Go For Gold: A New Take On An Old Way To Save

Table of Contents

Gold – this precious yellow metal is put on a pedestal when it comes to value so much so that even poverty-stricken neighbourhoods in India harp on gold as currency and collateral to help in bad times1.

It has become a status symbol, the prize of champions and a trade many want to bank in on. In 2013, it was dubbed as the “new way to make money in Malaysia2″and two years later, the country exported some 4.06tonnes of smelt gold worth RM523.4million3!

Gold has always been of value with many using it as a rainy-day fund (or rainy-day jewellery) to trade or pawn in times of financial strain .

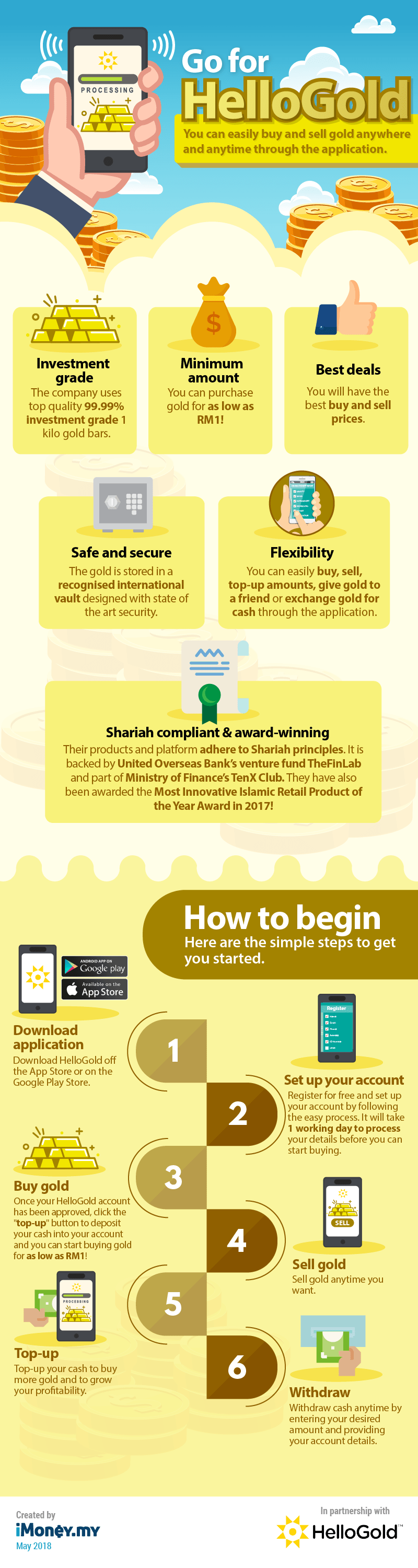

While putting in hard-earned cash in gold is nothing new, it is made easier with the birth of digital applications such as Malaysian-based fintech firm, HelloGold. The HelloGold application allows you to buy and save in gold anytime, anywhere, while offering one of lowest/best prices in the market.

The quest for gold can be a difficult one to comprehend, however, there could be an actual pot of gold waiting at the end of the rainbow if you start investing in it and here’s why.

It’s a gold mine for your dreams

Last year, it was revealed that more than half of Malaysians have no financial assets, while one in three does not even have a savings account4. Furthermore, Malaysians were borrowing more money rather than saving it, which isn’t the right way to reach your life goals.

To avoid being part of that statistic (or liberate yourself from it), we must think outside the norms of savings, which is where gold comes to the rescue; gold is within the safe-asset class and is a known hedge against economic factors such as inflation.

Last year, investors in Malaysia shifted their focus into gold5 to safeguard their financial health due to the uncertainty associated with the political landscape and market. The reason being, is that the price of gold will strengthen during economic downturn6 because investments such as bonds, stocks and real estate will depreciate in a bad economy. Basically, gold offsets any losses incurred in another asset class.

However, buying gold shouldn’t only serve the purpose of a contingency fund as it could help you gain a footing on your life goals. Instead of putting your money in a usual savings account, why not turn your paper notes into gold?

You can buy and store gold for as long as you want with platforms such as HelloGold and sell it anytime the selling price goes beyond your initial amount. Hence, if you allocate some of your monthly earnings into your gold stash consistently, it will accumulate and you can get more returns when you finally decide to sell it off.

Doing this, you can finally put down that 10% deposit for your dream home, go on a much-needed vacation, grow your child’s education fund or achieve any other goals you have been saving up for.

So, where can I buy gold?

Gold was first used as currency way back in history where people carried around gold coins as money. Nowadays, gold has been traded in for the more convenient paper notes, but its price remains strong and sought after.

So, here are the usual types of gold you can purchase.

- Physical gold – this refers to gold bullions (also known as gold bars), jewellery or coins. You can purchase these from specialised shops or banks.

- Gold savings/ investment accounts – this is also known as paper gold. This method requires investing in an account that allows you to buy gold, without you having to safeguard the physical gold yourself. Only some banks offer this, where those aged 18 and above can buy gold, assuming they are able to meet the initial purchase required to open a gold account. However, some banks also require the investor to have an existing savings or current account before investing in their gold.

When it comes to buying gold for investment purposes, physical gold isn’t the best choice as there is always a chance of theft, loss or natural disasters, despite you keeping it in a safe deposit box. Even if you were to keep it safe by investing in a storage vault, you would have to fork out extra to meet the storage or insurance fees. Hence, you would be paying more than expected, especially if you intend to buy gold for the sake of your savings.

