CIMB Credit Cards

CIMB Bank presents a variety selections of cards which include retail spending, petrol cashbacks, dining cashbacks and travel miles. CIMB also offers an attractive balance transfer program for most of their cards, offering 0% interest rates for 6 months without any annual fees. Compare all CIMB Bank credit cards and apply online today.

We found 9 credit card(s) for you!

Here's some popular credit cards for your reference!

CIMB Cash Rebate Platinum Credit Card

Splurge online or spend on your daily needs and get rewarded up to 5% cash rebates on cinema, groceries, petrol, mobile, and utilities.

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- Up to 5%

CIMB World MasterCard

Enjoy 1.5% unlimited cash rebate for overseas spending and 15% discount at any duty-free merchant.

- Min. Monthly Income

- RM 7,500

- Annual Fee

- Free

- Cashback

- -

CIMB Travel World Credit Card

Travel sooner than you think with your CIMB TRAVEL WORLD CREDIT CARD.

Earn up to 12x Airport Lounge Access

- Min. Monthly Income

- RM 8,333

- Annual Fee

- RM 554.72

- Cashback

- -

CIMB Visa Signature

Get complimentary Plaza Premium Lounge access, on top of 2x Bonus Points rewarded from all overseas retail spending!

- Min. Monthly Income

- RM 3,000

- Annual Fee

- Free

- Cashback

- Up to 5%

CIMB Visa Infinite Card

Your dining and travel companion that gives you 5X more rewards and 8x Airport Lounge Access after enjoying a premium ride to the airport.

- Min. Monthly Income

- RM 5,000

- Annual Fee

- Free

- Cashback

- Up to 5%

CIMB PETRONAS Platinum

7% cash rebate for Setel transaction with statement balance of RM1,500 and above,5% cash rebate with statement balance of RM1,500 and above. 3% cash rebate with statement balance below RM1,500!

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- Up to 5%

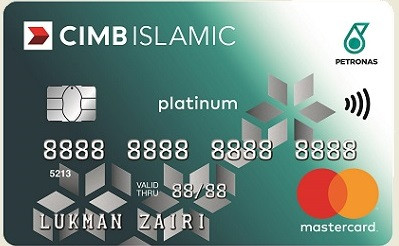

CIMB Islamic PETRONAS Platinum

7% cash rebate for Setel transaction with statement balance of RM1,500 and above,5% cash rebate with statement balance of RM1,500 and above. 3% cash rebate with statement balance below RM1,500!

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- Up to 5%

CIMB Travel Platinum Credit Card

Travel sooner than you think with your CIMB TRAVEL PLATINUM and earn up to 2X Grab Airport transfer.

- Min. Monthly Income

- RM 2,000

- Annual Fee

- Free

- Cashback

- -

CIMB Travel World Elite Credit Card

BEST CREDIT CARD for Affluent Clients (USD 70,000 AUM and above) by Global Retail Banking Innovation Awards 2023

- Min. Monthly Income

- RM 20,833

- Annual Fee

- RM 1215.09

- Cashback

- -

Balance Transfer to any CIMB credit cards

Other Credit Card categories

Still unsure about which product best suits you?

Leave your details and our friendly agents will get back to you!

How do you apply for a credit card online?

Step 1

Use our Credit Card Smart Search to find a list of cards that fits your needs! Choose the one you are interested in.

Step 2

Once you fill in your contact details, we will call you to help you apply!

Read more about Credit Card

FAQs Why get a CIMB credit card?

CIMB offers a wide range of credit cards that caters to just about every lifestyle. Get cash rebates, air miles, exclusive privileges and discounts, and even double dip on rewards when topping up your e-wallet!

-

CIMB provides easy cash advances with easy repayment options though CashLite. No cash advance fee or guarantors needed.

-

Credit cards from both Visa and Mastercard payment networks are available through CIMB, allowing you to choose which best suits your needs. There is a credit card for every income level and lifestyle.

If you are an avid eWallet user, the CIMB e Credit Card is for you! Double dip on rewards by earning up to 10X Bonus Points when topping up your e-wallet and shopping with online merchants like Zalora and Lazada. Earn double that bonus when you shop on the CIMB eDay.

Get additional cash rebates on retail purchases, petrol, dining, or entertainment depending on your priorities - or earn air miles to save up for that big holiday you always wanted. CIMB credit card promotions help you earn what you want.

-

Redeem a wide range of gifts with your CIMB Bonus Points - earned when you spend with your CIMB credit card. CIMB offers the best bonus point conversion ratio available. So you get what you want sooner.

-

There is a credit card for everyone. From online shoppers with the CIMB e Credit Card, to low income earners with the CIMB PETRONAS Platinum credit card. High rollers can opt for the CIMB Visa Infinite Credit Card that gives you additional privileges just for holding the card.

Those that are truly special should take a look at the CIMB Preferred Visa Infinite Credit Card, which acts as a CIMB Preferred Recognition Card and offers a full suite of unparalleled privileges and benefits.

-

Simply apply online with iMoney. Select the credit card you want and fill in your contact details in the form provided. Our representative will contact you to guide you through the application process.