The Two Most Important Things In Your Life You Should Focus On This Year

Taking steps to improve your health and wealth should not be restricted to the New Year. Maintaining or improving these both very important aspects of your life should be an on-going process throughout the year.

Good health allows you to enjoy life and work towards accumulating wealth. Consequently, more wealth means a financially secure future.

It is our day-to-day choices and activities that maketh our health and wealth.

Here’s how you can be healthier and wealthier.

Invest in your health

Being healthy means getting work done efficiently and doing things you enjoy the most without any constraints. Here are three small yet effective steps you can take to be healthy.

Step 1: Change your eating habits

Some small changes that you can incorporate to your eating habits are:

- Choose whole food such as fruits, vegetables and whole grains for all meals instead of processed food such as potato chips and hot dogs.

- Cut down on deep-fried food such as banana fritters, keropok lekor and curry puff, which are highly popular this side of the world during teatime.

- Control your portions to prevent overeating and loading up on extra calories. This means skipping the nasi lemak and curry mee.

- Drink enough water to keep yourself hydrated. According to the World Health Organisation, the adequate intake of water for a healthy adult requires averages 11 cups (2.7 litres) for women and 15.5 cups (3.7 litres) for men.

Step 2: Exercise regularly

Malaysians are used to driving everywhere and in our tropical weather, it really is not appealing to walk from Point A to Point B. However, fitting in 150 minutes of moderate-intensity physical activity such as fast walking, jogging, swimming and biking a week will make you fitter and healthier.

Here are some small steps that can get you started before you move on to jumping jacks and lifting weights:

- Running up the stairs at work (Not when you are wearing heels!) can help you burn calories. You can burn up to 11 calories per minute climbing stairs at a fast speed.

- Have a stand-up meeting, or work on your laptop while standing. Sitting down for a long period of time has been linked to weight gain and obesity, so get your butt off your chair sometimes.

- Take a walk after a meal to help in digestion and to reduce belly fat. If you want 6-pack abs, you will need to take more than a walk.

With regular exercise, you will:

- Normalise your blood pressure

- Lower your cholesterol level

- Improve your bone density

Step 3: Manage your stress

Chronic stress can deteriorate the quality of your life and result in various health issues such as depression, weak immune system, high blood pressure, and increased risk of heart attack.

Apart from eating healthy and exercising, some of the fool-proof ways to beat stress are:

- Setting aside some time every day doing what you love to relax, whether it’s watching Netflix, reading a book or just listening to your favourite music.

- Getting enough rest and sleep. According to a study, Malaysians get six hours and 18 minutes’ worth of sleep on average per night. The recommended amount of sleep is between seven to nine hours of sleep nightly.

- Seeking professional help when things get tough. Befrienders provides emotional support 24 hours every day and the Malaysian Mental Health Association has long lists of counselling services and psychiatric services that you can benefit from.

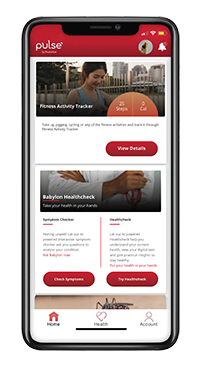

It might seem like a lot to do but you don’t have to completely overhaul your life in one go. Here’s how Pulse by Prudential can help you manage the above and more with its AI-powered chatbot and interactive features.

Start building your wealth

Money may not be everything, but it provides you with some of the essential aspects of life. For instance:

- You can afford the best healthcare if you fall sick

- You can afford to pursue your hobby and take calculated risks

- You will be able to retire in peace, without any worry of financial setback in your twilight years

Here’s how you can kick start your journey towards better financial health.

Step 1: Plan and stick to a realistic budget

Making a weekly and monthly budget will help you to keep track of your spending and give you a better perspective on your finances.

One of the most common budgeting rule is the 50-30-20 rule popularised by Elizabeth Warren. This rule requires you to allocate 50% for needs, 30% for wants, and 20% for savings.

Step 2: Take savings seriously

Saving 20% of your salary may seem impossible, but professional money management expert and best-selling author Dave Ramsey shared some ways that will make it easy for you.

- Automate your savings

Instead of saving what is left at the end of the month, it would be more effective to put aside the 20% as soon as your salary is credited into your account. Even better, if you automate your savings, there will be no chances of slip-ups.

- Clear your debt

Having debts such as credit card or loan may slow your pace towards financial security. Work on clearing them off one by one and once you are done with your debts, it will be easier to accumulate savings. An effective way to clear your debt is by consolidating them.

- Pack lunch for work and eat at home at other times

Cooking can save you a big amount of money. Instead of eating out for lunch at work, you can opt for a simple sandwich you made at home or leftover from dinner. Find out how much you can save by cooking here.

- Skip your expensive coffee

A cup of coffee in a fancy café comes with a big price tag. If you are buying pricey coffee almost every day, you will easily spend RM200 per month. Save this amount by choosing to make your coffee at home before you leave for work.

- DIY all you can

Assemble the bed yourself instead of opting for service from a third party. The same goes to minor air-conditioning services, wrapping gifts, minor tailoring and carpentry.

Step 3: Invest in a financial safety net for you and your family

Be it hospitalisation and surgical insurance or critical illness insurance, getting a suitable one according to your needs will help buffer you from a financial crisis in case of emergency.

For instance, a critical illness insurance will provide you a lump sum that you can use as a buffer while you recover from critical illness such as heart attack, stroke and cancer.

Another way to grow your money while ensuring a financial safety net for you and your family is through an investment-linked insurance policy (ILP).

An ILP offers protection while allowing you to invest at the same time.

What this means is that the premiums you pay for your ILP are divided into life insurance protection and investment units. The amount earmarked for investment units is invested into professionally managed investment-linked fund(s), and the returns will vary according to market conditions, just like any other investment.

For instance, PRUMy Medical Plus comes with a basic ILP plan and medical coverage that provides long term protection to suit your unique needs. Besides keeping you protected, it will also help to kick start your long-term investment goals.

If you are all geared up to get your health sorted in 2020, Pulse will be the perfect guide throughout your journey!