You’ve Got To Fight For Your Investing Rights!

Table of Contents

This article is sponsored by Securities Commission Malaysia, under its InvestSmart initiative.

Imagine that you have just made your first investment in the stock market: you are now the proud owner of shares from Astro Malaysia Holdings Berhad. As part-owner of the company, does this mean that you and your family can now receive satellite TV services for free? Would it also mean that you will have access to all their channels, including the sports packages that were previously out of reach due to the exorbitant prices? While these benefits are highly unlikely, it does pose a thought: As a shareholder, what are your entitlements, rights and privileges? In this article, we focus on illustrating the privileges that come with being a shareholder.

When you invest in shares, you automatically become the owner of a small percentage of the company. That is certainly an accomplishment of sorts considering that your shares come with a bundle of rights that you are now entitled to. In practice though, most investors are rarely aware of their rights, and even less will utilise them. Knowing your rights as an investor allows you to preserve your finances, minimise risks and maximise your investments effectively.

Shareholders have a significant role to play in exercising their rights. By making practical and effective use of your rights and privileges as a shareholder of a company, you promote transparency, integrity and accountability of the board, and consequently enhance the practice of good corporate governance.

1. Attend investor meetings

As a shareholder, you are entitled to attend shareholder meetings of the company you invested in. At these meetings, the company usually presents details about its financial performance and future outlook. This provides investors with a clear direction of the company, an avenue to question the directors and senior management on past performances and future plans, and to hold them accountable for preserving corporate democracy.

In summary, the key rights of shareholders in relation to general meetings include the right to:

- requisition for and convene general meetings;

- attend, appoint a proxy and speak at general meetings;

- vote at general meetings;

- receive information such as the Registers of Substantial Shareholders, the Register of Debentures, the Instruments and Register of Charges, the Register of Directors’ Shareholdings, the Register of Directors, Managers and Secretaries, the Minute Book of General Meetings, the Registrar and Index of Members. A copy of audited financial statements must be circulated to shareholders at least 14 days prior to the meeting; and

- enforce the above rights.

2. Voting on major issues

Shareholders have a say in company decisions. For example, when a company is looking to elect a new director, shareholders have a right to vote on the candidate of their choice. This also applies to fundamental changes affecting the company such as liquidations or mergers. Under the CA, each equity share issued by a public listed company (PLC) or its subsidiary confers the right to one vote at a poll at any general meeting.

Decisions at general meetings are made through votes, most commonly by a show of hands or by poll. However, if you, as the shareholder, are unable to attend the meetings, you may appoint another person or persons (whether a member or not) as your proxy to attend and vote on your behalf. A proxy has the same rights as a shareholder to speak at the meeting.

In the case of a unit trust holder, you have the right to call for a unit holders’ meeting and vote for the removal of the trustee or the management company through an Extraordinary Resolution.

3. Inspecting corporate books and records

When you hold shares – regardless of the amount – you are automatically entitled to receive the company’s annual reports and other financial documents pertaining to the company’s performance in the past year, its plans for the near future and how it expects to invest in future projects. Most PLCs are required to make their financial dealings public. Annual reports are usually published on the company’s official website, and you may also request for a copy to be mailed/emailed to you.

A company’s Investor relations or corporate communications unit is also a good place for investors to clarify any concerns or obtain information. Most PLCs utilise this unit to give consistent and updated information on the company and works a good point of reference for investors.

For unit trusts, the performance of all funds are disclosed in the annual report after the close of each financial year. Each unit holder also receives periodic statements on their transactions and interim reports on the managed funds.

4. Right to lodge complaints

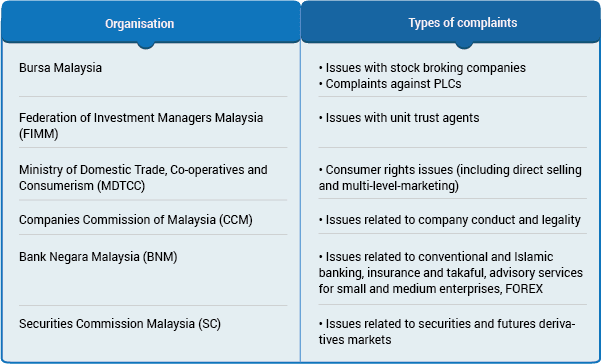

As an investor, you should not remain passive and ignore any wrongdoings against the law or against your own personal right. If you ever need to lodge a formal complaint, here is a quick reference chart of the various bodies related to investments and where you can channel your complaints to:

5. Suing for wrongful acts

Shareholders have a right to sue the company if it provides you with an inaccurate view of its financial health. Examples of these types of wrongdoings include false reporting of profits, fictitious revenue declarations and fraudulent stock sales. The right to sue for wrongful acts is important in safeguarding shareholders against poor management.

The importance of due diligence

When it comes to investing, always ensure that you decide to invest only after thorough research and a good understanding of your rights.

Professional financial consultants are obligated to act in your best interests. However, not all consultants hold true to professional ethics and some may still try to peddle high-fee instruments that do not agree with your risk appetites and will not bring you the returns hoped for in the long run, benefiting only the consultant through incentives received.

Seeking professional advice and opinion is recommended, but it is important that you also carry out due diligence and understand the products, services and company you are considering before deciding to invest. Disclosure documents such as prospectuses or annual reports are a good source of information on the history of the company, its operations and its financial performance over the years. It is also important to consider other factors such as your age, risk appetite and financial goals.

As an investor, the power to grow your assets lies in your hands. Become an informed investor by educating yourself on your investing rights and privileges – this way, you will be able to make better investment decisions and eventually reach your investment goals.

Before you invest, take the time to understand all the costs and charges associated with your investment, as this impacts the value of your investment portfolio.

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: admin@investsmartsc.my.