Why You Should Dump FD For Bond

Table of Contents

The rising cost of living has become a common topic of debate and discussion amongst Malaysians this year as more and more people are finding it hard to survive with their current salaries.

The rising cost of living has become a common topic of debate and discussion amongst Malaysians this year as more and more people are finding it hard to survive with their current salaries.

Most are looking for ways to stretch or grow their money, as earning a fixed monthly income may not be enough anymore. For the uninitiated, fixed deposits will most probably be the investment vehicle or saving method to go for. However, due to rising inflation, a 3% to 4% (according to the government) interest rates offered by fixed deposits may not cut it anymore.

So, what is the best course of action to optimise your money for the future? If you are the typical risk-averse fixed-deposit type, this is the time to throw (some) caution to the wind and take a plunge into the low-risk, higher reward pool of bonds.

A bond is a debt investment whereby an investor loans money to a company for a defined period of time at a fixed interest rate. Essentially, you are lending your money to a company as an investment, unlike fixed deposit, where you deposit the money at a bank.

It’s not you, it’s me

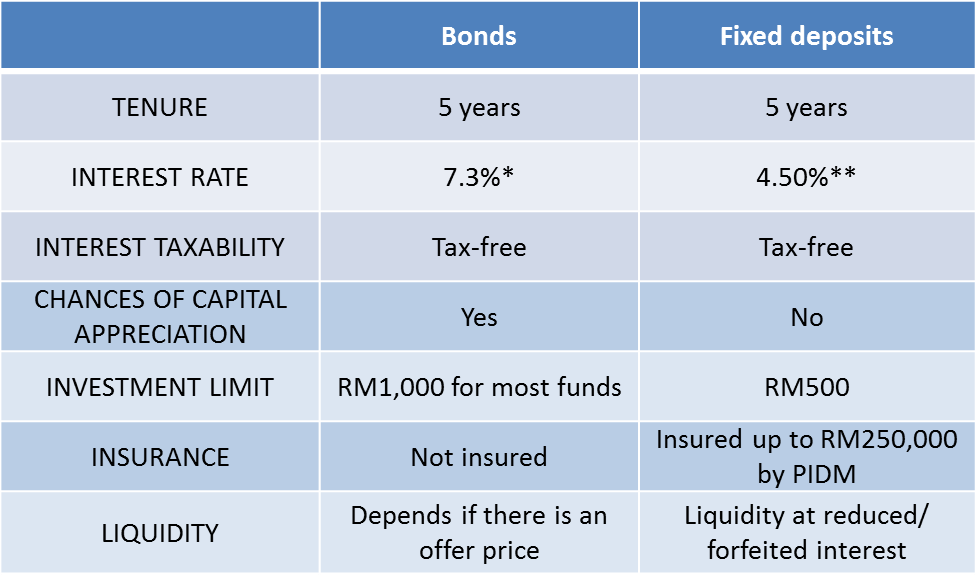

So, why should you dump the dependable Mr. FD for the exciting and mysterious, Mr. Bond? When it comes to investing in bonds, many investors prefer to compare it with the most popular fixed income instrument – fixed deposit accounts.

Similar to fixed deposit, investing in bonds may yield a stable interest income that is usually higher than the interest received from normal deposit rates for a comparable tenure.

*AmDynamic Bond

** Bank Rakyat Fixed Deposit

But Mr. Bond is not perfect, too

Nobody is perfect, including Mr. Bond. Before you consider a relationship with him, here are some of his flaws for you to consider:

1. Mr. Bond is susceptible to mood swings

A bond’s value can fluctuate daily based on market moods. However, if you are looking at it as a medium to long-term investment, daily fluctuation should not be a cause for concern. You should be prepared to invest your funds in bonds for the full investment tenure; you could lose part or all of your investment if you choose to sell bonds prior to maturity.

Never mind what happens to Mr Bond’s market prices, if you hold them to maturity, it is most likely that you will get all your capital back.

2. Mr. Bond does not offer security

Bond investment does not offer assurance of protection against a default by the issuer or company. You may not be able to recover your principal if the company you invested in goes bankrupt as it is not protected by Perbadanan Insurans Deposit Malaysia (PIDM), unlike fixed deposit, which is protected up to RM250,000.

However, the likelihood of a listed company going bust is quite slim in current economic conditions.

Are you ready for life in the fast lane?

If you are still not convinced that you should pick bonds over fixed deposits, you can think of fixed deposits as short-term saving vehicles rather than an investment, whereas bonds should be thought of as a longer-term investment.

Go for it. It is time to shed your inhibitions.

To make an informed investment decision, find out more about fixed deposit here.

Diversify your investment by investing in unit trust funds. Find out how here.