PRS (Part 3): Private Retirement Schemes in Malaysia – The Big Picture

Table of Contents

An important thing to know is that you could either make money or lose money through PRS.

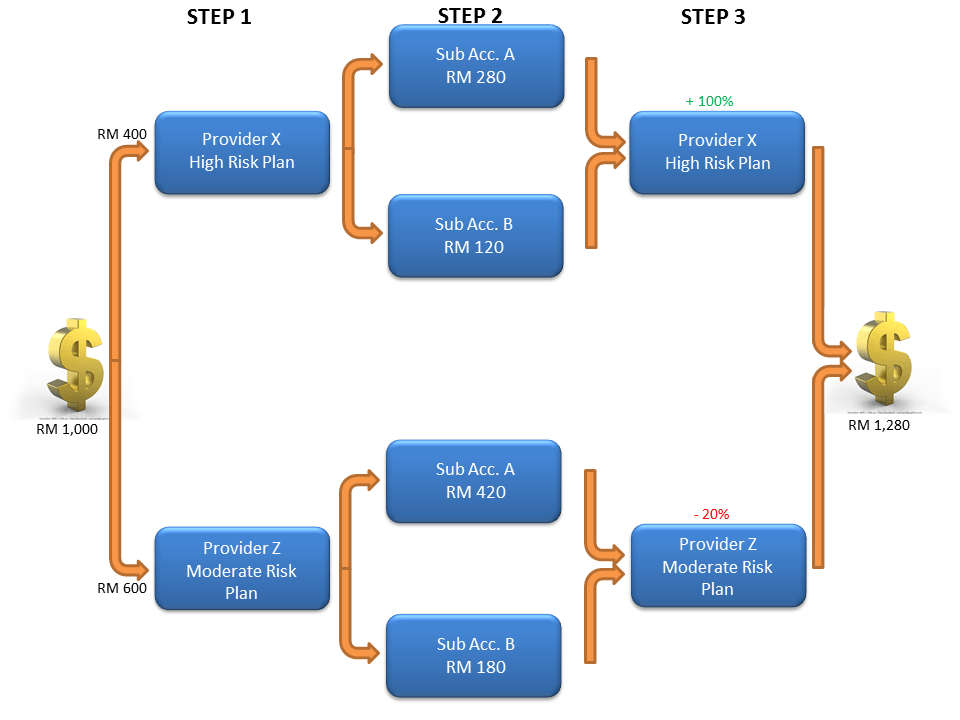

In Part 3 of iMoney’s PRS Series, we’ve laid out a three-step flowchart illustrating an example of how PRS works from start to finish.

For readers who are struggling to figure out the terminology and technical mechanisms of PRS, this simple example allows you to better understand the general flow of PRS without going into the details.

Step 1: Choosing the PRS Plans

In the above example, the subject has decided to contribute RM1,000 towards his retirement using two different PRS providers. 40% of the fund is contributed to Provider X who manages a High Risk Plan, whilst 60% is contributed to Provider Y who manages a Moderate Risk Plan. Take note you can always choose to go with one single plan or multiple plans with the same provider. The choice is yours.

Step 2: Segregation of Funds into Sub Accounts

After receiving the funds from the subject, the PRS providers split the contributions into sub account A (70%) and sub account B (30%). Funds from sub account A can only be withdrawn upon retirement , permanent emigration or death; whilst funds from sub account B can be withdrawn once a year, subject to tax penalty of 8% on the withdrawal amount.

Step 3: Performance of the PRS Plans

The subject’s funds are now fully managed by the PRS providers. Depending on the performance of the plans he’s contributed to, the monetary value of his account may grow or shrink over the years. Additionally, he may also make additional profit if his providers declare a dividend.

In the example above, the subject’s High Risk Plan does exceptionally well and doubles in value. However, his Moderate Risk Plan doesn’t do so well and loses 20% of its original value. In the end, he ends up with RM800 from the former and RM480 from the latter for a combined amount of RM1,280.

Take note this example assume that the subject did not carry out any withdrawals from his sub account B, did not receive any dividends over the years and made no further contribution. It also did not take into considerations factors such as increases in monthly contribution and inflation.

Important Lesson: You Can Make or Lose Money from PRS

Ultimately, the important thing to learn from the above flowchart is that like any other investment scheme, profit is not guaranteed. To put it simply, you could either make money or lose money through PRS.

To better under the pricing of PRS plans and what influence their values over the years, go to Part 4 of iMoney’s PRS Series.

Alternatively, if you think fixed deposit is the way to go in your financial planning; proceed to our fixed deposit comparison table; to see which bank provides the best interest rate right now!