Simplify How You Save And Invest With This Robo Advisor

Table of Contents

Investing used to involve making appointments with financial planners, driving through traffic to meet them and it may even take several meetings before you can even get started. Not to mention having to come up with a big sum of money you need to put aside, often thousands of ringgit or more before you can actually invest.

Today, there is a simpler way to start investing – with a robo advisor. This is a great alternative to traditional investment options especially if you are new to investing. For most of us who are not looking to be professional investors but just looking for ways to grow our wealth, a robo advisor is a less intimidating way to start.

Which bring us to the next question, which robo advisor should you try? Choosing the right one which suits your needs starts with knowing what to look for before you commit your time and money to it.

What to consider when choosing a robo-advisor

While robo advisory services have been around for over a decade, they officially entered Malaysia when the Securities Commission issued licenses in 2018. Today, there are several robo advisory platforms registered in Malaysia.

A robo advisor is like your automated investment manager which you give your instructions through a digital investment platform. However, you still need to pay fees for this investment service so it’s best to know what you need, whether you are looking for lower fees, minimum balances, portfolio rebalancing or access to certain funds before you pick one.

Here’s a quick checklist to help you find the best robo advisor for your investment needs.

-

Management Fees

In general, local robo advisors’ fees range from 0.2% to 0.8%. Besides management fees, there may also be annual fees and these fees may vary depending on the type of investments in your portfolio.

-

Minimum/initial investment

Some platforms start as low as RM5 while others start from RM100. Either way, they are all extremely affordable. Which is why depending on what you are using the robo advisor for, having a low or flexible minimum investment amount may work better to your advantage when you want to start investing.

-

User features

Check on the portfolio allocation options, and the type of technology used by the robo advisor to manage your investments. Can the robo advisor connect to your local bank and allow you to easily switch, buy or sell your investments?

-

Licensing

Finally, all robo advisors in Malaysia are regulated by the Securities Commission (SC) and must be licensed to provide robo advisory services.

So which robo advisor should you choose?

If you want low or even zero management fees, interested to buy, switch, and sell your investments at no cost and start with just a few hundred ringgit, Kenanga Digital Investing (KDI) checks all the boxes.

Let’s have a closer look at the products offered under the KDI umbrella, KDI Save and KDI Invest.

KDI Save

KDI Save is a Cash Management Fund (CMF) that is designed to help you save money and provide fixed returns, while also offering you the flexibility to deposit and withdraw your money at any time without any penalties.

Here are the highlights of KDI Save you should know:

- Best rates in town

KDI Save’s returns are derived from deposits with different maturity periods, which allows them to offer you higher returns.

- Low entry investment

KDI Save allows you to start saving with just an initial deposit of RM100, with any subsequent top up at RM10, which makes it very accessible for all Malaysians

- No restrictions

Unlike fixed deposits, there are no restrictions or lock-in period with KDI Save. This means that you can deposit and withdraw your money at any time, according to your convenience and it also helps you avoid having to pay a penalty for early withdrawals.

- Fixed daily returns

With KDI Save, you can watch your savings grow daily! KDI Save allows you the opportunity to earn daily returns while you wait for the right investment opportunity to roll around.

- Zero fees

And last but certainly not least, you can get all this at no cost at all. KDI Save does not charge you anything, either in management fees or hidden expenses fees.

*Terms and conditions apply. KDI Save is not PIDM protected.

KDI Invest

This robo advisor allows you to invest in a basket of selected Exchange Traded Funds (ETF) listed in the United States of America that matches your preferences.

This means you are able to gain access to multiple asset classes from the global markets which allows you to enjoy wider diversification and risk management. KDI Invest is also backed by a 24/7 Artificial Intelligence to help monitor the markets and your investments, so you can enjoy peace of mind while your money works for you.

Check out these benefits of KDI Invest:

- Lowest fees in town

In fact, it is completely free if your investment amount in KDI is below RM3000. If your investment amount is above RM3000, then your annual fee will be somewhere between 0.3%-0.7%, which is still very reasonable for access to global ETFs. Plus, you can buy, sell, switch at no cost.

- Access to global investments

You can add world class assets and US ETFs to your portfolio from just RM250. Through ETFs, you can even add Meta, Apple, Microsoft, Google, and Amazon into your investment portfolio for a fraction of the cost.

