6 Deadly Investments Mistakes You Should Avoid At All Cost

Table of Contents

This article is sponsored by Securities Commission Malaysia, under its InvestSmart initiative.

It has been said that “Mistakes are the stepping stones to learning.”

With that in mind, most investors, experienced or otherwise, will try their best to avoid making any mistakes when it comes to investing by making sure they learn as much as they can beforehand!

The best way to start is to know what are the mistakes that you could potentially make, and finding out the best ways of avoiding them.

We’ve done the homework for you – here are six investment mistakes that you should not fall for:

1. Investing without planning

Every investment portfolio should have an underlying strategy based on the financial goals you want to achieve.

Unfortunately, many who invest do it merely by investing based on trends and hearsay. One might be dumping thousands of Ringgit into a stock just because his/her friends are doing so.

You need to establish a plan and know what you want to achieve.

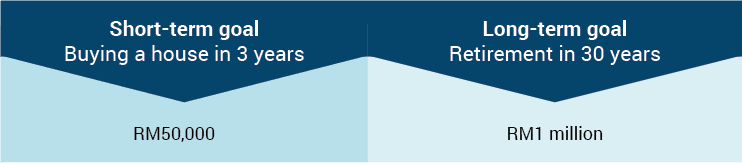

Step 1A: Financial goals should be quantifiable

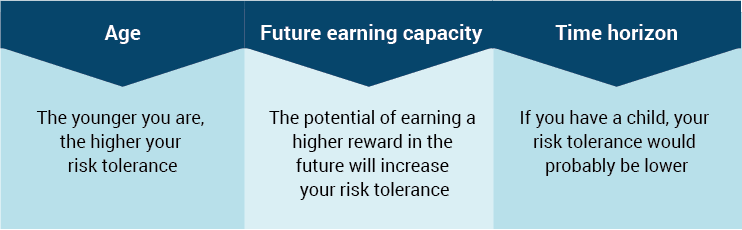

Step 1B: Evaluate your risk appetite

Step 1C: Diversify your investment portfolio according to your risk appetite

A diversified investment portfolio consists of different baskets, also known as asset groups. Within each asset group, you can further diversify. For example, one of your asset groups may consist of shares, and you can then further diversify by investing in shares from different industries. Doing this allows you to spread your risk across different asset classes.

2. Not doing your homework

Don’t invest in something you don’t understand. However, don’t let that stop you from investing either! Take your time to study your potential investment to understand how it works.

Information is mostly free and easily accessible online. Read up about a certain investment you are interested in before taking the plunge.

Conversely, you can seek professional help by getting a financial advisor to help you plan your portfolio. Even then, always take note of the basics and understand your portfolio or investment plan.

Here are some websites to help get you started:

3. Not understanding your investment

Doing your research prior to investing is crucial. However, taking what you read word-for-word can be dangerous too.

Whatever reading materials you decide to use for your research should just serve as your basic guideline. Everyone has different financial goals and investment plans. There is no one-size-fits-all when it comes to investment tips, take everything with a pinch of salt. Remember: Refer, don’t rely!

The most important part of doing research is not to absorb every single piece of information that you have read, but rather understanding how to apply the information when planning your investments. For example, investing in shares does not just require you to understand how the stock market works, but also understanding the industry and the company that you want to invest in as well as the risks, fees and charges involved.

These documents will help to provide you with an insight on your potential investment(s):

4. Letting greed take over

Getting a return from your investment is a pretty good feeling. It gives you the adrenaline rush, and also confidence to invest more.

The excitement you feel can sometimes cloud your judgement, and greed may sneak in before you realise it. Letting emotion control your decisions can lead you to fall into an investment trap faster than a fly flying into a spiderweb.

Though most investors know this (theoretically), it still happens all the time, especially when the stock market is booming. People lose reason and start making wild bids on stocks that aren’t worth the price.

However, to ensure that your investment is sustainable, think long term. Investing is not a get-rich-quick scheme. Let your financial objectives, the time frame needed to achieve your goals, and your ability to take risks ground you from making irrational decisions. Stay disciplined!

5. Falling for hearsay

Imagine you just heard from an acquaintance at the coffee shop, who heard from another friend, that Company X will be merging with Company Y, and that the price of both companies’ shares should spike up in the next few weeks. Would you then make an investment decision based on this?

Sometimes we fall for what we would like to believe is a “hot tip”. Like everything else, this kind of information can sometimes be true, but more often than not, these tips fall through and you’d find yourself losing thousands of Ringgit.

Don’t fall for unsubstantiated “tips”. Stick to your fundamentals and you’ll achieve your goals.

6. Procrastinating

“I am too young to start investing and saving for retirement”. “I need to save up a certain amount before I can get started in investing”. “I’ll wait for the price to spike up or drop before making my move”.

Does this sound familiar? These are some common excuses people use to procrastinate when investing.

Sometimes these reasons can be valid, but more often than not, they are just excuses people use to delay making an investment decision. Why? It could be due to a fear of failure or losing their hard-earned money.

When it comes to investing, the earlier you start, the higher your chances of earning a return. Do not disregard the cost of opportunity that you may incur by delaying your decision to invest.

Conclusion

For the uninitiated, investing your money can be daunting. However, by knowing and understanding what you are up against (and preparing yourself to avoid the above six common mistakes), you would have already won half the battle.

So remember, arm yourself with the right information to make an informed decision when investing. Never leave anything to chance!

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: admin@investsmartsc.my.