Investment Guide: You Have RM50,000. Now How Should You Invest It?

Table of Contents

Fifty thousand Ringgit is a vast amount of money for most people. It could wipe out debt and help pay off your student loan, car loan or even use as a down payment for a property. But what if you don’t need to and instead you’d rather use it to make more, what are your options?

Fifty thousand Ringgit is a vast amount of money for most people. It could wipe out debt and help pay off your student loan, car loan or even use as a down payment for a property. But what if you don’t need to and instead you’d rather use it to make more, what are your options?

How and where to invest RM50,000 is dependent on a number of factors – time horizon, risk appetite, term of investment and your financial goals. Knowing the answers to these can help determine the investment strategy you should follow to achieve your goal.

Very rarely can we be successful in building our wealth without solid financial goals. Be it saving for the down payment of your first home, or building up your retirement fund, having a clear and measurable goal will help you determine how and where you invest your money.

Here are some investments you can turn to according to your financial goals:

1. Affording a RM600,000 property in five years

If you are planning to buy your first property and you need a plan to help you achieve it, first, you need to know the approximate price of the property and set a deadline for it.

To afford a property of RM600,000 you will need at least RM60,000 in cash for down payment (margin of finance at 90%) and at least another RM20,000 for other fees and charges.

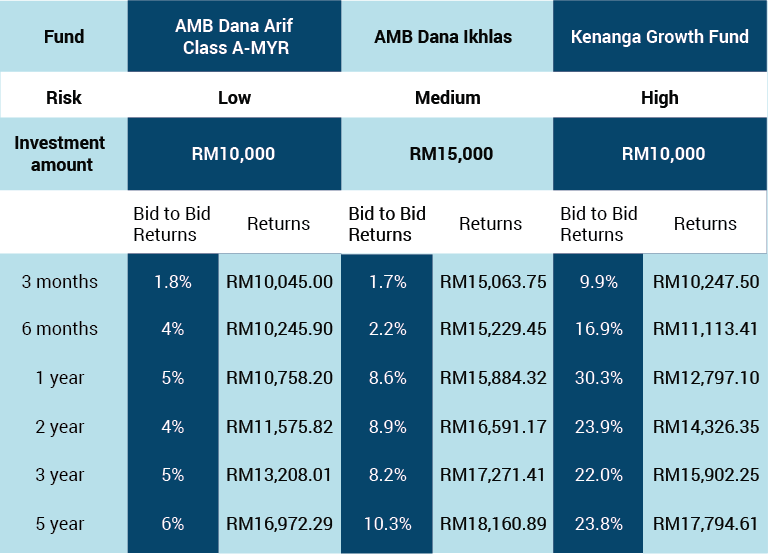

Here’s how you can grow your money to afford that using unit trust funds and shares:

Unit trust funds

Shares

Total returns: RM81,970.34

Total profit: RM82,289.49 – RM50,000 = RM32,289.49

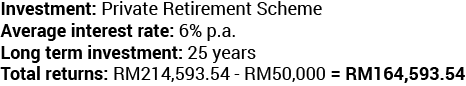

2. Saving up RM200,000 in 25 years to supplement EPF after retirement

3. Saving up for your child’s education fund of at least RM350,000 in 18 years

Though property investment requires high capital, and also monthly investment in the form of home loan repayment, with RM50,000 you can easily pay for the down payment of a property selling between RM300,000 and RM400,000.

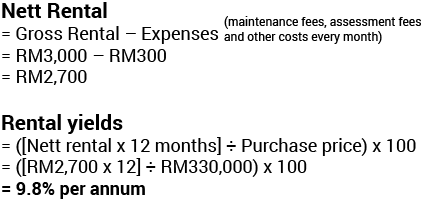

With an average return of 4% to 8% per annum for rental, and capital appreciation of between 2% and 3% a year, property investment may be a conservative investment you can consider to save up for your child’s education.

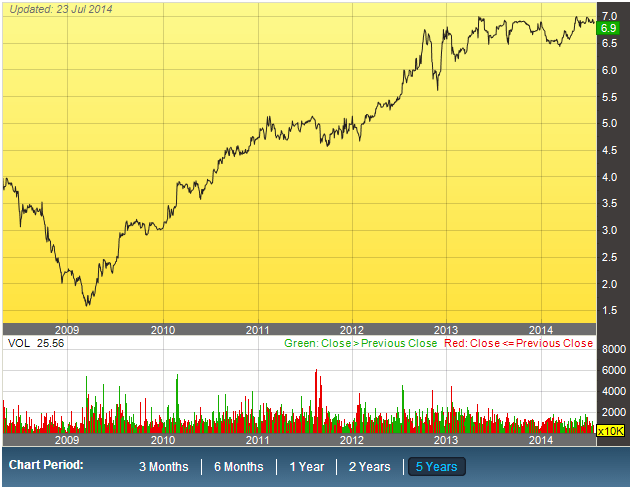

If you purchase one of the 3+1-bedroom low-rise condominium in Faber Ria Condominium in Taman Desa, Kuala Lumpur in 2010, you would paid about RM330,000. Four years later, in 2014, the unit would have fetched at least RM800,000, while a fully-furnished unit can easily be leased at RM3,000.

If you sell the unit now, you would have made RM470,000 (not deducting other fees, charges and commissions).

However, if you missed the boat in 2010, you can still put your money in a good piece of real estate now.

While waiting for the property to hopefully appreciate to the value that you need (in this case, RM350,000), rent out the unit and earn in the form of rental yield. The rental yield for the unit can be roughly calculated as follows:

Properties are relatively stable and predictable in both their rental returns and their market value and banks are ever willing to lend money to good buyers and for properties in excellent location.

Fifty thousand Ringgit in cold hard cash may seem a lot right now, but by just leaving the sum in your savings account, it will probably be worth half in real value in 15 to 20 years. If you are growing your money for your retirement or for your child’s education fund, you not only need to ensure your money is growing but also that it can weather the increasing inflation.

The above investment ideas and strategies are merely a few conventional and balanced methods you can use to achieve your target at the period you set. The world of investment is vast, and there will always be something else that you can consider putting your money into and reaping the rewards that you need.

Don’t have RM50,000? Check out this investment guide and kick-start your investment with just RM1,000.

* ROIs used in the calculations above are based on historical performance.