shah Alam

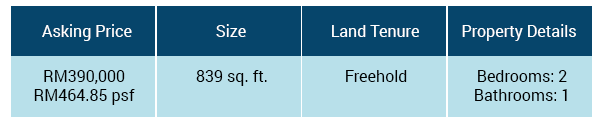

When affordability declines as home prices rise, affordable housing moves further into areas that require some of the longest commutes. However, Shah Alam being relatively near to where the jobs usually are (20 minutes to Petaling Jaya, and 25 minutes to Kuala Lumpur) and having to just pay RM390,000 for a 2-bedroom condominium is quite a good deal.

What does that mean to your pocket every month?

Can you contend with paying RM1,586 every month and also fork out RM55,000 in cash? If your answer is yes, you may just be on your way to owning your first home!

10. The Palm Garden, Bandar Baru Klang, Klang

Today’s unaffordable markets are likely to stay unaffordable. Instead of waiting for the property prices in the prime locations to go down (highly unlikely in the near future), it will be wise to purchase properties that are within your budget before even those get too expensive.

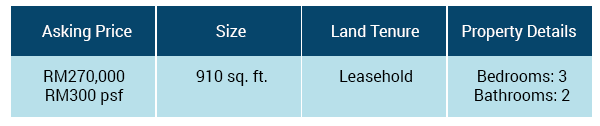

A new development means less money spend on renovation and new facilities. The Palm Garden in Klang may not be in your ideal location, but it definitely will fall within the price range of a middle income earner.

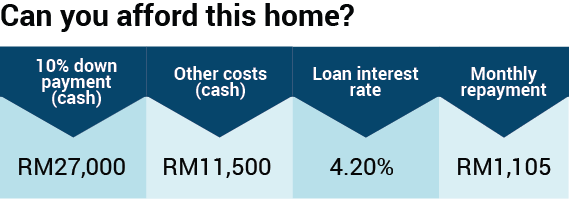

Here’s the math to own a unit:

As urbanisation hit the area like a gigantic piling machine, commuting longer and further to work doesn’t seem like such a crazy idea anymore. With just RM1,105 a month, it will not put too much of a financial strain on a person earning RM4,000 a month. Just save up RM38,500 for down payment and other miscellaneous cost and you will be well on your way to owning your first home!

Today’s housing market may be unaffordable for most in the “sandwich class” – sandwiched between the high income earners and the lower income earners – but a collapse in the housing market is nothing to wish for and not worth waiting for.

Although the federal government has been implementing new measures to curb property speculation and to slow down the increase in housing prices, there are still new developments popping up and being swept up by investors within months.

For middle income earners, it is time to realise that things are very different now and you will need to rethink your property buying strategy in order to get in the game before it’s really too late.

* Loan eligibility or debt service ratio (DSR) is based on net income of RM4,000 a month, 35 years loan tenure, and 90% margin of finance.