Will Vacations Cost You A Bomb Post-GST?

Table of Contents

Our domestic tourism industry is in no way excluded when it comes the Goods and Services Tax (GST) effective April 1 this year. Does this spell trouble for those who caught the travel bug?

Can we expect prices to go up across the board, including travel-related products and services? When we travel, a large portion of our expenses typically goes towards accommodation, dining and transportation – and these expenses are subjected to GST.

What travel expenses will be GST-ed?

Last year, an industry guide was published by the Customs to set out the application of GST within the travel industry. Based on that industry guide, GST will affect the cost of your travel expenses in the following ways:

- All domestic travelling related expenses such as flight fares, inbound package tours, hotel accommodation, deposits, booking, cancellation or amendment fees, tour guide services, transportation, dining, cruises, spas and entrance fees will be charged 6% GST.

- Air ticketing service fees, airport tax, passenger service charge, travel insurance and fees for arranging travel insurance will also be charged GST.

- If a local travel agent has commissioned another travel agent to run an inbound package, 6% GST will be charged on the commission payable.

- Other items subject to 6% GST are airport taxi fares, airport limousine hire, chartered bus hire, car hire and self-drive car rentals.

- Items exempted from GST are taxi fares and public transportation by land and rail (such as RapidKL, KTM, LRT, ERL and MONORAIL).

At present, when a customer receives a bill, it would be for the price of the meal plus a 10% service charge and 6% Government tax. The service charges collected are considered tips which are then distributed to the staffs. However, GST would be imposed on the total meal cost plus the 10% service charge – so be prepared to pay more come April 1.

Effects of GST on travel

In short, the implementation of GST would inevitably result in a hike in domestic travelling cost as tour packages rates, which comprise air transportation, land transportation, cruises and meals, are all taxable.

Any travel on or after April 1 is subject to GST irrespective of when the booking was made. This simply means, even if you made a booking with full payment before April 1 but travel only after that, the travel arrangement that you have purchased is subject to GST as the consumption of your travel arrangement is on or after the implementation of GST.

Your travel agent might absorb the extra cost that comes with GST or they may send you a “tax invoice” to collect GST from you. Therefore, it is best to check with your travel agent when you are making any travel arrangements for travel after April 1.

MATTA remains optimistic that GST will not impact the profitability of travel agencies directly, as it can be claimed from the Government. The only immediate area of cost increase is likely to be the compliance cost of managing GST. This could come in the form of recruiting additional staff to keep track of records that affect their liability to tax.

However, the same can’t be said for travellers.

How much more will domestic travel cost?

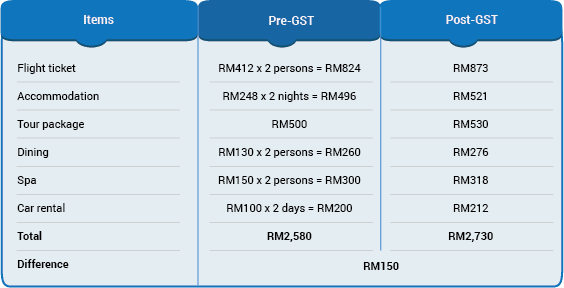

Let’s compare the cost of a three-day-two-night trip to Langkawi for two, before and after GST:

Based on the example above, there will be an approximately 6% increase in travelling to Langkawi for two.

Nonetheless, there will be a positive impact on the travel industry in the long run. Revenue collected from GST can be used for tourism promotions by the Government. Additional infrastructure and enhancement of tourism attractions can boost tourism arrivals, both locally and internationally.

If you are not planning to cut down on your travelling in the future, it might be the right time to cut down on non-essential spending.