Are You An Investment Guru? [Quiz]

As cost of living and inflation increases, for most, salary remains the same imposing a need for a downgrade in lifestyle just to make ends meet. So, if you’ve ever entertained the idea of growing your money but have been putting it off, now is the right time to take action.

But, how do you grow money in this day and age? If your answer is with ample amounts of water and sunlight, you have much to learn, young grasshopper. Most likely you’d answer “INVEST IT!” and if you did, you’re on the right track.

When it comes to investments however, there a few things that you should know lest you make investment decisions that end up costing you more than you earn. Here are five questions that may make you think twice about how much you know about investments.

Q1: Which is a better investment?

- A. 10% potential annual return stock.

- B. 3% annual return short-term cash investment.

- C. It depends on the risk.

Score:

This may seem like an easy choice; obviously a return of 10% is the best investment option, but note that you’ll be investing in stocks. Stocks are considered to be risky investments, thus generating a higher return. When it comes to choosing what to invest in, the right answer usually depends on the amount of risk you are willing to take.

Q2. How do you decide on your investment allocation?

- A. Allocation? I go all in on one!

- B. I spread all my investments equally

- C. I decide base on my risk profile

Score:

Refer to the feedback for Question 3 for the explanation.

Q3. How do you decide when to change your investment allocation?

- A. I’m all in on one, the only change I need is for parking.

- B. I change when I lose money.

- C. I change when my risk profile changes and after adequate research.

Score:

Thinking that the less diversified your portfolio is, the lower your risk will be is not entirely true. More often than not, it’s a lot riskier. As previously mentioned, different investments carry different levels of risk and thus varying levels of return.

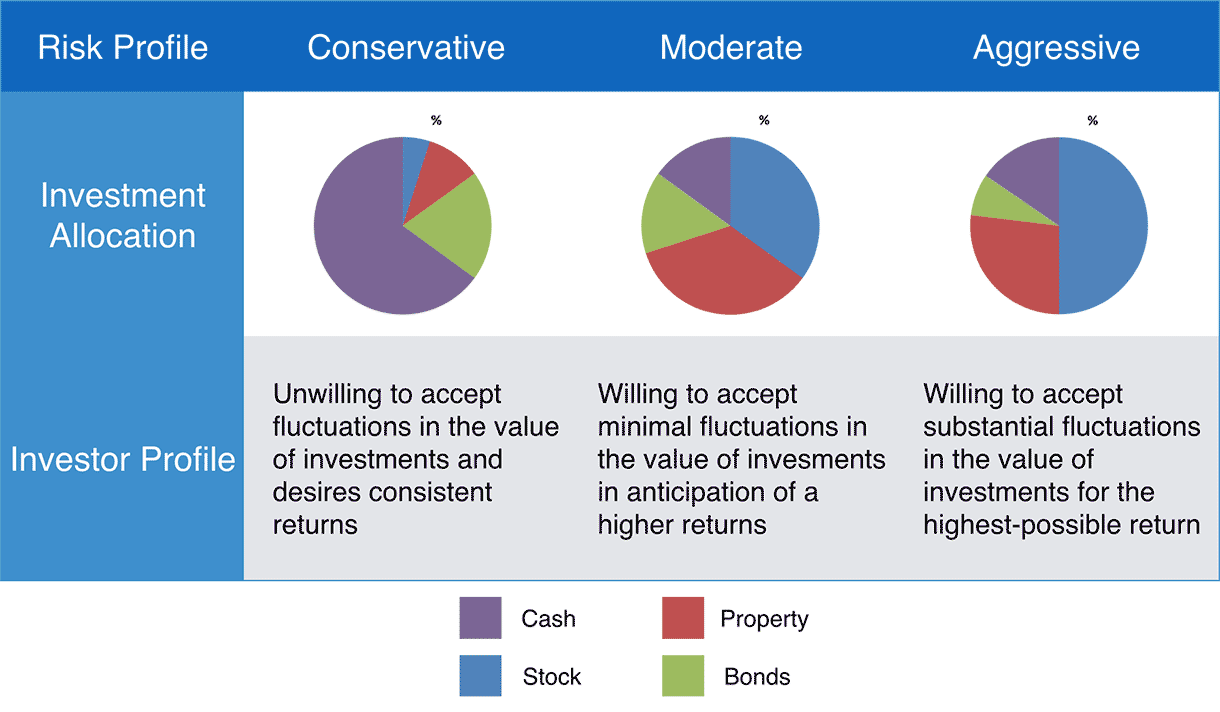

With a diversified portfolio, the loss from one investment (say stock) can be mitigated by the gains of another investment (say bonds). You should always diversify by how you choose to diversify however should be based on your risk profile:

Q4. Do you know how much your investments cost you?

- A. It’s totally free!

- B. I have a rough idea but I don’t know the exact numbers.

- C. I know how much it costs.

Score:

Investing often requires the expertise, knowledge, and experience of professionals that will likely charge you a fee. However, hidden or excessive fees can offset any potential returns from your investments, thus it is important to know how much each investment costs by identifying what portion goes to your advisors and if there are any penalties for switching investments.

A good general rule of thumb to follow is to compare prices before making a commitment.

Q5. How do you keep track of the progress of your investments?

- A. I don’t have time to track, I just keep going!

- B. I track the progress of my investments with a yearly spreadsheet.

- C. I opt for regular updates (if possible) and keep track my investments on a monthly or quarterly basis.

Score:

The old adage that knowledge is power rings true when it comes to investing. If you don’t regularly keep track of how your investments are doing, you will most likely be unable to make timely decisions on your investments. Failing to do so can at best prevent you from achieving your financial goals or cause you to lose money.

Your total score is:

Score of 8 or less.

Investor Level: Rookie

You haven’t done you research and your lack of understanding puts you at high risk of being a victim of fraud or theft. Investment(s) are unlikely to meet financial objectives.

Score of 9 to 12.

Investor Level: Young Grasshopper

You understand the fundamentals of investments but still have a moderate risk of being a victim of fraud or theft. Your investments might meet financial objectives but you may not be maximising their full potential.

Score of 13 or higher.

Investor Level: Financial Guru

You have a thorough understanding and you’ve spent hours of research on investing. This puts you at low risk of being a victim of fraud or theft. Your investments are likely to meet financial objectives.