A Guide To Malaysia’s Living Costs By State In 2025

If there is one thing every Malaysian has talked about this year, it is prices. Inflation has cooled nationally to around 1.2% year-on-year in July 2025, but that headline hides big differences in how much it actually costs to get by depending on where you live and your family set-up.

The Department of Statistics Malaysia (DOSM) shows state-level inflation and incomes moving at different speeds, while the Employees Provident Fund’s updated Belanjawanku 2024/25 budgets spell out what a modest but decent life requires in specific cities.

Why the experience feels different by state

If there’s one topic that has been on everyone’s lips this year, it’s the rising cost of living. On paper, Malaysia’s inflation rate looks relatively calm, official figures put it at about 1.2% in July 2025, but anyone who has done the weekly shop or paid their rent knows that number doesn’t tell the full story. What you actually pay to get by depends heavily on where you live, who you’re supporting at home, and the kind of lifestyle you can realistically afford.

The Department of Statistics Malaysia (DOSM) has highlighted how uneven things can be across the country. Prices for essentials aren’t moving in lockstep, and state incomes aren’t rising at the same pace either. On top of that, the Employees Provident Fund’s latest Belanjawanku 2024/25 guide breaks down what it costs to maintain a modest but comfortable life in specific cities, and the picture it paints is far from uniform.

The reasons for these gaps are not hard to see. In major cities, high rents and childcare fees eat up a big share of the budget. In smaller towns, it’s the cost of transport that really makes a difference, while food bills can sting more in places where dining out is the norm or where supply chains push up everyday prices. And then there’s the reality of income: DOSM’s last household income survey showed the national median sitting at RM6,338 in 2022, but with huge variation, more than RM10,000 in Kuala Lumpur at the top end, and closer to RM4,400 in Kedah.

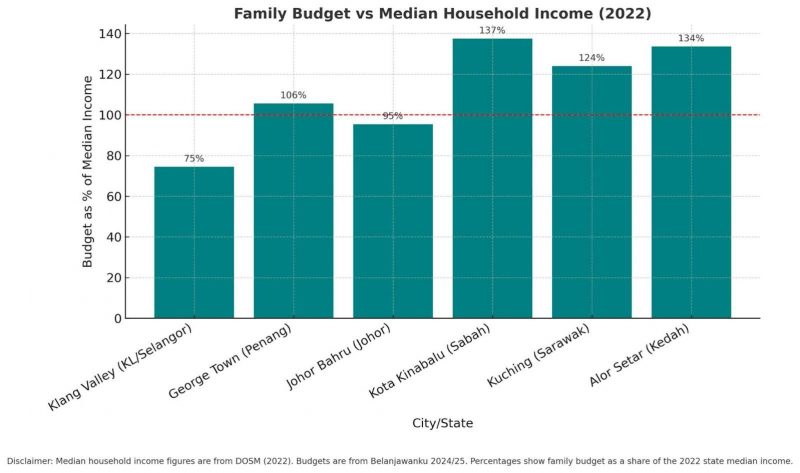

Budgets vs typical local incomes across different states in Malaysia

If you’re single and rely on public transport, your basic monthly living cost in Kuala Lumpur/Selangor (Klang Valley) is about RM1,970 according to Belanjawanku 2024/25. In contrast, the median household income for the state in 2022 was RM9,983. That means for a single person, this living cost is roughly 20% of what a typical household earns (state median).

For families with two children, the required budget in the Klang Valley jumps sharply to RM7,440. Compared to that same state median of RM9,983, this amount drains about 75% of a typical household income. In other words, most families in Klang Valley need to spend three-quarters of their state’s median just to cover what Belanjawanku considers a modest but decent standard of living.

Over in George Town, Penang, the single public transport user budget is about RM1,860. The state median household income there in 2022 was RM6,502, meaning a single person’s monthly needs cost almost 29% of what a typical Penang household earns. Once you move to a married household with two children (budget: RM6,870), that takes up about 105% of the median, meaning it exceeds what the average household earned in Penang in 2022. In Johor Bahru, a married family with two children would need around RM6,560 per month. The Johor state median household income in 2022 was RM6,879, so that’s about 95% of income, leaving very little buffer for savings, unexpected costs or lifestyle extras.

On the flip side, in Sabah (Kota Kinabalu) and Kedah (Alor Setar), incomes are much lower. Kota Kinabalu’s state median in 2022 was RM4,577. A family needing RM6,290 (Belanjawanku budget) is using around 137% of that median, meaning that typical incomes fall well short for families living modestly. In Alor Setar (Kedah), the two-children family budget is RM5,880, which is about 134% of the state median income of RM4,402. In both places, the living cost is more than what the average household earns.

*Note: Belanjawanku 2024/25 budgets compared against DOSM 2022 state median household incomes show that families in Penang, Sabah, Sarawak and Kedah face costs exceeding typical earnings.

The moving parts behind cost of living in Malaysia in 2025

- Housing and utilities: Rents and maintenance charges lift the Klang Valley and George Town above the rest. Even when national inflation is low, shelter costs can stay sticky. DOSM’s consumer-price dashboards confirm that state-level price trends differ, especially for housing, food away from home and transport.

- Transport: Car ownership swings monthly costs by hundreds of ringgit. The Belanjawanku data shows a jump from RM1,970 to RM2,800 for a single person in the Klang Valley when moving from public transport to owning a car, and similar gaps in other cities. That is before petrol and tolls.

- Childcare and schooling: For families, childcare is often the second-largest line item after rent in larger cities. Belanjawanku’s baskets include this explicitly, which is why the family budgets differ more than the singles’ between cities.

- Food: Eating out frequently pushes costs up in urban areas. DOSM’s CPI tool lets you see where food-at-home and food-away-from-home inflation is running hotter than the national average in any given month.

What this means if you are deciding where to live or work

If you are early in your career or changing jobs, Malaysia living cost by state matters as much as the salary number. A RM6,000 offer in one city can stretch further than RM7,000 in another once you add rent, commuting and childcare. Use Belanjawanku to pressure-test job offers, and then match them to DOSM’s state medians to see how your household would sit relative to typical incomes where you plan to live.

If you are already settled, the fastest wins usually come from housing and transport. Room-sharing or moving a few kilometres out can chop rent. Switching to public transport in cities that support it can free up RM500–RM1,000 a month depending on your commute. Belanjawanku’s side-by-side budgets show these levers clearly.

The bottom line

Malaysia’s overall inflation is tame by regional standards right now, but “average” does not pay your bills. The interplay between city-level budgets and state incomes is what really drives affordability. Build your own budget with Belanjawanku as a starting point and DOSM’s latest CPI dashboards to track the categories that move most in your state. That is how you take a national story and turn it into a plan that works for your household.