Know The Property Market In Malaysia

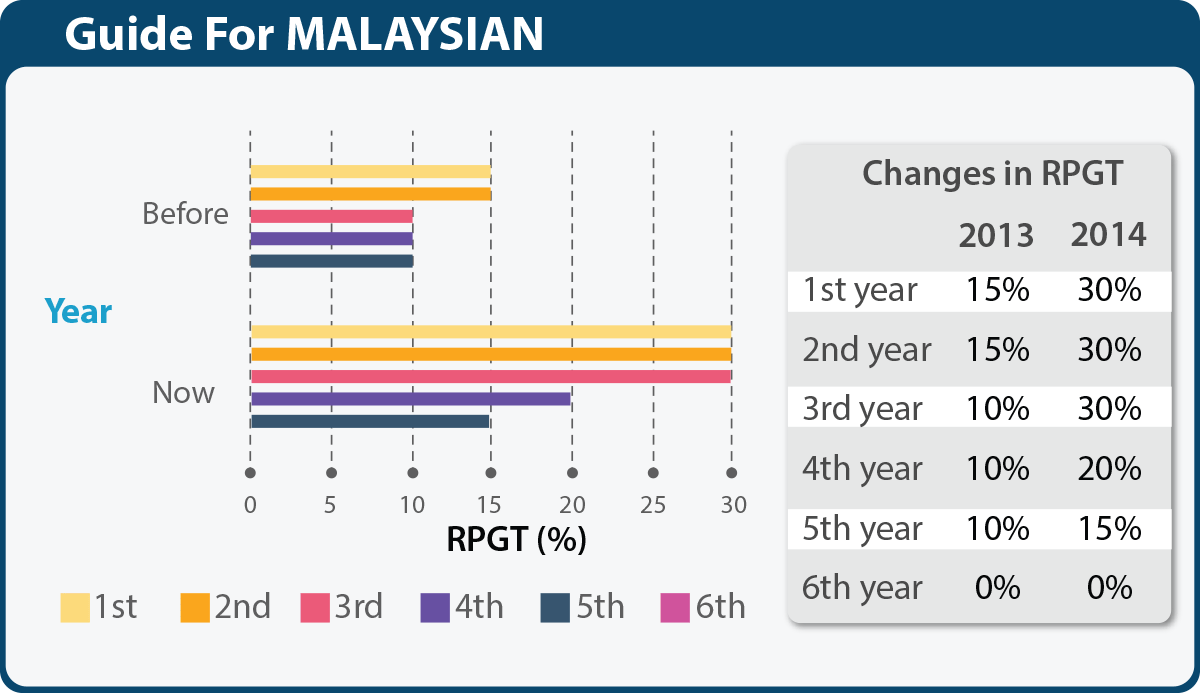

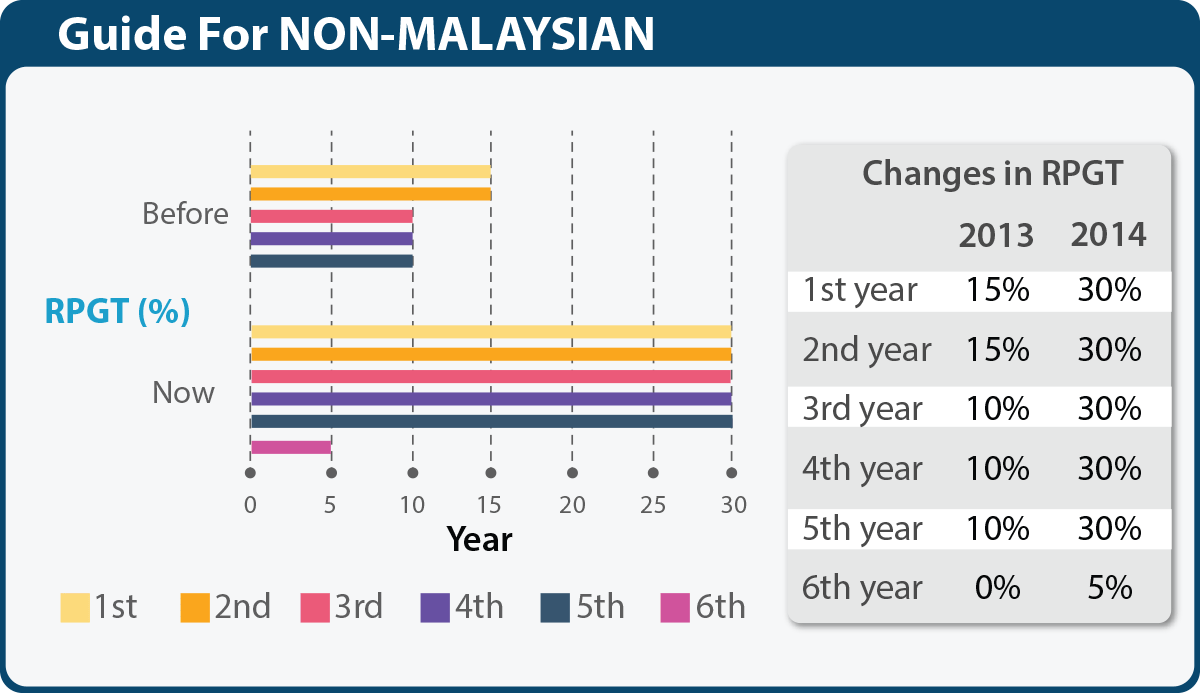

a Real Property Gains Tax (RPGT)

RPGT increased from 15% to 30% for properties disposed within the first three years which is likely to affect investor’s sentiment and could cause a drop in interest in the secondary or sub-sale market.

