RM13.3Bil In Unclaimed Money, How To Check Through eGUMIS

Table of Contents

Have you ever unexpectedly found cash in your pockets, in sofa cushions or in a drawer you haven’t opened in years? It’s a nice feeling, isn’t it?

But forget pocket change. What if you had RM100 or RM1,000 lying around that you’ve forgotten about? Perhaps it’s an insurance claim that has been approved but for some reason has not been paid to you, or money in a savings account that you’ve left idle for years.

As of April 2025, the unclaimed money in Malaysia totalled RM13.3 billion according to the Accountant General’s office. This amount has increased since January 2025 when it amounted to RM12.7 billion.

Previously, all unclaimed monies are held by the Registrar in the Consolidated Trust Account for 15 years. The proposed amendments will see the 15-year period reduced to 10 years.

Here’s how to check if you have any unclaimed money.

But first, what is unclaimed money?

Unclaimed money can refer to unpaid money that is legally payable to you, or money that has been dormant for many years. According to the Accountant General’s Department of Malaysia, there are three categories of unclaimed moneys:

- Money that has been unpaid for at least a year (e.g. salaries, bonuses, dividends, insurance claims, etc.).

- Money that has been idle for at least seven years (e.g. savings account, current account, fixed deposit).

- Money to the credit of a trade account that has been dormant for at least two years (e.g. trade creditors account, trade debtors account with credit balance).

How to check for unclaimed money online

A few years ago, you’d have to physically go to a Registrar of Unclaimed Money counter to check for unclaimed money and apply for a refund.

But with the Electronic Government Unclaimed Money Information System (eGUMIS) portal, you can now do that online. When the portal first launched, you could only check for unclaimed money, but still had to make a physical or e-mail application to the Accountant General’s Department. Today, you can initiate the entire refund process through the portal. Here’s how.

1. Register at eGUMIS

Head to the eGUMIS portal to register a new account.

2. Update your eGUMIS profile

When you log in for the first time, you’ll be asked to update your profile with these details.

3. Search with an IC number

Once you’ve updated your profile, you will be taken to the eGUMIS dashboard. To start your search, click on “Click here to check for unclaimed moneys”.

Enter the identification number you want to check. Note that you can only check a maximum of two numbers a day – you’ll have to wait for the next day if you want to check more numbers.

If the identification number you entered has any unclaimed money, you’ll see search results appear below. Click “Proceed To Application” to continue.

4. Add payee details

Here’s where you’ll see the application form.

