I Can’t Afford Kids. But Malaysia Can’t Afford To Go Childless

Table of Contents

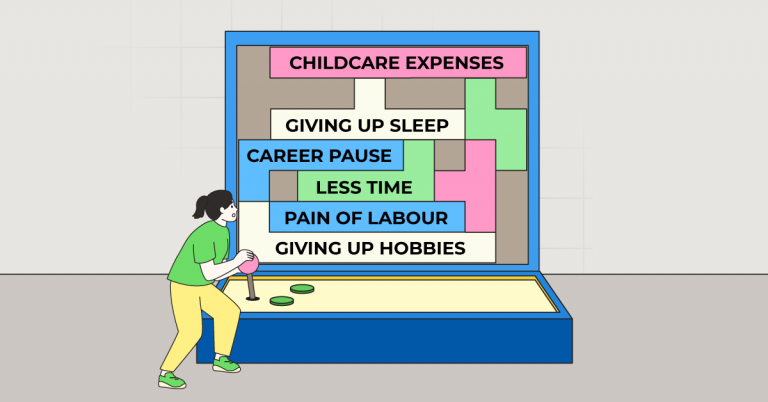

I always knew having a child was an irrational choice. The list of personal and financial sacrifices I’d have to make seemed endless.

Here’s just a glimpse:

Less time

Less money

Giving up hobbies

Giving up sleep

Discomfort of pregnancy

Pain of labour

Pain of breastfeeding

Medical expenses

Childcare expenses

Career pause

Parenthood penalty

Gender pay gap

Financial uncertainty

Many in my life stage have found themselves making these same considerations. Is it any wonder then that Malaysia’s birth rate has plummeted to a record low in Q1 2025?

And we’re not alone. The global fertility crisis has been raising louder alarm bells in the last few years.

Humankind’s replacement rate is 2.1; that is, 2.1 births per woman in order to sustain our population. The fertility rate in Malaysia is currently 1.6 – way below what’s needed for our long-term economic stability. Ironically, our improving economy might be part of the problem; it’s been observed that fertility tends to drop as economic prosperity rises. (Hurray for us, I guess?)

In fact, we’re plodding down the path of other developed nations like South Korea (1.1), Japan (1.4), and the USA (1.8), where low birth rates are even more severe.

And the #1 reason people cite for not having kids? Drumroll!…It’s…financial limitations.

While I’m sure nobody’s surprised, it is strange to think about. Those who can seemingly best afford to have children feel the least financially equipped for them.

In other words, the richer we get, the fewer kids we think we can afford.

So what gives?

The rising cost of parenthood

In a different era of Malaysia, my father arrived as the 6th child of a growing family. 5 more children were to follow – a whopping 11 siblings. My mother’s family was no different; she was the youngest of 10 siblings.

Just a few decades ago, large families like theirs were the norm. Today, young parents struggle with the decision to have ONE child.

The difference? Back then, children were seen as assets. They could be put to work, contribute to the family, and support their parents in their old age. Now, many of us see children as financial liabilities instead.

And the numbers back this up. The cost of raising a child in Malaysia ranges from RM400,000 to RM1.1 million from pregnancy through university, with education taking the biggest chunk.

These rising living costs have changed how family planning looks for our generation. Young couples are delaying marriage to focus on career advancement and financial stability first. The average age of marriage for Malaysian women jumped from 23.5 years in 1980 to 28.1 years in 2020. by the time they feel financially ready, many precious baby-making years have already slipped away.

The motherhood penalty

Another explanation for why higher income countries tend to have fewer babies is rising equality between genders. Women’s equality, education and financial independence lead to less baby-making. More choice, fewer children.

Well, duh.

Biologically, women must consider the cost of pregnancy, labour and breastfeeding.

Culturally, women tend to bear the burden of running a household, even if both partners work full-time.

Financially, women take a hit in the form of career interruptions, discrimination and a growing pay gap. Studies show that having children can cost women up to $500,000 (RM2,101,750) across the course of their careers. Rising childcare costs and lack of flexible work arrangements are pushing mothers out of the workforce – but meanwhile, dads often get a pay bump after having a baby.

So while some may paint women who choose not to have children as selfish, the data reveals that motherhood requires so much personal sacrifice that the choice is almost impossible.

For those of my generation, none of this is new news. But how does it impact our country’s economic well-being? Why are countries everywhere panicking over this “crisis”?

The cost of childlessness to a country

The major concern is an ageing population. Malaysia’s aging population will shoot up from 7.9% in 2010 to 15% by 2030, and continue growing from there.

When seniors outnumber babies, our population, workforce and domestic consumer base will all shrink, leading to less money circulating the system. A smaller taxpayer base will mean less money for healthcare and infrastructure – two things that, incidentally, seniors highly depend on.

The math gets even worse when you look at retirement preparedness. When it comes to taking care of ourselves, Malaysians are scarily unprepared. Only 58% of 54-year-olds have less than RM100,000 saved in their EPF. (For context, you need RM240,000 to generate a measly monthly income of RM1,000.)

It’s bad enough that the government has recently proposed changes to EPF to help us manage our retirement funds.

The eventual outcome? Fewer young people will exist to support a bigger (and badly-prepared) base of old people.

BTW, those future old people are us, Millennials and Gen Zs.

So who pays the price?

The paradox is clear. For individuals, choosing childlessness is financially rational. For our country, it’s a collective disaster.

But the current system places the burden of parenthood squarely on individuals – and disproportionately on women.

What is the solution then? I wish I had neat answers to give you, like affordable childcare, longer parental leave, flexible working arrangements. Some countries like Denmark and Sweden have practiced this to some success, but none have brought their birth rates back up to replacement rate.

Because simple fixes like “giving cash” or “offering more leave” don’t address underlying issues. Cultural norms that make mothers the default parent. Housing costs that demand dual incomes. The growing demands of intensive parenting. Gender discrimination baked into workplace structures. The expectation that parents should bear all these costs alone.

Perhaps the solution, then, starts by asking how we can all share the cost of parenthood.

After all, you can’t solve a national problem through individual sacrifice.

When I personally counted the cost of having a child, it was clear that the math didn’t add up for me. But there was that irrational tug in my heart: I wanted to experience the magic of a new life.

I made that choice knowing it defied logic. And I don’t expect my fellow career-climbing women to reach this same irrational conclusion.

My question is: Should having a child require an irrational leap of faith?

Or can we build a Malaysia where the choice to become a parent isn’t an act of financial self-sabotage?

2024 Child Birth Rate: 12.2 births per 1,000 people (DOSM).

2025 (Q1) trend: Births down 11.5% vs Q1 2024 — continuing decline (DOSM Q1 2025).

Top drivers include:

- High cost of living

- Delayed marriage

- Expensive/limited childcare

- Career prioritisation (especially among women)

- Lower desire for larger families

- Infertility issues + cost of treatment

The estimated cost from pregnancy to the child’s first year for a middle-income family in Malaysia is approximately RM 42,715 (if both parents work) and RM 19,915 (if one parent stays home).

- Delivery in a private hospital (natural) in the Klang Valley: RM 3,000–RM 10,000; Caesarean: RM 6,000–RM 15,000.

- Childcare costs (if both parents work): RM 22,800–RM 36,000 annually.

Here are a few things that may happen:

- Shrinking workforce

- Higher ageing-related costs

- Lower tax revenue

- Slower economic growth

- Pressure to increase immigration or offer pro-family policies

- Couples delay or avoid having children

- Higher expenses reduce affordability of larger families

- Financial instability increases risk aversion

- Childcare + housing costs make raising kids harder