[Updated] E-Wallet Comparison Guide For Malaysians

We compare the most popular e-wallets available in Malaysia, covering what they offer over the competition and why they are special.

Table of Contents

Having to dig through wallets for cash feels very primitive in the 21st century. Yet, not everyone has ready access to credit and debit cards. Others remain wary about credit cards and their potential pitfalls. This situation has led to the introduction of e-wallets; digital services that help people pay for things through smartphone apps.

Given the options available, it’s not easy to decide which of these to adopt. We take a look at the most popular e-wallets in Malaysia and try to figure out which gives you the best ROI.

E-wallets in Malaysia

On the surface, e-wallets are like payment cards that work out of an app. You load funds into a virtual wallet, and then use those funds to pay for goods and services. How this works varies across the types of e-wallets. Some use QR code scanning to establish connections between customers and merchants in the real world, while others are only confined to internet transactions.

Transfers using Near Field Connection (NFC) technology also exist, but aren’t supported by a lot of smartphones.

Payments are not the only thing that these e-wallets are capable of handling. Each service adds their own sprinkling of features that they believe will bring the most benefit to their target audience. Most common would be the option to transfer funds between individuals; although there are also features like buyer protections, loyalty card integration, and proprietary magnetic strip technology.

Best e-wallet comparison

For this comparison, we use the most important metrics for an e-wallet. Firstly, payment technology is important for how easy it is for both customers and merchants to begin using the system.

Next is a short list of stores that accept the particular e-wallet; this is not a complete directory since it would take too much space to fit everything into one place. Instead, it’s a collection of the most useful locations.

Finally, there is a summary of additional features that set that particular e-wallet apart from the competition.

Boost

Payment method: QR code, In-app payments

Notable merchant: 99 speedmart, Telekom Malaysia, SYABAS, DBKL Parking

Bonus: Boost’s main audience are smaller merchants that are only experimenting with the idea of cashless payments. The company has been targeting pasar malam vendors across the country, and has seen some success in that regard. More importantly, it’s been working with utilities like Telekom Malaysia and SYABAS to all in-app bill payments. It’s also expanding on a partnership to allow users to pay for parking in the greater KL area.

Boost also has a partnership with Shell stations, allowing users to pay for petrol at over 800 stations around the country. However, this still requires the user to scan the QR code at the counter.

A rise in the number of e-wallet related scams in 2020 caused Boost to discontinue a feature that allowed users to withdraw their credit to a bank account. This took effect in May 2020, and had the unfortunate effect of removing one of Boost’s most unique features.

GrabPay

Payment method: QR code, In-app payments

Notable merchants: TeaLive, Inside Scoop, Manhattan Fish Market

Bonus: GrabPay has the benefit of being part of the Grab Platform ecosystem; essentially allowing it to be used for calling a Grab ride or using it to order from Grab Food. It also has a partnership with Maybank for cross platform use with merchants that accept Maybank Pay.

It should be noted that while GrabPay is available across Southeast Asia it does not convert credits to local currencies. Meaning that customers will have to manually top up their credit when traveling.

Lazada Wallet

Payment method: Online

Notable merchants: Lazada

Bonus: Lazada Wallet is one of the few e-wallets to offer cashback on all purchases. This comes at the massive price of only being able to use it on Lazada’s own online store, and having cashback credits that expire after a few months. This is perhaps the most limited of the e-wallets considering the scope. It’s meant to lock users into the Lazada ecosystem, so people should be aware of what they are getting themselves into.

Samsung Pay

Payment method: Magnetic Field Transfer, NFC

Notable merchants: Anywhere that supports credit card swiping

Bonus: Unlike the other e-wallets in this comparison, Samsung Pay doesn’t actually store any funds. Instead, it stores payment card information and acts as a sort of additional layer between the two. What is unique here is its proprietary MFT technology. This allows a smartphone or smartwatch to mimic the magnetic strip on a credit card, allowing it to work without any additional investment from merchants. MFT also allows Samsung Pay to support loyalty cards like those from Aeon; meaning that those can also be stored within the app.

