Top 10 Credit Cards

in Malaysia by iMoney

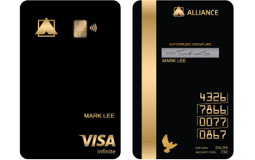

Alliance Bank Visa Infinite Credit Card

*Terms and conditions apply

- Min. Monthly Income

- RM 5,000

- Annual Fee

- Free

- Cashback

- -

OCBC Cashflo Mastercard

Terms and Conditions

- Min. Monthly Income

- RM 5,000

- Annual Fee

- Free

- Cashback

- 0% Auto-IPP

RHB Cash Back Credit Card/-i

Earn up to 10% cashback on all retail purchases from petrol to dining and groceries plus a FREE annual fee on your first year.

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- Up to 10%

HSBC Amanah MPower Platinum Credit Card-i

Shop smart and safe with up to 8% bonus cash back on eWallet spend, petrol, and groceries all whilst protected by E-Commerce Purchase Protection.

- Min. Monthly Income

- RM 3,000

- Annual Fee

- Free

- Cashback

- Up to 8%

RHB Shell Visa Credit Card/-i

Enjoy cashback deal when you spend with your new RHB Shell Visa Credit Card/-i. Get 5% cashback on everyday essentials which include grocery, online spend, e-wallet reload, retail spend & utilities.

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

Maybank Shopee Visa Platinum Credit Card

Receive 5000 Welcome Shopee Coins after RM300 spend and enjoy up to 5x Shopee Coins for any spend on Shopee, dining, entertainment, and contactless payments.

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

Maybank 2 Cards

Enjoy cashback and exclusive rewards with a minimum RM300 spend whilst enjoying up to 5x TreatsPoints on your weekday spend.

- Min. Monthly Income

- RM 2,500

- Annual Fee

- Free

- Cashback

- RM50 /mth

HSBC Visa Signature Card

Up to 8x Rewards Points on overseas and local spending with E-Commerce Purchase Protection coverage of up to up to USD200.

- Min. Monthly Income

- RM 6,000

- Annual Fee

- Free

- Cashback

- -

Maybank PETRONAS Visa Platinum

Earn 8x TreatsPoints on weekends and 5x TreatsPoints on weekdays when you link your card and pay for fuel via CardTerus on the Setel app.

- Min. Monthly Income

- RM 5,000

- Annual Fee

- Free

- Cashback

- -

Maybank Visa Signature

Taking shopping overseas to a 5x new level of TreatsPoints for every RM1 spent PLUS up to 5% cashback on all petrol and grocery spend.

- Min. Monthly Income

- RM 5,833

- Annual Fee

- Free

- Cashback

- up to 5%

HSBC TravelOne Credit Card

Instant reward redemption with an extensive selection of airline and hotel partners.

- Min. Monthly Income

- RM 5,000

- Annual Fee

- Free

- Cashback

- -

HSBC Live+ Credit Card

Live it up with extra cashback

Who says you can't have it all? With our HSBC Live+ Credit Card, you can spend on all the things you love… and earn cashback towards the things you've got your eye on.

- Min. Monthly Income

- RM 5,000

- Annual Fee

- Free

- Cashback

- Up to 5%

Other Credit Card categories

Still unsure about which product best suits you?

Leave your details and our friendly agents will get back to you!

How do you apply for a credit card online?

Step 1

Use our Credit Card Smart Search to find a list of cards that fits your needs! Choose the one you are interested in.

Step 2

Once you fill in your contact details, we will call you to help you apply!

Read more about Credit Card

FAQs Top 10 Credit Cards in Malaysia

Choosing the right credit card in Malaysia can open doors to numerous benefits like cashback, rewards, travel perks, and exclusive discounts. Whether you’re a frequent traveler, big spender, or someone looking for savings on essentials, finding the best credit card can significantly enhance your lifestyle.

The best credit card in Malaysia depends on your spending habits, lifestyle, and financial goals. From high rewards on overseas spending to cashback on essentials, there’s a card for everyone. For frequent travelers, the Maybank 2 Cards Premier and HSBC Visa Signature offer valuable perks. Cashback lovers may prefer the Standard Chartered JustOne Platinum Mastercard for their excellent rebate programs. Meanwhile, budget-conscious users will find value in the AEON Credit Service Visa Gold or Public Bank Quantum Visa/Mastercard.

-

The Standard Chartered JustOne Platinum Mastercard are top choices for cashback on dining, groceries, and online spending.

-

The Maybank 2 Cards Premier and HSBC Visa Signature provide excellent travel perks, including lounge access, travel insurance, and more.

-

Yes, the Public Bank Quantum Visa/Mastercard and AEON Credit Service Visa Gold offer no annual fee options, either by default or through waivers.

-

Consider your primary spending categories (cashback, rewards, travel perks), income eligibility, and annual fee preferences to pick the card that best fits your needs.

-

Having multiple credit cards can be beneficial if you want to maximize rewards across different spending categories, but it’s important to manage them responsibly to avoid debt.

-

Yes, many banks in Malaysia allow foreigners to apply for credit cards, though they may have specific eligibility requirements like a valid work permit, minimum income levels, and additional documentation. Check with each bank for their exact requirements.

-

Typically, credit card approval can take anywhere from a few days to a couple of weeks, depending on the bank’s processes and the completeness of the documentation submitted.

-

The minimum income requirement varies by card and bank, but generally, a basic credit card may require a minimum annual income of RM24,000, while premium cards often require higher income levels, usually RM60,000 or more per year.

-

Yes, some premium credit cards offer zero or reduced foreign transaction fees, which is a great feature for those who frequently shop or travel abroad. It’s best to confirm the foreign transaction fee structure with each card provider.

-

To maximize rewards, use your card for purchases in high-reward categories (like dining or groceries), meet minimum spending requirements for cashback tiers, and keep track of your card’s promotional offers.