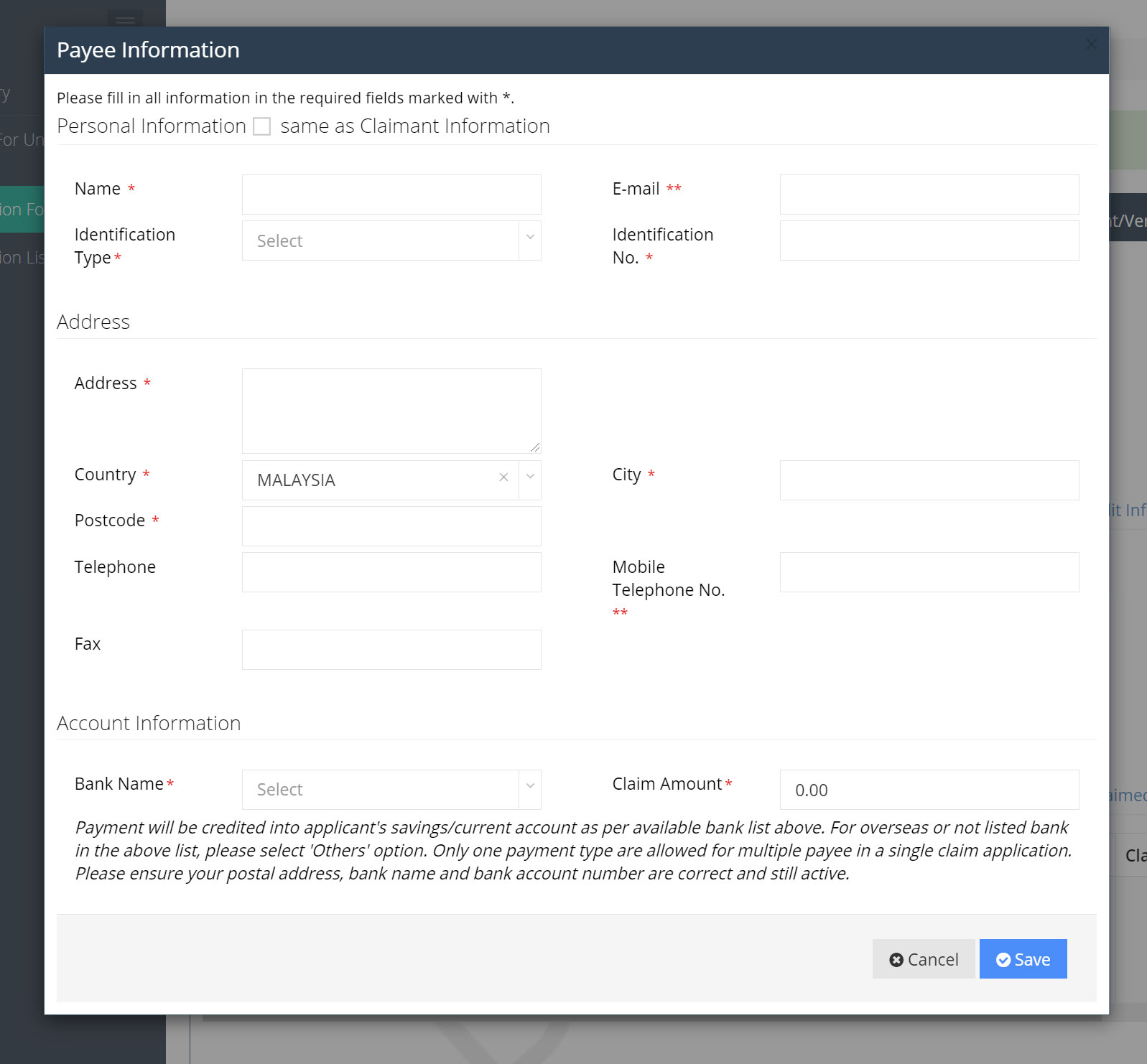

Click “Add Payee” to fill in the details of the person who should receive the refunded money.

Save the payee information, then click “Next”.

5. Upload relevant documents

Next, you’ll be asked to upload the necessary documents to complete the application. You’ll need these documents:

- A copy of your IC, passport or other form of identification

- A copy of your active bank account statement

If you are claiming these funds on behalf of a parent or spouse, you may need additional documents, such as your birth or marriage certificate.

Once you’re done uploading the documents, you can click “Next”. When you complete the application, you will see a notice that your “Record has been successfully submitted”.

Finally, wait for your refund

While your application is still pending, you can log into the portal any time to check on its status. If your documents have been successfully verified, you will receive an e-mail notification from eGUMIS that your application has been successful. Your payment will be credited to your bank account within 30 working days from the date of the notification.

If your documents could not be verified, you will receive a notification from eGUMIS, asking you to log back into the portal and reupload the correct documents.

All in all, applying for a refund through eGUMIS is a painless process. If you already have your documents ready, it could take mere minutes – that’s well worth the effort to reclaim any money you may have forgotten about.

Did you know EPF also has unclaimed monies?

The Employees Provident Fund (EPF) had announced recently that it is trying to get in touch with members aged 100 and above who still have savings in the EPF.

It is urging these members or their heirs to check the unclaimed savings using their ID card or EPF number on the page shown below.

You can also reach out to the EPF Contact Management Center at 03-8922 6000.

EPF will keep these unclaimed monies until 31 December 2023. After this date, the savings balance will be transferred to the Unclaimed Money Management Division, Accountant General Department of Malaysia (BWTD). Any claim after the transfer is made will be through the eGumis portal as outlined above.

FAQs: Frequently Asked Questions on eGUMIS Unclaimed Money

Commonly asked questions on unclaimed money and using the eGUMIS portal.

The latest update from the Ministry of Finance puts the amount of unclaimed money at RM11.2 billion.

The Ministry of Finance appointed the Accountant General Registrar of Unclaimed Money with effect from the 1st day of June, 1975.

- Photocopy of identity card (for Malaysians)

- Photocopy of first page of bankbook or bank statement (for bank account refunds)

- Original document to show ownership of the unclaimed moey (certificate, statement)

- Photocopy of passport of person applying to claim to show passport number, issuing country, official name, date of issue (for non-Malaysian)

- Note: addiional supporting documents to be submitted if original owner is deceased (power of attorney, letter of administration, probate grant, court order)

Accountant General’s Department of Malaysia (AGD) had put out a media statement earlier about a fake website for the eGUMIS system. The public is asked to be vigilant and careful by ensuring that they are browsing the real website for Unclaimed Money at https://egumis.anm.gov.my/