What Your iMoney CreditScore Tells You; And What It All Means

Table of Contents

Applying for a new credit card or loan usually involves something called a credit score. We’ve covered this topic before, but here’s a quick recap in case you missed it.

A credit score is basically a rating of your credit health. Most financial institutions have their own methodology for calculating this score, but there are some common factors that are taken into account.

Basically, your history of borrowing money (and paying it back) influences your score. Most of the time, you will be required to pay a fee to check your credit score; but you can get it for free with iMoney CreditScore.

Getting started

Firstly, you will need to register for an account with iMoney. It’s recommended that you use your mobile device for this, as you will be asked to provide pictures of your IC for verification. However, you can also use a desktop or tablet to sign up.

Additionally, you will be asked several security questions about your financial history for an additional level of identity checks.

If you did everything right, you will obtain your iMoney CreditScore within two minutes of sign-up. On the other hand, you may have to wait an additional 24 hours if you failed to answer the security questions correctly

I got my score!

You’ve now reached a page that shows your score and some additional information, but what do all those numbers mean? What is this advice about? What do you do with all this?

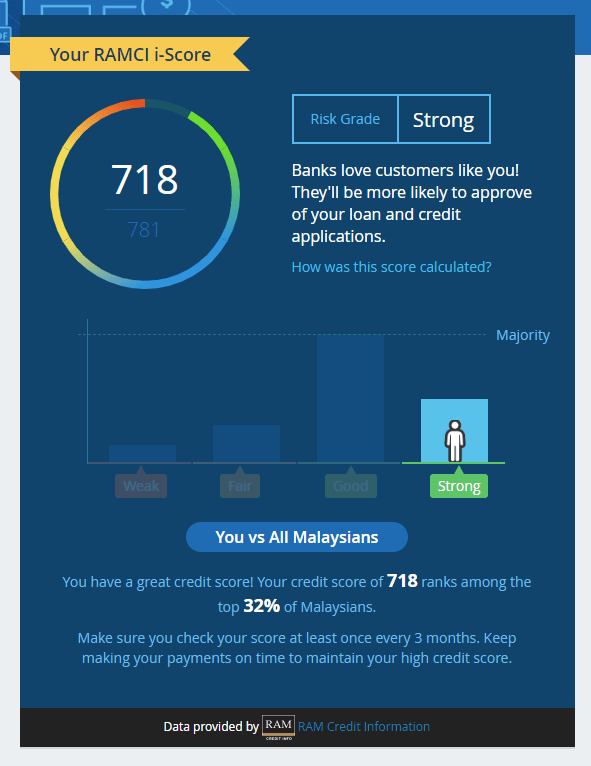

Your final score is sorted into one of four categories. These are a general indication of how a bank may view you as a customer.

| Score | Rating | Meaning |

|---|---|---|

| 661 - 781 | Strong | Excellent credit record. You are seen as a prime bank customer and are more likely to get approved for credit products. |

| 581 - 660 | Good | Good credit score. You are seen as a good bank customer, but may still be turned away for certain products. |

| 461 - 580 | Fair | Below average credit score. You may have trouble getting approved for bank products. |

| 201 - 460 | Weak | Weak credit score. You are seen as a poor risk for banks. |

If you are within the “Good” and “Strong” categories, you have a good chance in seeing your future loans being approved, as well as reducing your lending interest rates. Lower than that and you have some work to do to improve your credit score.

Just keep in mind that this is not a definitive rating for how a bank will treat you as a customer. Every institution has its own parameters for approving loans, so having a strong or good iMoney CreditScore cannot guarantee that you will get a loan, but it is a pretty good indicator.

More information

iMoney CreditScore shows you the status of your loans and credit cards; including whether there are any missed payments you forgot about. There is also a section for your credit application record over the past 12 months.

It’s important to know if you are paying on time as this affects your credit score. Applying for loans and credit cards more than three times a year could negatively affect your score, so take note of all of this.

On the other hand, not having a credit history could distort your rating. Not owning a credit card or ever taking a loan could result in a very low credit score. This doesn’t mean that you are poor, but rather that financial institutions have limited evidence that you are a good paymaster.

In other words, an empty additional information section is probably why your credit score is so low.

This may also be a good time to see if the information you’re looking at is accurate, and that nobody has applied for loans using your name.

Read the Advice

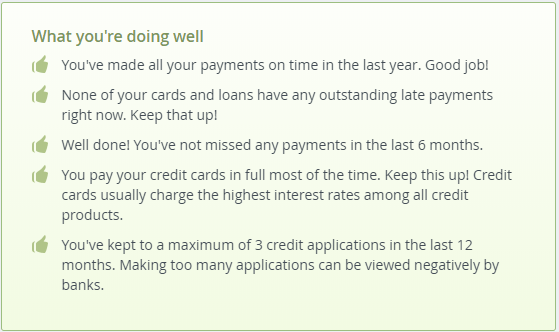

On top of receiving your score, iMoney CreditScore also offers some advice on how to improve your credit health. Even those in the “Good” and “Strong” category will get advice on how to strengthen their credit score further, so it’s worth looking into!

The advice you get can range from making sure you pay back what you owe promptly, to taking on a couple of credit cards to build your credit score. Your credit score will change over time so it’s best to check every three to six months to see if you’re on track.

How will all this benefit me in the end?

Knowing your credit score is a good start when you’re planning to apply for any financial products, as knowing this will help you understand the chances of your application being rejected and how you can improve your approval rate.

Having a strong credit score will help you a lot in the future, so do your best to pay what you owe on time and build your credit by utilising your credit card and loans wisely.