- Superior risk-adjustment

With KDI’s Factor Analytics Machine Learning Engine, your portfolio’s volatility is always monitored and adjusted to fit your risk profile, which means that you can rest easy while the AI does all the work for you. This allows your portfolio to be judged purely based on performance and data, which potentially can promise higher returns, while also managing risk at a minimal level.

*Minimum deposit is RM250 for ETF product.

Sign up and start investing with KDI

One of the biggest misconceptions about investing is that it requires a huge amount of capital to get started. In truth, with the advent of robo advisors, comes a new form of investing that is much more accessible for everyone.

With KDI, you can start saving and investing towards your life goals right now. All you need to do is to sign up, provide your personal information, wait for your information to be verified and you’re all set to start.

Thankfully, the sign-up process for KDI is very simple. Let’s start.

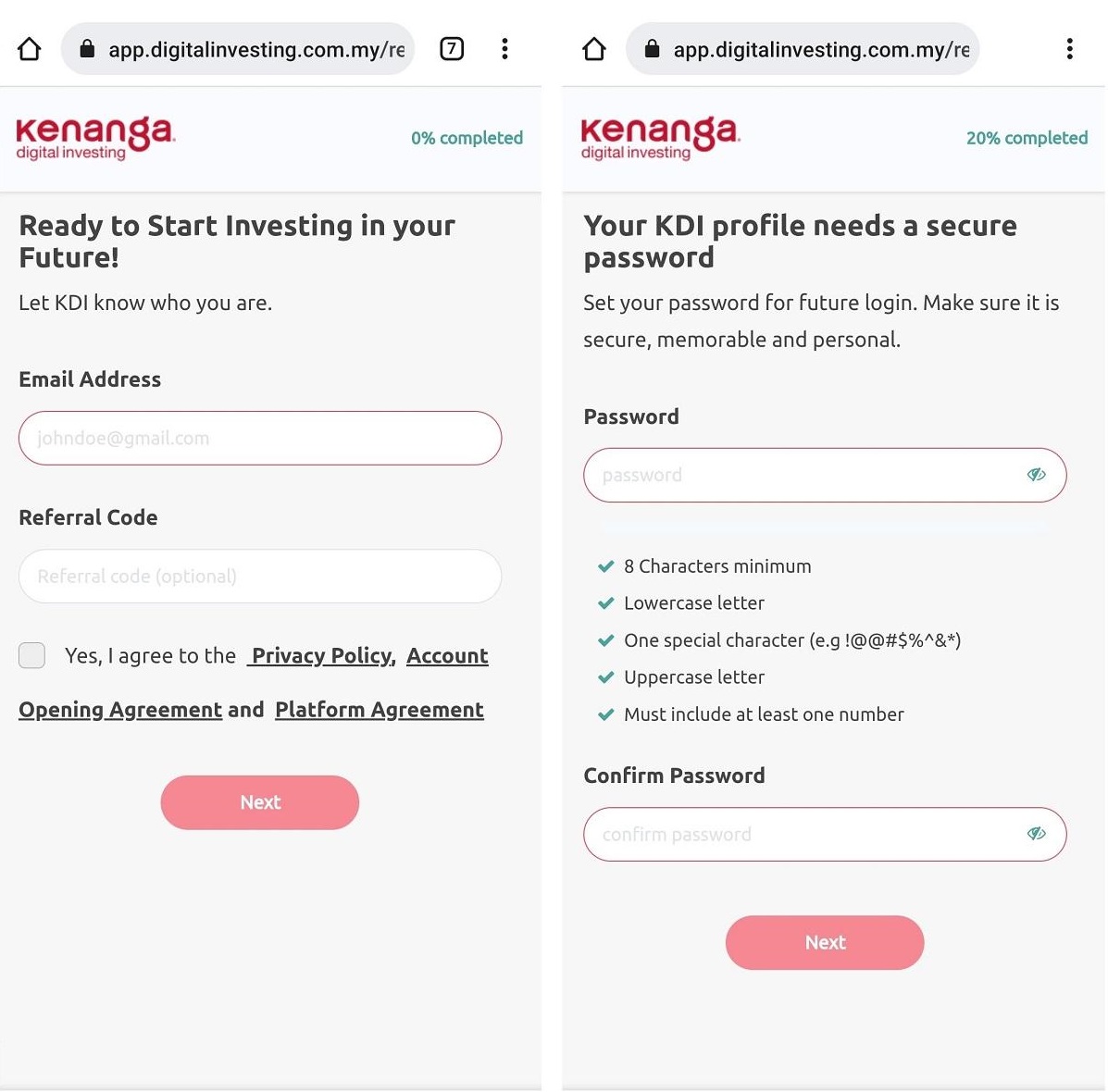

First, you need to provide an email address to sign up, and if you have a referral code, type that in the space show below; then followed by creating a password for your KDI profile.