This spells good news for first-time home buyers as the property prices will escalate at a slower pace, making them more affordable.

b Developer Interest Bearing Scheme (DIBS)

Developer Interest Bearing Scheme (DIBS) is a scheme commonly offered by developers of newly launched properties still under construction to entice home buyers. Under DIBS, the property developer will bear the home loan interest incurred by you throughout the period of property construction.

While DIBS benefits home buyers by freeing up cash that would otherwise be used to service the home loan interest for investments, it has been reported that property developers have been marking up property prices by 5% to 15% in order to cover the interest absorbed by them during property construction.

As per the announcements doing the tabling of Budget 2014, property developers are no longer allowed to offer DIBS. Similarly, financial institutions are prohibited from providing final funding for projects with DIBS.

The abolishment of DIBS is expected to curb speculation and inflated pricing but will also affect the way a home buyer will plan his or her finances to be able to afford a home.

| With DIBS Before | Without DIBS Now | |

|---|---|---|

| You take up a loan to buy a property | You pay an initial payment

(Usually 10% of the property price)

|

You pay an initial payment

(Usually 10% of the property price)

|

| Construction of property | The developer bears the loan interest during this stage | You start paying loan interest from here on |

| Property completed | You only start paying loan interest from here on |

c New housing regulations in Penang

In a bid to ensure public housing and affordable homes are accessible to low and middle-income first-time home buyers, the state of Penang has enforced new housing regulations on February 1, 2014.

Under this new housing regulation, buyers will have to be qualified as a ‘listed buyer’ by the state housing department if buying the following pre-owned properties:

- Low cost home

(bought for RM42,000 or less by seller) - Low-medium cost home

(bought for RM72,500 or less by seller) - Affordable home on mainland

(bought for RM250,000 or less by seller) - Affordable home on the island

(bought for RM400,000 or less by seller)

Additionally, the new regulation stipulates that foreigners are only allowed to purchase a property with a minimum price of RM1 million or RM2 million for a landed property on the island.

On top of the existing RPGT for disposal of properties within the stipulated timeframes, disposal of properties in Penang within the first three years will be charged a 2% levy for citizens and 3% for non-citizens.

New property regulations in Penang

d My First Home Scheme (MFHS)

If you find yourself struggling to save up the 10% down payment plus the additional charges to purchase your first home, you can consider opting for My First Home Scheme (MFHS).

Introduced in 2011, this scheme aims to help young adults buy their first home by allowing them to obtain 100% financing from banks and enjoy a 50% stamp duty exemption (exemption valid till December 31, 2014). To qualify, the borrower must meet all the following personal and property criteria:

Personal criteria:

- First-time home buyer

- Malaysian citizen aged 35 and below

- Gross income of RM5,000 or less per month (single borrowers); combined gross income of less than RM10,000 per month (joint borrowers)

- Existing repayment obligations do not exceed 60% ofnet monthly income or maximum limit imposed by the lending bank, whichever is lower.

Property criteria:

- Minimum property value of RM100,000 and maximum property value of RM400,000.

- Residential properties bought for owner occupation only.

- Remaining lease of 60 years and above for leasehold properties.

In addition to the above criteria there are also financing requirements that must be adhered to under MFHS:

- Maximum loan tenure of up to 40 years or until the age of 65, whichever is earlier.

- Amortising facilities only, where the principal of the loan is paid down over the life of the loan according to an amortization schedule.

- Repayment of monthly instalments via salary deduction or standing instruction.

- Insurance/Takaful is compulsory.

e MyDeposit Scheme

Launched in April 2016, the MyDeposit scheme aims to assist the middle-income group in purchasing their first homes by providing the funding for the 10% deposit or down payment. This is perfect for those who are struggling to save up enough to cover the down payment of a property.

Launched in April 2016, the MyDeposit scheme aims to assist the middle-income group in purchasing their first homes by providing the funding for the 10% deposit or down payment. This is perfect for those who are struggling to save up enough to cover the down payment of a property.

This scheme helps first-time home buyers cover the 10% of down payment, or a maximum of RM30,000, whichever is lower.

To qualify, the applicant must meet all the following personal and property criteria:

Property criteria:

- A Malaysian citizen

- 21 years old and above (No maximum age)

- First-time home buyer within one household family

- Earning a gross household income of below RM10,000 a month (This includes all income be it from employment, business, wage, commission, bonus and other allowances.)

- Purchasing a property priced at RM500,000 or less

- Eligible for a bank loan from any bank in Malaysia (credit worthy, not blacklisted, or bankrupt)

Property criteria:

- Property must be from licensed development projects of residential properties.

- Also applicable to residential properties in the secondary market.

Property price must be RM500,000 or below. - Only applicable to private residential properties development that do not receive subsidy/incentive or Government funds.

- Properties bought with MyDeposit scheme cannot be sold for 10 years, from the date of the Sales & Purchase Agreement. This clause will be added in the Sales & Purchase Agreement.

With the MyDeposit scheme, you will need do your homework much earlier before you apply for the scheme. Compare home loans in Malaysia simultaneously while you look for a property to save time.