The Bank Has Repossessed Your Car! What Should You Do Now?

Table of Contents

If you have never missed any of your car loan payments before, that’s great. Keep up the good work!

However, if you have been unable to make your loan payments lately, don’t simply ignore the problem and hope it will go away. Before you know it, your car might be repossessed.

Failing to pay for your car loan puts you at risk of getting your car repossessed by the bank. It’s common sense that if you fail to pay for your loan, your asset will be repossessed, but sometimes life happens and you get a kick in the back in the form of a repossession notice from the bank.

How does this happen?

The process of repossession

Car repossession process does not happen immediately when you miss a payment. Typically, you will only be served a repossession notice after you’ve missed two successive payments.

Here’s the timeline to the repossession of your vehicle.

Sources:

Hire Purchase Act 1967, Attorney General’s Chambers

Code Of Ethics For Permit Holder On Repossession, Association of Hire Purchase Companies Malaysia

If you are unfortunate enough to have that happened to you, you should know that:

- Repossessors must get your consent first before entering your premises.

- Repossessors must not use any strong force or oppressive measures to repossess the car.

- Repossessors must have a standard notice that delivers information such as the address and telephone number you should contact.

- Repossessors must give you reasonable time to remove your personal items and belongings.

Before the repossessor tows away you vehicle, he or she must produce:

- Legal permit to repossess your car

- His/her MyKad or I/C

- The repossession order issued by your bank or the court order.

If you fall victim to the oppressive measures taken by the repossessors or if your rights have been wrongfully infringed during repossession, make a complaint to the bank that repossessed the car. You may also complain to the Association of Hire Purchase Companies Malaysia to seek support.

After the repossessors fulfil all of the above, your car will be towed away and kept within a premise by the bank.

What to do if your car is repossessed?

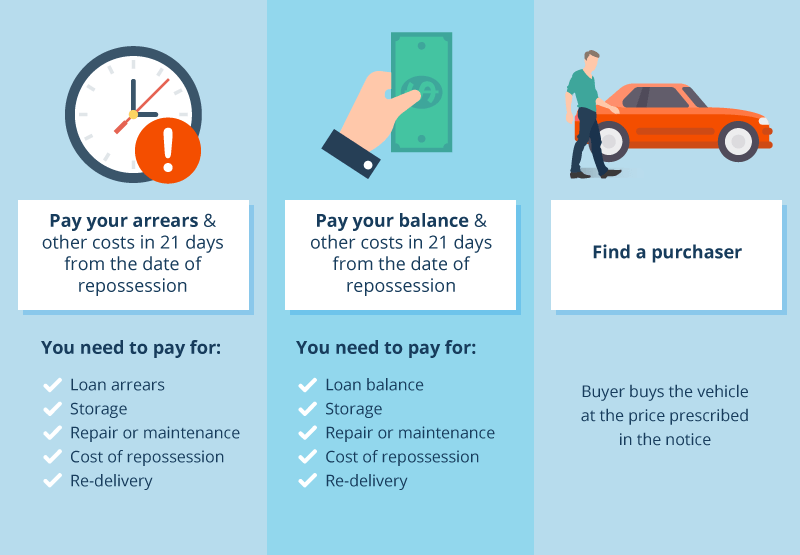

If panicking is on top of your list of what to do after your vehicle has been taken away, take a deep breath and consider your options. It’s not the end of the world if you know what to do, and act quickly. You will receive a 21-days’ notice to take action before the bank moves on to the next step.

Here are your options after your car has been repossessed:

Source : A Guide To Hire Purchase, Association of Hire Purchase Companies Malaysia

Failing to do any of this after 21 days, your car will be sent for auction.

What happens in the auction?

In this worst case scenario, your car will have to be auctioned off to pay off the debt that you owe. Auction prices are based on a forced sale value, which means it will be lower than the prevailing market value. Instead of the sale price going up during the auction, the price will actually reduce at each subsequent bid carried out until the car is finally sold.

This means, if your car is only sold in the subsequent auction, the proceeds from the auction may not be enough to cover your outstanding loan and other out-of-pocket expenses that incurred in the process.

In this case, the bank will continue to demand the rest of payment from you. You will also need to bear the auction expenses as well and any other fees related to the repossession, so it will be a major loss for you.

How can you avoid the drama?

The best way to avoid the whole sticky situation is, of course, paying what your loan on time. But if you’re facing financial difficulties, here are some things that you can do:

- If you know you’re having cash flow problem, you can discuss with the bank to restructure your car loan. The bank may revise your monthly payments and/or extend the tenure to ease your burden. Although the bank is not obligated to revise your finances, there’s no harm in trying. This is best done early on, so you won’t be slapped with a repossession notice.

- If you can’t pay back what you owe and the bank refuses to revise your monthly payments, your best option at this stage is to sell your car before it gets to the repossession stage. Remember, selling a car is not done overnight. So, you need to ensure you have enough time to dispose of your vehicle and settle your loan with the bank before repossession kicks in.

Take note that if you have paid more than 75% of your car loan, the bank cannot repossess your car unless they get a court order. Repossession is only valid if you owe the bank more than 75% of the car loan and you have defaulted your loan twice, consecutively.

For those who have yet to buy a vehicle and get a loan from the bank, there are many factors you need to consider to keep your vehicle from being repossessed a few months or years down the line. First of all, make sure that the vehicle you buy is one that you can afford, and not just based on the loan you are eligible for. You want to be able to repay your loan so that you never default, or have financial issues. So take note of how much you can really repay monthly, and work from there.

Having an emergency fund is also crucial to cover your loan repayment just in case you lose your job or you’re going through a rough patch financially. Plan out how much you will need to have in your emergency fund, not just for your car loan, but also for your other financial commitments.

A repossessed car will affect your credit rating, which will make it harder for you to get any loans or mortgages in the future. As with any credit facilities, you need to consider the repercussions of the worst case scenario. Will you be able to weather through job loss, financial downturn, or pay cut?

Whatever the situation is, always know your rights when you’re sent the letter of repossession and take action accordingly. Most importantly, focus on paying off your loan to ensure nothing bad happens to your finances and your vehicle.