Is Your Insurance/Takaful Plan Sustainable?

![]()

Insurance or Takaful protection is a mid- to long-term financial planning. If you have purchased an insurance/Takaful plan when you were young and single, your protection needs may differ from when you are older and are starting a family. If you find yourself needing extra coverage, you will likely have to shop around for a new plan that addresses your needs.

Investment-linked products (ILPs) offer a more flexible alternative for those who are concerned about their changing needs. These ILPs are once again coming to the forefront of insurance or Takaful plans as Bank Negara Malaysia is introducing new regulations regarding annual updates on performance of funds.

How does ILP work?

As with any type of investments, ILPs which offers protection on top of the investment aspect, come with some risks.

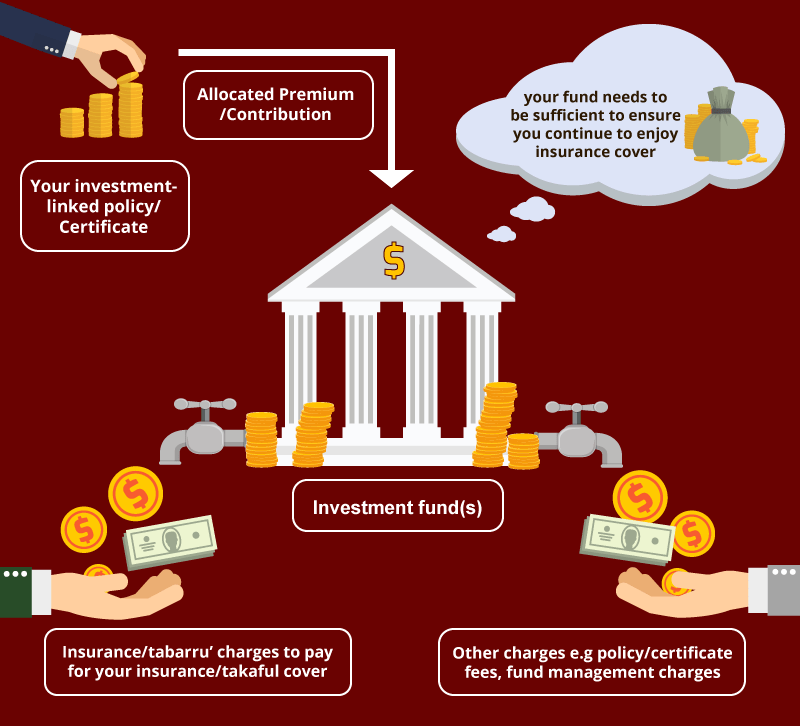

The idea is simple, you buy an ILP and then begin paying your monthly premiums or contributions. A portion of this premium/contribution goes towards paying for your insurance/tabaruu’ charges, while the rest is then allocated for investments.

If the insurance/tabaruu’ charges exceed the premium/contribution, the Insurer/Takaful operator will allocate some units from the investment to fund the insurance/tabaruu’ charges. If your Insurance/Takaful coverage is high coupled with a poorly performing sub-fund, the value of your units may not be enough to pay the insurance/tabaruu’ charges. You will have to top up your premium/contribution or reduce the coverage.

Other factors may also deplete the value of your ILP, such as: failing to pay premiums/contributions when they are due, deciding not to increase premiums/contributions despite adding riders, choosing not to increase premiums/contributions when there is an increase in insurance/tabarru charges, or when you make partial withdrawals from the fund.

Similarly, part of the monthly contribution of an investment-linked Takaful plan will go towards a Takaful participative fund (tabarru’) and the balance of the contributions will be used to purchase the Shariah-approved investment funds.

Basically, you are entering into an agreement contract (aqad) with other certificate holders to provide financial assistance to one another. This is done by making contributions to the same fund; pooling your money for the greater benefit of everyone.

Should you get an ILP?

Generally, ILPs are suitable for those who have a longer investment horizon due to the potential market fluctuations. as well as initial costs which can eat into your short-term potential returns.

If you are in for a long ride, then an ILP comes with its own set of benefits. It comes with the flexibility to adjust your investments according to your changing financial needs. For example, if you are starting a family, your aversion for risks may be lower than before, and your protection needs may increase. Hence, you can lower your investments or switch your investments to a lower risk sub-fund, and increase your coverage.

On the other hand, when your income has increased or become more stable, you can consider topping up your investments. In times of need, you can even make partial withdrawals.

Another benefit of an ILP is the ease with which additional riders can be added to your policy/certificate. This allows you to adjust your coverage based on where you are in life. Younger policyholders/certificate holders may be less concerned with critical illnesses but may want to take precautions as they grow older.

ILPs are also very useful for middle-aged people with a little more disposable income; and are facing the prospect of potentially needing more medical treatment. Adding riders like critical illness and hospitalisation are useful for those looking to expand their Insurance/Takaful coverage.

In general, this is for people who want a personal Insurance/Takaful plan that evolves with them. It will provide a safety net during hard times, but also grows during the good times.

Why annual performance updates are needed

Bank Negara Malaysia (BNM) has directed financial institutions to put more emphasis on sustainability updates for their ILP from July 1, 2019. Policyowners of ILP are advised to speak directly to their Insurer/Takaful operator or agents to find out how their investments have performed. Low performing funds may require the customer to increase premiums/contributions or lower coverage in order to maintain sustainability.

ILP vendors are required to introduce annual performance updates to customers come January 1, 2020. Generally, it is meant to provide a simple update on how the policy/certificate has done over the last year; and shouldn’t require any further action.

Additionally, those with ILP policies purchased before July 1 will receive an advance notice if their funds are in danger of lapsing within the next 12 months.

This move by BNM is to help you to stay informed about the health of your fund, and whether it will remain sustainable at the current premiums/contributions. It also allows you to decide whether to increase your premiums/contributions in order to shore up the investment with higher premiums/contributions, reduce your coverage to match the current premium/contribution, or to switch to a different fund.

The reason for the change is to keep the policyholders/certificate holders focused on having the ILP as a means of protection against unexpected situations, rather than treat it as an avenue for investments.

Ultimately, BNM’s position is to ensure that your ILP can sustain you through unforeseen events. New regulations will provide a stronger safety net against fluctuations in the market; allowing you to better protect yourself through the years.

Knowing that your ILP is secure and ready to cater to your needs is the first step in taking care of your future – and that of your family.