Medical Costs Are On The Rise: What Does This Mean For You?

Table of Contents

In partnership with

You head to the cashier to pay for your mee goreng. The bill comes up to…wait, RM7? You could have sworn that this was RM6 a few months ago!

If this sounds familiar, then you’ve experienced one of the most common financial occurrences: inflation. Thanks to inflation, prices are constantly rising year by year. Unfortunately, it doesn’t just affect everyday costs, but big ticket ones like medical expenses.

In fact, medical inflation is often higher than the hike in prices of other goods and services – and medical care isn’t cheap to start with. A lab test can cost up to RM1,000 in a government hospital, or around RM6,000 for a diagnostic test like an angiogram at a private hospital. Surgical procedures at private hospitals can cost even more – for example, around RM30,000 for an angioplasty.

So how and why are these costs rising, and what does it mean for you? Here’s what you need to know.

How much are medical costs rising?

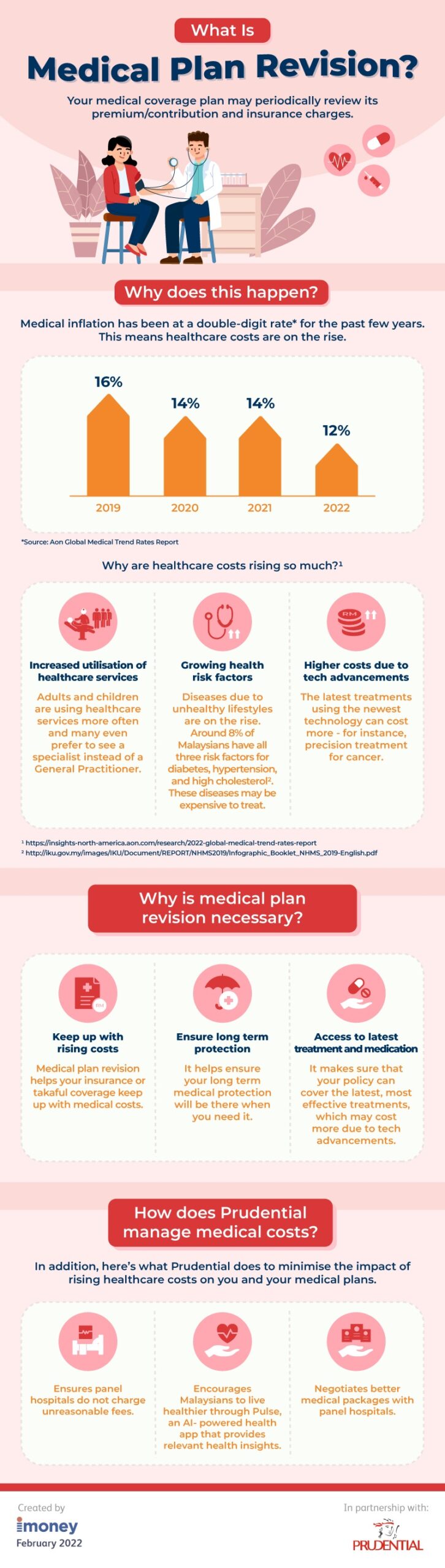

According to global insurance risk services firm Aon’s 2022 Global Medical Trend Rates Report, Malaysia’s estimated medical trend rate (i.e. the change in the cost of health care) this year is 12%. In contrast, the annual general inflation rate – that is, the increase in prices of other goods and services – is only estimated to be at 2% this year.

But why are medical costs rising so much? According to Aon’s report, factors that affect medical costs include increased use of healthcare services due to aging, growing health risk factors and higher costs due to tech advancements.

What does this mean for you?

Aside from the obvious consequence of having to pay more for medical costs, it also means that you may need to seek or review your medical coverage, as well as consider other ways to manage these costs.

1. Medical coverage can provide a financial safety net

An insurance or takaful policy can help you cover your medical costs. Here’s how it works: you pay a small amount every month (also known as ‘premiums/contributions’). In exchange, the policy provider will pay for your medical expenses if you get hospitalised.

There are different types of plans available in the market. For example, hospitalisation and surgical insurance plans can cover your hospital room and board, lab fees, use of special facilities, nursing care and certain medicines. Basically, it covers the cost of necessary medical treatments you need when you’re hospitalised.

This can be incredibly helpful to cover medical costs, especially when they’re constantly rising. With adequate insurance or takaful coverage, you can rest easy that your medical costs will be covered, while focusing on recovery.

If you already have a medical coverage policy, it could be a good time to review your coverage to see if it has kept up with rising medical costs.

2. Keep up with rising costs with medical plan revision

As medical expenses are constantly rising, your insurance or takaful coverage may periodically review its premium/contribution or insurance charges. This is referred to as medical plan revision.

3. Prioritise healthy habits

Besides making sure you have adequate medical coverage, one of the ways to help minimise medical expenses is by living a healthy lifestyle. Research suggests that healthy lifestyle habits such as regular exercise and taking early steps to manage any risk factors can have a measurable positive impact on our health which will help reduce medical expenses in the long run

Research also shows that too much alcohol and salt intake combined with a lack of exercise can increase your risk of getting noncommunicable diseases like heart attacks, cancer and diabetes which will require long term medical care, leading to higher medical expenses.

4. Be a smart consumer

As a consumer, there are also a few things you could do to keep medical costs under control:

- Seek recommendations on healthcare providers. It can help to compare prices among different hospitals in your area, as private hospitals may have different charges for the same procedure.

- Understand the recommended procedures. Having a basic understanding of why you’ve been recommended certain procedures or tests can help you avoid being overcharged for unnecessary ones.

- Opt for day surgery. Many surgical procedures are eligible for day surgeries, which allow you to be admitted to a hospital and be discharged on the same day. This means that you won’t have to stay overnight at the hospital and incur more charges.

- Ask for an itemised bill. This provides a detailed description of your treatment costs, which can help you negotiate if you’ve been unfairly charged.

Get affordable comprehensive coverage with Prudential

You should regularly review your coverage to ensure that it is in line with your protection and financial needs.

If you need to keep to a budget, consider deductible plans where you pay a small, fixed amount for your medical expenses, while your plan covers the rest. These plans generally have lower monthly premiums.

If you don’t have any coverage, consider Prudential’s medical plans. Prudential has a wide range of plans that fits any budget, life stage or protection needs. In addition, Prudential has recently enhanced its plans with Total Pandemic Protection. This protects you not only during the COVID-19 pandemic, but also any pandemic(s) in the future.