3 Myths About Takaful That Malaysians Need To Be Aware Of

Table of Contents

- What makes Takaful unique?

- Myth 1: Takaful is only for Muslims and non-Muslims have to opt for conventional insurance by default

- Myth 2: Takaful is less secure than conventional insurance

- Myth 3: Takaful is a religious matter that doesn’t follow conventional business standard or procedures

- Make a smart move with FWD Takaful

In partnership with ![]()

Getting your family and yourself covered by insurance schemes has become a must-do today. For most Malaysians, insurance coverage is not a luxury anymore, but a necessity. While the means may vary, the goal is one: to be secure in the event of emergencies.

Launched in 1984, Takaful penetration among Malaysians today stands at 15.2% compared to a 60% Muslim population. Due to the lack of awareness, misconceptions and ignorance, Takaful growth has been slower than anticipated in the past.

Now, with the involvement of service providers who are keen to deliver on the government’s aim to achieve 75% insurance penetration by 2020, the Takaful segment is expected to benefit from this push to gain more traction among Malaysians.

Before we move on to break the myths revolving around Takaful, let’s first understand the mechanism of the service that sets it apart from conventional insurance.

What makes Takaful unique?

Takaful advocates principles of solidarity, risk sharing and brotherhood. Takaful operates based on Shariah principles known as Ta’awun (mutual assistance) and Tabarru’ (donation) where the risks involved are shared mutually and in the case of misfortune, participants in Takaful will provide protection mutually.

Another aspect that sets Takaful above and beyond when it comes to upholding values is the fact that it is free from unethical practises such as usury, uncertainty and gambling elements.

Surplus distribution in Takaful involves the operators, as well as the participants unlike conventional insurance where the surplus gained is only recognised by the insurance companies.

Thoroughly invested in the concept of mutual sharing, ethical means and to provide financial protection to all those in need, Takaful is unique compared to conventional insurance. With more wholesome value-added products to appeal to protection seekers across Malaysia, regardless of race, religion and belief, FWD Takaful is among the driving forces aiming to revolutionise the Takaful industry in Malaysia.

What’s unique with FWD Takaful is its FWD Family First Takaful plan. Being the first Takaful plan in Malaysia that offers critical illness (CI) protection for the entire family (you, your spouse, and up to four children) in a single plan, this plan comes with features that makes it attractive to potential Takaful certificate owners. Among the benefits of this plan are:

1) All-in-one coverage plan with flexibility to include your future newborn children

2) Overall coverage of 250% of the sum covered for your family to claim from

3) Future contributions will be waived in the event that either parent dies

Evidently, the offerings of Takaful plans are plentiful and would positively impact the financial security of Malaysians.

However, besides the low exposure about Takaful, myths surrounding it have also contributed to the misunderstanding or lack of attention towards Takaful. Let’s clear the air over the myths surrounding Takaful in Malaysia.

Myth 1: Takaful is only for Muslims and non-Muslims have to opt for conventional insurance by default

This misconception occurs mostly due to the name ‘Takaful’ and the origin of this protection system which is related to Islam. Many non-Muslims wrongly connect the dots and misunderstand that Takaful is religion-based and hence, is not for non-Muslims.

On the contrary, while Takaful advocates the concept of ethical protection and promotes brotherhood as per the Islamic teachings, it is not a religious product. Non-Muslims can explore this financial tool and all those who believe the ethical elements behind Takaful will find what they need with Takaful.

Further, being a financial tool, Takaful is open for anyone globally to pay contributions and be a part of Takaful. Anyone despite their race, religion, background and creed can explore and gain from Takaful.

For example, the FWD Future First protection plan will ensure your family is well-protected if you pass away, suffer from total and permanent disability, or are diagnosed with a terminal illness. Including intangible support in the form of legal and grief counselling sessions as well as Badal Haj support for the Muslim customers. Your spouse can also request for a new takaful certificate without any underwriting with a sum covered of RM100,000 with no contributions payable for the first two years.

What’s more, non-Muslims will receive an additional lump sum of RM2000 (this is one of the components of the package).

Myth 2: Takaful is less secure than conventional insurance

The lack of awareness about some key facts that may have contributed to the misconception that Takaful is less secure than conventional insurance. Some of these facts are:

Being regulated through the Islamic Financial Service Act 2013, supervised by Bank Negara Malaysia and the Governor of the Bank holding the regulatory responsibility, is would be safe to say that Takaful is secure, safe and reliable for Malaysians to invest in.

Further, just like conventional insurance policy holders, Takaful certificate owners will also be protected by PIDM under the Takaful & Insurance Benefits Protection System (TIPS). Established by the government, TIPS include PIDM member institutions known as insurer members. Should an insurer member fail, PIDM will protect you against the loss and provide you security.