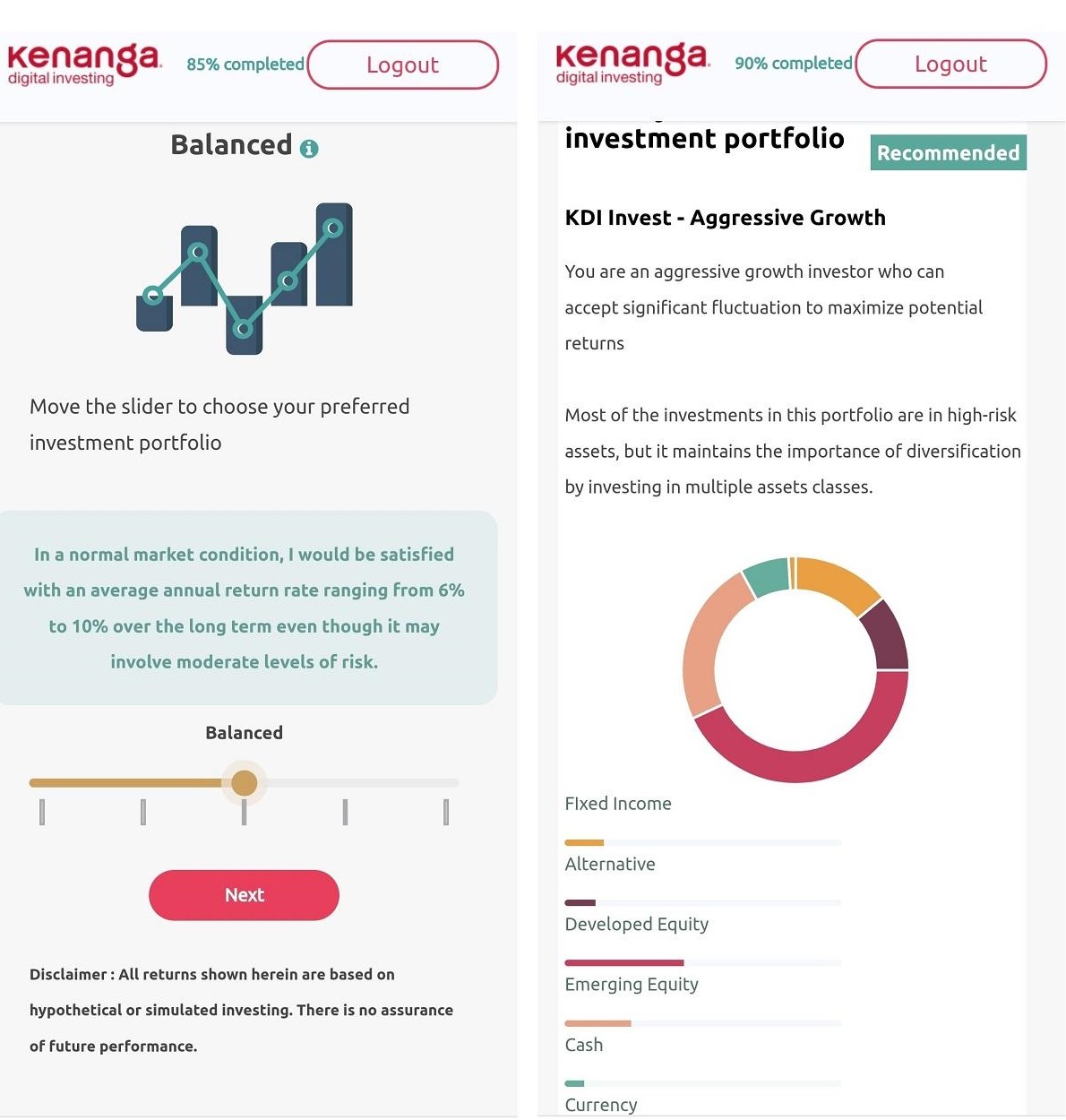

Then, you will be asked to provide your mobile phone number for mobile phone verification. Once you’ve verified your phone number, you can start customising your profile as show below. This will help KDI’s Artificial intelligence create a customised and unique investment plan for you.