The only drawback is that Samsung Pay is confined to selected Samsung branded smartphones and smartwatches. MFT support also only appears on the highest end Samsung smartphones, leaving the more affordable devices with only NFC support. Although, nothing says living in the future like paying for lunch with your watch.

PayPal

Payment method: Online payments. Offline payments exists in select countries

Notable merchants: Almost every online store

Bonus: PayPal is the grandfather of e-wallets. Existing from even before the term was coined. Being an international level organisation means that PayPal can be used across borders and will even convert between currencies for payments. It also allows users to cash out by transferring their funds to a local bank account. Buyer protection for PayPal is also considered to be one of the best in the world; although this occasionally comes at the expense of the merchants.

PayPal’s main problem is the substantially higher fees it charges on money transfers. The company has a 7% cut on international remittance; which is higher than some people would like to deal with.

Touch ‘n Go eWallet

Payment method: QR code

Notable merchants: Family Mart, 7-Eleven, myNEWS.com, Tesco, Plus highways, almost everywhere

Bonus: Since the wrapping up of the beta test of the TnG mobile app, TnG has quickly grown to be one of the, if not the biggest e-wallets in Malaysia. Thanks to the widespread acceptance of TnG e-wallet as an accepted payment method, it has quickly risen to the top of the most popular e-wallet in Malaysia. The acceptance of TnG e-wallet as a payment method is so widespread that nowadays, there’s a high chance that you’d get to utilize TnG e-wallet at your local grocery stores.

One of the most popular features of the TnG e-wallet is the the Pay Direct feature, which allows users to link their TNG cards with the TnG e-Wallet. Doing this will cause toll plazas to deduct funds from the e-wallet first and will only charge the TNG card if there is insufficient credit. Touch ‘n Go’s RFID payment option is also tied to the TnG eWallet. It deducts funds automatically when the gantry scans the RFID tag on your car.

WeChat Pay

Payment method: QR Code

Notable merchants: KK Mart

Bonus: WeChat Pay is perhaps one of the most anticipated e-wallet to reach Malaysia; being tied to one of the most popular instant messaging services available. It provides the additional benefit of being able to also buy bus tickets. A convenient feature that’s likely to cater to WeChat’s main demographic.

Also available here is the option to use WeChat Pay in China. It’s something more useful for Chinese tourists visiting Malaysia, but also works in reverse. However, it should be noted that there is no currency conversion. This means users need to top up their Chinese RMB and Malaysian Ringgit separately.

Razer Pay

Payment method: QR Code

Notable merchants: Steam, 7 Eleven, Starbucks

Bonus: Aimed largely at gamers, Razer Pay is the result of a collaboration between gaming peripheral maker Razer, MOL, and Berjaya Group. For the most part, this e-wallet is intended to support Razer’s own eco-system and virtual currency.

Funds stored in Razer Pay can be used to buy Razer’s zGold-MOLpoints; which can later be used to buy games digitally. Alternatively, the virtual currency can also be used to buy gaming peripherals (like keyboards and mice) from the Razerzone online store. This is less attractive for the average consumer, but is perhaps more relevant to gamers.

BigPay

Payment method: QR Code, NFC, Prepaid Card

Notable merchants: Airasia

Bonus: Created by AirAsia, the BigPay service is split across a Mastercard-backed prepaid card and an e-wallet. The benefit of this is that it users are not confined to only using the mobile app to pay for things. Instead, being free to use the prepaid card like a credit card. Complete with the option to make online purchases and withdrawing funds from ATMs.

BigPay also allows users to earn Big Loyalty Programme points; which is also the loyalty programme for AirAsia flights. Unfortunately, this comes with the caveat that the points are not earned for domestic transactions.

AirAsia founder Tony Fernandes believes that this will eventually be worth more than his airline. Although there seems to be quite a lot of competition in this space.