As a potential Takaful certificate owner, it is your duty to make sure the service provider you are looking at is an insurer member as well as licensed Takaful operator under Malaysian Takaful Association (MTA) to ensure you are choosing the right Takaful operator and will be rightfully protected in case of emergencies.

FWD Takaful is one such Takaful operator in Malaysia with the interest of customers close to heart. Being a licensed Takaful operator and member of PIDM, FWD Takaful is a safe and sound choice. Opting to relieve its customers of complex underwriting and inefficient claims process, FWD Takaful is making its way to be a customer-led provider among Malaysians.

Being a safe and secure Takaful provider, FWD Takaful has embarked on a long term journey to provide a financially-secure future for certificate holders through its FWD Invest First. There are three types of investment-linked Takaful plans which are: Education Plan, Legacy Plan and Wealth Management Plan. You can opt to save for your child’s education, invest to pass on to your family and children, as well as benefit from three simple and practical maturity options. With wider fund options to invest in, you have the flexibility to design the type of future you want with FWD Takaful.

Myth 3: Takaful is a religious matter that doesn’t follow conventional business standard or procedures

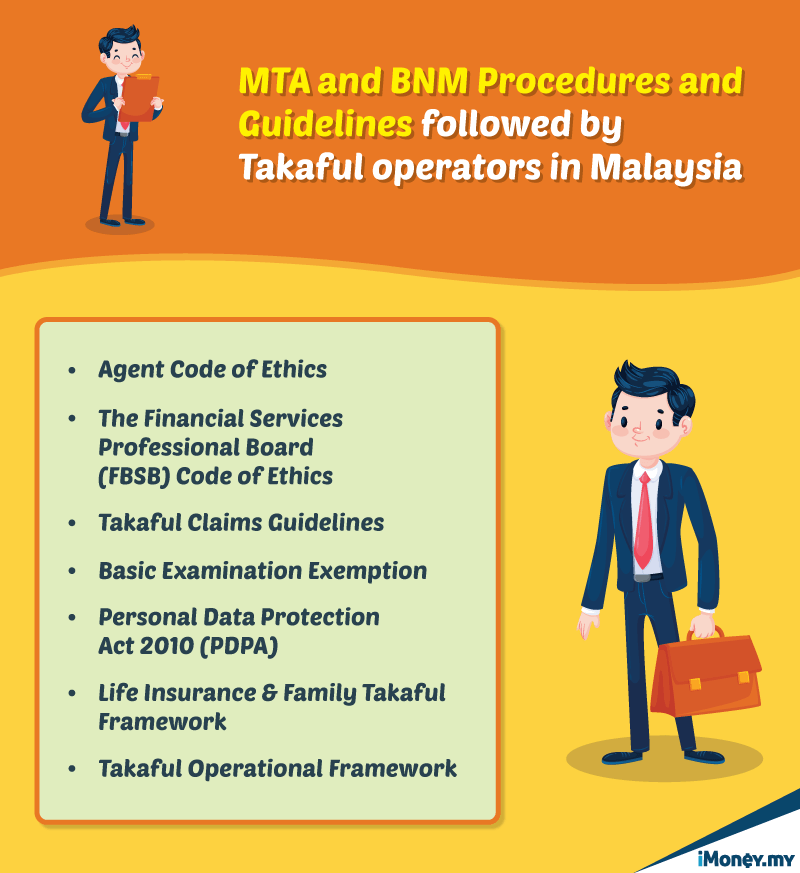

The Malaysian Takaful Association (MTA) and Bank Negara Malaysia (BNM) has standard guidelines and procedures that Takaful operators need to follow to ensure a healthy and highly credible environment for both the operators and certificate holders.

From agent’s code of ethics, FBSB Code of Ethics, guidelines on Basic Examination Exemption, and PDPA to Life Insurance & Family Takaful Framework and the Takaful Operational Framework to be enforced on 1 July 2020, the Takaful industry is streamlined and follows the government-regulated operating procedures.

Despite the difference in principles of the mechanism of Takaful and conventional insurance, both the services aim to provide protection to customers during emergencies and involves the well-being of customers and as such is heavily regulated by the government.

Apart from the guidelines and codes set by the government, some Takaful operators such as FWD Takaful also set their own code of conduct to ensure the highest level of service to their customers across the region. Some of the guiding principles are:

- Honesty and Integrity

- Be Informed and Act Responsibly

- Open and Clear

- Professionalism and Respect

- Socially and Environmentally Responsible

The guiding principles includes rejection of bribery, advocating fair competition, maintaining confidentiality and data privacy, as well as preventing discrimination. Being applied in all FWD companies covering all employees and management teams, the company aims to set the highest bar of quality in the Takaful industry.

Make a smart move with FWD Takaful

Make a smart move with FWD Takaful

Make a smart move with FWD Takaful

Make a smart move with FWD Takaful Now that you are aware of what is Takaful, how it works, the principles guiding it, and the busted myths, you can now make fair comparisons and choose the best protection for your future and your family.