Are Unit Trust Funds Better Than Savings Accounts?

You’ve been managing your finances really well and saving up a huge sum of money. But what should you do with all the cash? You could put all your money in a savings account or maybe you should take the plunge and invest it in unit trusts. But which should you do?

If you have a considerable amount of cash saved up, about RM1,000 or more, it’s time to take it out of your savings account. Sure, putting your money in a savings account is liquid, but the interest rates don’t come close to protecting you from the rising inflation rates.

So, how can unit trust funds help you save more in the same duration? Here are some things to consider before taking the plunge:

If you have some money that you know you won’t need for the next few months, if not years, unit trusts are the better option to keep that money in. Changing from a savings account to investing in unit trust funds is more of a psychological leap than it is a change in actual mechanics.

With a unit trust fund, you can still maintain liquidity and security, but it is no longer a savings account – it is an investment.

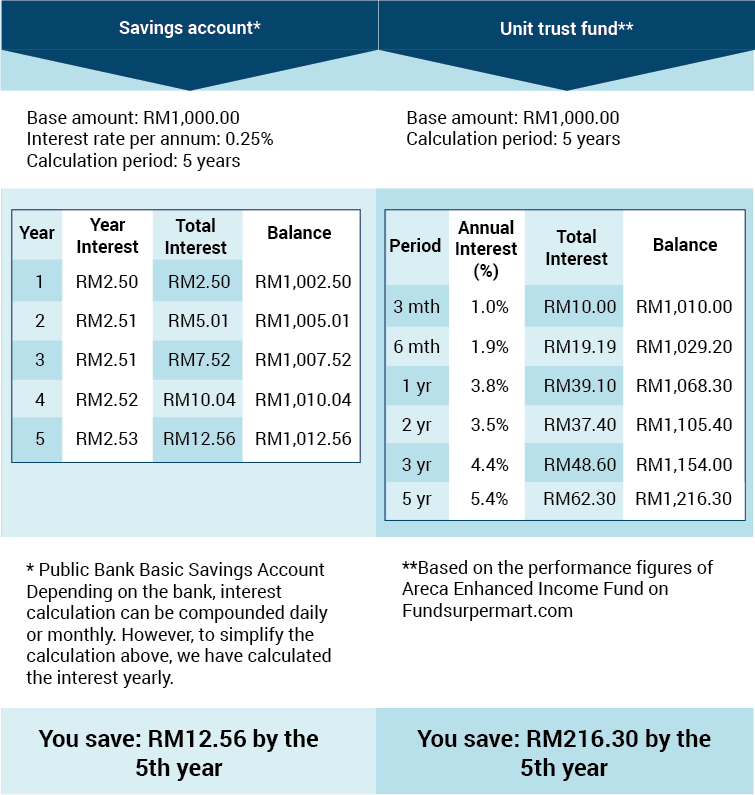

For example, let’s compare saving RM1,000 in a savings account to putting the money in a unit trust fund for five years:

Based on the example above, the unit trust fund is clearly a better option to grow your money. The returns are better, the security is comparable and the return is almost 18 times higher! Investing in unit trust funds will help you to realise increased returns from cash you are holding on to. It’s a great first step to help you build an emergency fund or as part of your retirement nest.

Want to understand unit trust funds better? Check out this beginner’s guide to unit trust funds.

Another option to invest your money is through Real Investment Trust Funds (REITs). Learn what it is and how to kick-start your investment here.