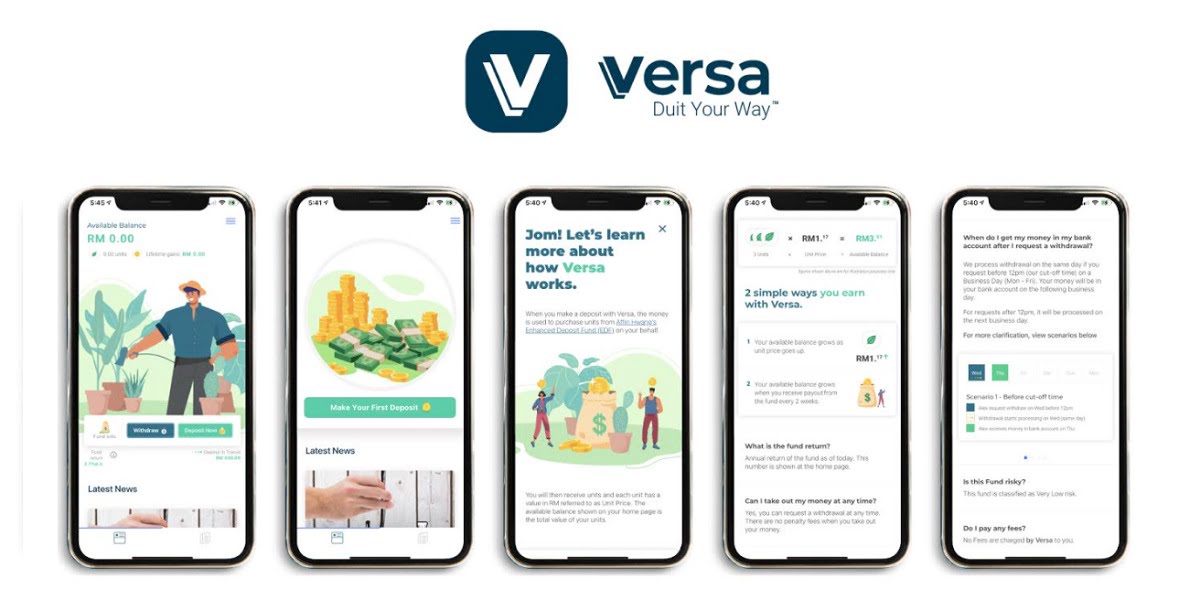

This New Cash Management App Allows Users Access To Money Market Funds

Versa is a digital cash management platform that allows you to get returns almost similar to low-risk deposit options but still enjoy instant access to your funds like you have with a savings account.

Launched in partnership with Affin Hwang Asset Management on January 29, 2021, Versa puts money market funds (MMF) within the reach of ordinary investors to benefit from its low-risk and high liquidity.

Allen Woo, Chief Innovation Officer of Affin Hwang Asset Management said that this mobile app will allow Malaysians to get higher yields for their cash but without sacrificing liquidity. “Through our partnership with Versa, we are excited to bring a new solution into the market that will allow Malaysians to more easily tap into money market funds which were not commonly accessible to retail investors in the past,” he added.

Versa’s Chief Executive Officer, Teoh Wei-Xiang also highlighted that the younger generation may have less disposable income but Versa’s low risk money management is suitable for their spending patterns.

“They can kick start their investment journey with a low entry fee, and at the same time have full access to their funds, enabling them to withdraw money within a 24-hour window without any penalties incurred,” Teoh said.

“Moving forward, we hope that Versa’s digital cash management platform can alleviate their financial worries, and introduce better and more practical investment alternatives over traditional ones such as fixed deposits and trading,” he added.

Versa is also connected to every bank in Malaysia through the online payment solution FPX. It is a recognised market operator (e-service platform) under Section 34 of the Capital Markets and Services Act 2007 with approval and a licence from the Securities Commission Malaysia (SC).

The mobile application is now available on the App Store and Google Play.