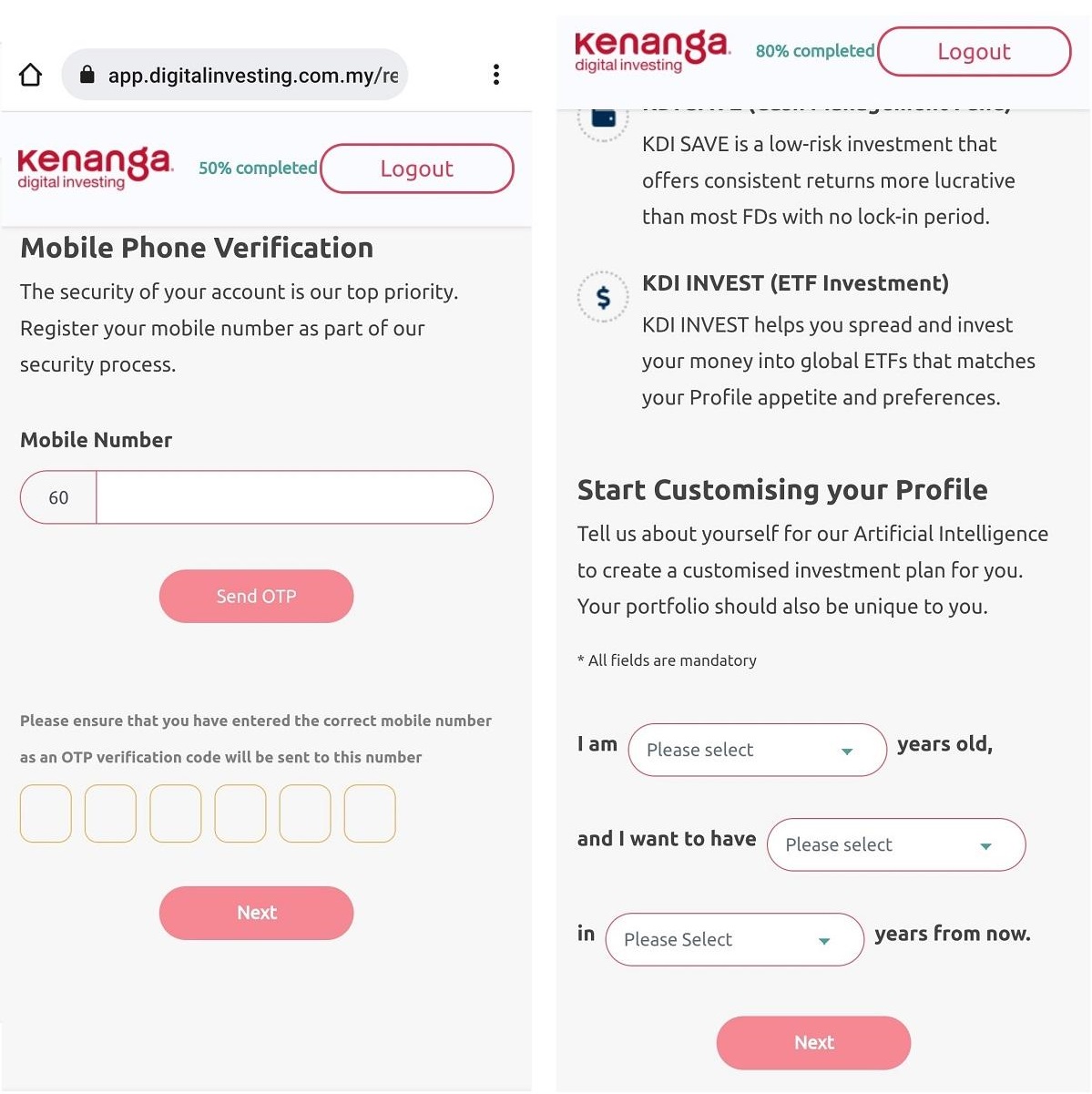

Next is for you to pick a risk profile that suits you and your needs and then KDI’s AI will show your portfolio recommendation.

You will also be asked to provide details on your income sources as well as provide foreign income declaration to complete your profile.

That’s it and you can start investing.

Register now and benefit from KDI’s fixed returns savings promotion and zero management fees.