Moreover, buying physical gold from a dealer means paying between 30% and 40% more than you should because dealers are selling gold with the intention to make profit. If you were to pay the actual gold price when buying from a dealer, it would defeat their purpose of selling it in the first place.

If you intended to cash out your gold at a pawnshop or retailer, the only ones making a profit would be the buyer (the shopkeeper) because their profit margin is based on the lowest price that you (the seller) are willing to let it go for.

Thus, a gold investment account is the safer choice when comparing these two methods, but the downside is that the minimum investment amount might be a stretch for the average income earner. The minimum purchase ranges from 1 grammes (the price of gold is RM168 at the time of writing) and up to 1,000 grammes for some banks!

But before you shy away from the thought of investing in gold, there is an easier and cost-effective way to start with HelloGold. HelloGold offers the best price in the market and you can buy any amount you want starting with RM1. If you don’t believe us, you can compare their rates to other mediums with our gold investment account comparison.

However, it is not associated with a bank or a specialised shop, which means it does not fall within the methods we’ve listed above. Instead, HelloGold is a downloadable mobile application which allows you to easily buy and sell gold anytime, anywhere at the tip of your fingertips.

When should I sell my gold?

The sale of your gold stash is entirely up to you, however, do not expect to gain returns within a week or even a month for that matter. It’s best you grow your stash, especially if you are starting small, before you sell it off – like any other investment, it will take time before you find the right time to sell your gold.

However, you can sell it once you reach your target goals to sustain your life-long dreams such as that 10% down payment we mentioned earlier. But, if you are living comfortably with your monthly earnings, we suggest you sell your gold when you really need the returns because gold is within the safe-asset class and will protect you in an economic crisis or during emergencies.

But what determines the price of gold? To better gauge when you should let go of your gold, let’s break down some of the main factors that influence gold prices.

- Supply and demand: Only several countries such as Malaysia, China and the United States (to name a few), produce gold. So, if gold mining at these countries decline and the demand remains high, the price of gold will hike up as there is less gold to supply buyers.

- The strength of the USD: Gold is priced in US dollars worldwide. Thus, the value of the dollar affects its price. People are more likely to invest or trade when the currency is stronger, which in turn decreases the value and price of gold. However, if the dollar weakens, the price of gold increases because gold investments are much valuable in this situation because it is a hedge during an economic struggle. Thus, the health of the United States economy also affects gold prices.

- Inflation: The reason why gold is a go-to asset during inflation is because its price appreciates with inflation. The demand and price for gold rise when the expansion of money (inflation) decreases the value of the currency.

So, when should you buy gold? As the Chinese proverb goes, the best time to buy gold was 20 years ago and the next best time is today. The reason for this, is that it’s hard to predict gold prices in the short term but we know that they appreciate in the long term. You can check the price trends of gold in ringgit with graphs such as the one below.

The graph shows that the price of gold will always be an upward trend and it’s best to buy gold now because you can sell it off in the future when the prices are higher. Also, this means the longer you wait to buy gold, the more you will have to pay.

What is HelloGold?

HelloGold, isn’t among the conventional methods of buying gold, instead, it is a mobile application that aims to change the landscape when it comes to buying and selling gold. Furthermore, the company, which was founded in 2015, is the first digital application in the world to be certified as Shariah-compliant – this means their operations and processes are in line with the investment Shariah standard on gold.

Through the application, users can buy gold, which is 99.99% investment grade sourced from PAMP, one of the top 5 international gold refiners, for as low as RM1. Users can keep the stash for as long as they want and sell it back to HelloGold or have the gold bar delivered to their home whenever they like.

Here are six main reasons why HelloGold could be the easiest way to invest in gold, especially if you are just starting out.

However, before you jump in, here are additional facts you might want to know before you start on HelloGold.

- Minor transactional fees: There will be a RM1.20 charge per transaction when you top-up. The price to buy includes a 2% fee on the ongoing international price of gold. The price to sell back to HelloGold also includes a 2% on the ongoing price. However, until June 30, 2018, HelloGold has reduced fees which makes it the most affordable way to buy gold in Malaysia!

- Identification card or passport: You will be required to snap pictures of your IC or passport to validate your identity. This is to prevent any criminal activities.

- Bank statement for withdrawals: When making withdrawals from your HelloGold account, you will need to take a picture of your latest bank statement with your name, bank name, address and account number. This is for security purposes to ensure you are the actual customer registered with HelloGold.

- Safety ensured: If you are worried about your gold, fret not, the vault provider (BullionStar International) in Singapore will provide a bar list showing the amount of gold that has been bought daily. You can cross-check your amount and no names will be shown as all transactions are numbered.

- You can redeem physical gold: You can withdraw physical gold by tapping the redeem button in the application. You will need to contact the customer support team to place in the delivery request and confirm shipping and insurance costs.

- You can gift gold: We briefly mentioned this, but you can gift gold to another user. All you must do is allocate the amount, insert the recipient’s email address as per their registered address with HelloGold and enter a code to complete your request. The receiver will have 24 hours to redeem the gold before it expires.

So, why not give gold a go?

References

1www.economist.com/blogs/economist-explains/2013/11/economist-explains-11

2www.thestar.com.my/business/business-news/2013/10/04/gold-the-new-way-to-make-money-in-malaysia/

3https://www.thestar.com.my/business/business-news/2017/03/15/malaysias-gold-output-on-the-rise/

4www.thestar.com.my/business/business-news/2017/02/25/do-you-save-enough-for-retirement/

5www.thestar.com.my/business/business-news/2018/04/06/wealthy-msian-investors-shift-money-to-safehaven-assets/

6www.thebalance.com/gold-prices-and-the-u-s-economy-3305656