Tips For Choosing The Best Medical Insurance Plan For You

A simple Google search will show you a long list of medical insurance providers and products. There really isn’t one best medical card in Malaysia or the best insurance product for everyone. There is just one that fits your individual needs.

5 Common medical insurance terms that you must know

First thing first, reading about insurance might give you a headache from all the jargon thrown in. Apart from putting you off altogether, it can also leave you more confused.

Here are 5 common insurance terms that will help you to understand your insurance plan better.

5 Things to know when buying medical insurance

It is easy to get confused when you are looking for the most suitable medical insurance for you or your family. More so, with the plethora of options available from various insurance providers, it is natural to get confused and go off track.

Here are 5 most important things to be aware of when selecting the best option for you or your family.

Define the type of insurance you need

Here are the types of medical insurance commonly available in Malaysia: Hospitalisation and surgical insurance, critical illness insurance, and medical insurance for senior citizens. The types of plans available depends on the insurance provider.

You should choose a medical plan based on your needs and regularly review your policy after you have bought it to ensure that you continue to have sufficient protection.

For instance:

If you are a 20-something, you would have just started working and building your emergency fund. Hence, having a basic medical plan will save you from forking out hefty amounts of money for treatments during emergency. The most suitable options are the hospitalisation and surgery insurance as well as critical illness insurance.

Read more on how you can choose the best medical insurance here!

Adequacy of existing insurance coverage

Make sure your existing coverage is adequate for all emergencies. Your personal medical insurance or the one provided by your employer may not be sufficient in the face of health problems especially if your treatment costs exceed the limit of your personal/employer insurance coverage.

Naturally, your needs will change as you grow older. Your current health condition may be different than it was when you first took your policy. So, it is crucial to continuously review your coverage to prevent unfavourable scenarios later on.

If you are an employee, you will most probably benefit from your company’s medical insurance. While it may cover your regular medical needs, there might be limitations to the coverage value. Hence, it would be wise to find out the full coverage details of your company’s medical benefits.

Choose a plan that you can afford

Just like shopping, you need to have a budget in your mind. Choosing a plan that is beyond what you can afford will only lead to default of payment and lapse of your medical insurance plan.

It is highly advisable to keep the monthly premium at 10-15% of your income.

Also, some insurance plans come with increasing premium as you age, while some are maintained throughout. It would be wise to take note of this to prevent getting a shock later.

Keep an eye open on the claims process

It would be troublesome to deal with a complicated claims process when all you want to do is rest and recover from your illness. Hence, make it a point to find out the process to ensure a smooth claims process.

Some of the things that you must take note of are:

- What is covered and not covered under your policy

- Know all the documents and forms you need to submit to the insurer

Be mindful of the insurance provider’s reputation

This is one of the crucial parts of choosing medical insurance because a good insurance provider can help ensure your peace of mind.

Here are some things to keep in mind when you are deciding on an insurance provider:

- Know the company’s financial strength

- Find out if the claims process is smooth and easy

- Ask your family, friends and internet buddies about their experience with the insurance provider

- Find out if the insurance company goes the extra mile to care for the wellbeing of their customers

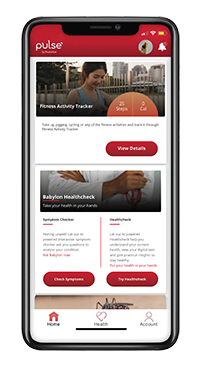

Prudential, with its recently launched AI-powered health app, Pulse, wants to partner with their customers to protect and grow their health and wealth.

*Online Consultation is free for Prudential customers, RM10 for non-Prudential customers.