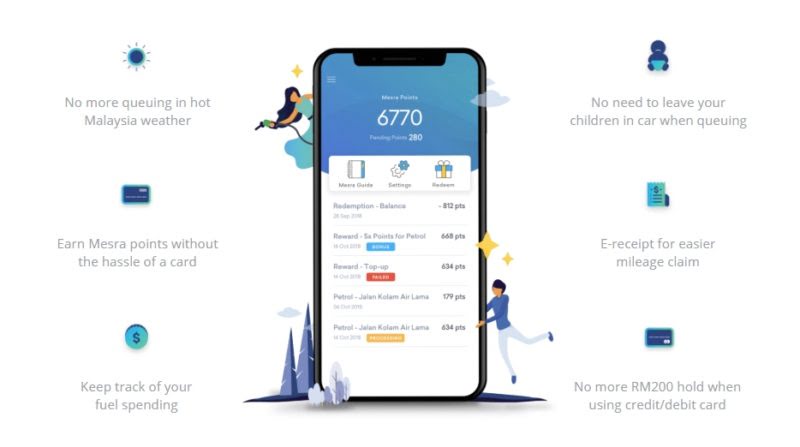

Setel

Payment method: GPS location tracking

Notable merchants: Petronas

Bonus: Petronas’ homegrown e-wallet brings an interesting twist to the technology. It uses GPS location tracking in order to facilitate payments. Basically, the app will detect that you are at a participating Petronas station and allow you to begin making payments.

This is a completely unique payment system, and one that is unfortunately a closed ecosystem. The system is limited to only a small selection of Petronas stations at the moment. On the other hand, it is extremely useful for those who would rather not swipe their credit cards at petrol stations.

AEON Wallet

Payment method: QR code, Visa-back prepaid card

Notable merchants: AEON affiliated stores

Bonus: This is not necessarily a traditional e-wallet, being mainly designed to work with the AEON Members Plus Visa card. The idea is that the AEON Wallet complements the prepaid card by allowing users to access its funds and loyalty programme without having to carry the card around.

However, this also means that it benefits from being an e-wallet with a Visa-backed prepaid card. Including the ability to use the funds in non-AEON affiliated stores and for online shopping.

AEON has also released their new digital bank, AEON Bank, where the points collected from AEON Wallet can be transferred to your AEON bank account.

AliPay

Payment method: QR Code

Notable merchants: 7-Eleven, Family Mart

Bonus: AliPay is technically not available for Malaysians, despite being accepted by local merchants. It is meant to be used by Chinese nationals who are visiting the country and would like to continue their cashless experience.

That said, the main benefit of being able to use AliPay is that it also works in China. Visitors to the country are able to purchase a Tour Pass that gives them the option of adding funds without first owning a Chinese bank account. This is valuable to tourists as China has largely phased out the use of physical cash and many merchants only accept payments through e-wallets.

Apple Pay

Payment method: Near Field Communication (NFC)

Notable merchants : Everywhere that accepts credit/debit card payments

Bonus : Apple’s answer to Samsung’s SamsungPay, Apple Pay was first launched all the way in 2014, but Malaysians only got a taste of it in August 2022 when it first launched in Malaysia. Using a combination of NFC and embedded secure element (eSE) to securely store payment data and perform cryptographic functions, Apple Pay allows users to input their card data in their Apple devices (iPhone, Apple Watch, iPad, Mac, and their latest offering, the Vision Pro) and use their Apple devices to make payments on their purchases.

As of right now, how Apple Pay works in Malaysia doesn’t really fit the traditional definition of an e-wallet, as Apple Pay in Malaysia is strictly a payment method, and it does not allow for users to transfer cash or the equivalent of cash to other users (that feature is only available in the United States).

The future of e-wallets in Malaysia

This is not an exhaustive list of e-wallets in Malaysia. At present, there are 35 companies and 5 banks with e-money licenses from BNM, all of which are governed by the Financial Services Act 2013 and Islamic Financial Services Act 2013

Not all of these licenses are currently being used for e-wallet apps, but a fair number have more focused services. For example, gaming peripheral manufacturer Razer and gamer-focused Razer Pay e-wallet.

That said, BNM has issued a directive to create a unified QR code system for the various e-wallets. There has been little news on when this will be rolled out, but it shouldn’t take too long for all involved parties to sort out the matter.

Going forward, this move will make at least a few of these services interchangeable and widen the number of available merchants for the benefit of their customers.