The ABCs Of Mobile Online Trading

Table of Contents

Approximately 77% of Malaysians are internet users according to data released by the Malaysian Communications and Multimedia Commission (MCMC). Out of this pool, 89.4% of them access the World Wide Web using their smartphones, making the country a mobile-oriented society, where most decisions are made within the palm of one’s hand.

One of the advances of high-speed internet is the ability to complete financial transactions online without any hassle, and this is trending across the region.

The same trend can be seen in online trading, where more and more investors are turning to their smartphones for savvier trading. On a regional level, especially in Asia, such methods of investing in shares and stocks are in vogue.

Trading online through a mobile app makes it easier for investors to be more responsive to the market in a timely manner.

Here are the ABCs of online trading through the smartphone that will help you trade like a pro!

A – Accessibility

With a touch of your finger, you can now purchase groceries, locate the nearest bank, or find directions to just about anywhere in the world. Technology has made it much more convenient to go about our daily tasks, and also for us to be on the ball with our money.

Mobile apps have also transformed the way we invest. It has allowed us to make smart investment decisions quickly.

When choosing the right trading app, the features are important. But how do we identify the right app that offers all the features we need?

Firstly, we need to identify our needs and find the best solutions available in the market. This means, trying out and reviewing different apps to find one that fits your needs in the best and most convenient way possible.

One of the strongest contenders in this area is the INVESK app by Kenanga. The app goes beyond the basic trades and view quotes by also allowing its users to be the first to spot market trends and investment ideas in real time. This will help investors stay on top of their portfolio.

However, it is not just about making decisions, but also the research that leads up to your decisions.

Having access to latest financial news and analysis, as well as features such as price triggering alerts and customised push notifications on your favourite stocks will also help to contribute to successful online trading.

INVESK gives investors the access to research articles and Buy/Sell calls from various research houses, daily updates from news sources such as The Edge, The Star and Bursa, financial reports and announcements on company updates and developments, as well as key market indices and forex.

With access to all the information needed for an investor to make prompt investment decisions, investors will not miss out on their golden opportunities.

B – Benefits

Is mobile app better than conventional online trading? For an investor on the stock market, a successful buy or sell lies in the timing. In these volatile times, a slight delay could result in losing an investment opportunity.

A mobile trading app can be the key to keeping up with the market. But how can you harness the advantages of mobile trading apps effectively?

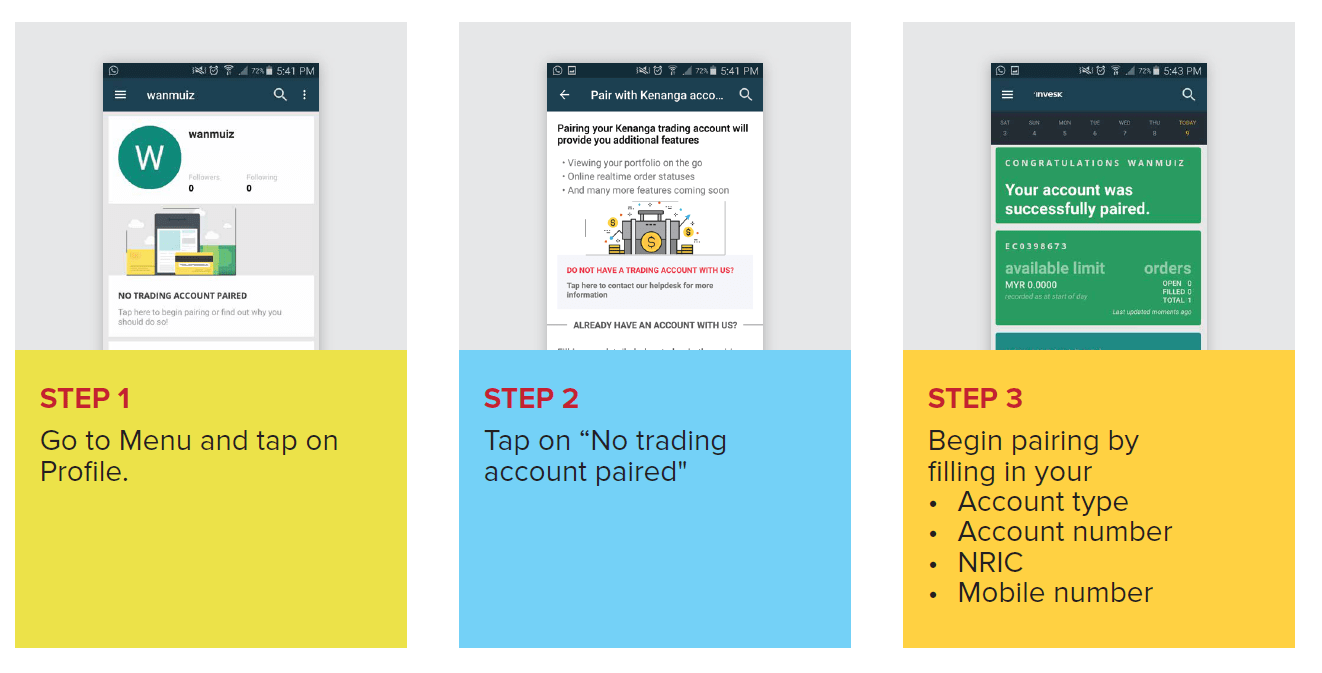

Getting started on mobile trading is a breeze. Once you download the INVESK trading app, you are good to go with just three (3) simple steps.

C – Cost

Many investment beginners are sold by the idea of potentially high returns of investment from stock trading, but fail to consider the cost of investment. To maximise investment returns, an investor should always try to minimise the cost of investment as much as possible.

This is why many retail investors are turning to online trading, as it typically charges lower fees compared to investing through a remisier.

Here is the trading cost involved:

| Fees | Rate |

|---|---|

| Brokerage fees | Different brokers charge different brokerage rate |

| Clearing fees | 0.03% |

| Stamp duty | 0.1% round up |

The good news is, effective March 1, 2018, stamp duty on shares of mid and small cap companies traded on Bursa Malaysia is waived for a period of three (3) years.

For first-time individual investors who open a CDS account between March 1, 2018 and August 31, 2018, trading and clearing fees will also be waived within this period of time.

If you do not have a trading account, now is the best time to open one to take advantage of these fees waiver. To open a CDS account, RM10.00 will be levied by Bursa Malaysia Depository.

Going mobile with your trading

The mobile trading platform has made trading a simpler and easier process to keep track of one’s accounts and the performance of the stock market.

The good news is this app is open to the public. Whether you are Kenanga client or not, you will still be able to access the research buy/sell calls. But Kenanga clients could take it a step further by executing the trade instantly with INVESK.