Having Kids In Your 20s Or 30s: Which Makes More Money Sense?

More and more couples are postponing having kids as they try to balance their careers and other life goals with their desire to have kids. Having children isn’t just an emotional decision, it is also a financial one.

We all know that having a child does not come cheap. Here’s a rough estimate on how much a household would spend on their child at different age range of the child. The estimation is for one child, and will double up if you choose to have two kids and triple up if you want to have three kids. We’ve also used a degree programme from a local university offering Australian based degrees.

| Child Age Range | Primary Expenses | Total | |

|---|---|---|---|

| 0 to 6 | Paediatrician | RM7,000 | RM184,600 |

| Baby Food | RM14,400 | ||

| Formula Milk | RM14,400 | ||

| Disposable diapers | RM4,800 | ||

| Day care Centre | RM108,000 | ||

| Insurance | RM14,400 | ||

| Living cost | RM21,600 | ||

| 7 to 12 | School | RM10,000 | RM139,600 |

| Extra curriculum activities | RM36,000 | ||

| Day care Centre | RM57,600 | ||

| Insurance | RM14,400 | ||

| Living cost | RM21,600 | ||

| 13 to 17 | School | RM12,000 | RM84,300 |

| Extra curriculum activities | RM50,400 | ||

| Insurance | RM14,400 | ||

| Living cost | RM4,000 | ||

| 18 to 21 | Living cost during varsity | RM32,000 | RM43,600 |

| Insurance | RM9.600 | ||

| Grand total | RM452,100 |

A staggering half a million! It really takes precise planning before you decide to have a child. Ask yourself and your partner these questions: How old should you have your first child for it to be financially easier? Will you and your spouse’s age make a difference?

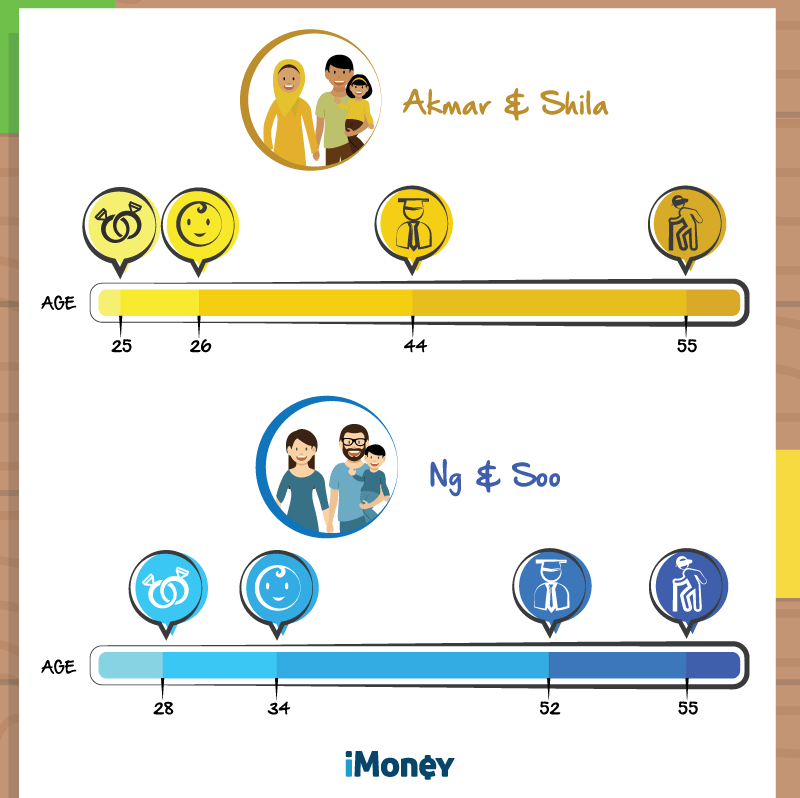

iMoney interviewed two couples who had their first child at different stages of their lives to find out how their age (and the corresponding financial state) impact these major expense areas – child care and medical, tertiary education costs and retirement.

Couple A – Akmar and Shila started their parenthood early, while still saddled with student and car loans. To save on day care expenses, they currently live with Akmar’s parents, but are saving to buy a house by next year.

Although they spend nearly all of their salary and have very little left to save every month, they wouldn’t change a thing of being young parents because they are confident they can make their budget work with a child.

Couple B – Dominic Ng and Jacklyn Soo waited to have their first child after fulfilling three aims they set for themselves – a bank balance of RM50,000, a house of their own and Soo wanted to complete her Master’s degree in England. Now, they have paid off their car loans and are currently paying off their house loan.

Both couples invest a significant portion of their salaries towards saving for their child’s tertiary education and their retirement.

Here’s the timeline process for both these couples based on their different timing of having a child.

Which family would fare better financially? Does it make sense to have a baby in your 20s, so you can tackle child-related costs earlier on? Or when you’re in your 30s and more financially stable?

Here are a few important considerations to bear in mind when you are planning to start a family:

1. Cost of supporting your child till 18

Delivering a baby does not come cheap especially if you opt for C-section in a private hospital. For Akmar and Shila, they had a natural birth and spent around RM5,000 for delivery and hospitalisation. They enjoy free child care as Akmar’s parents tend to their daughter while both of them are away at work.

Due to age complications, Couple B had to opt for Caesarean and it cost them approximately RM15,000. Though, it’s not a guarantee that a younger couple will always have a natural birth but the likelihood of a Caesarean is lower. As the couple lives on their own, Ng and Soo have to leave their son at a day care centre, which costs around RM1,500 a month.

Though Ng and Soo expend more for their child, at this stage in their life, they are financially ahead of Akmar and Shila, making it easier to fit the higher cost into their budget.

Who has the advantage?

Child care cost can take up a huge portion of your budget. Couple A have it easier with the help of his parents, but Ng and his spouse are better off financially (RM38,502 more annually than Akmar and Shila) to cover child care cost too.

Having a higher salary at the time of child birth could very well mean that Ng and Soo have extra to provide better for their child, without hurting too much of their priority expenses. Because childcare expenses for the child’s first six years proves to be the highest, and as the child grows, the expenses drop, and increase again when the child goes to university.

Here are how both couples fare financially over the course of their child’s life based on their income and expenses:

| Akmar & Shila | ||||

|---|---|---|---|---|

| Child’s Age | Parents’ Age | Income | Expenses | Balance |

| 0 to 6 | 26 to 32 | RM656,572 | RM530,008 | RM126,563 |

| 7 to 12 | 33 to 38 | RM771,803 | RM539,703 | RM232,100 |

| 13 to 17 | 39 to 43 | RM840,221 | RM484,366 | RM355,855 |

| 18 to 21 | 44 to 47 | RM823,913 | RM412,548 | RM411,365 |

| Total | RM3,092,509 | RM1,966,625 | RM1,125,883 |

| Ng & Soo | ||||

|---|---|---|---|---|

| Child’s Age | Parents’ Age | Income | Expenses | Balance |

| 0 to 6 | 34 to 40 | RM970,055 | RM700,107 | RM269,948 |

| 7 to 12 | 41 to 46 | RM1,136,230 | RM658,977 | RM477,253 |

| 13 to 17 | 47 to 51 | RM1,143,021 | RM603,761 | RM539,260 |

| 18 to 21 | 52 to 55 | RM978,464 | RM531,409 | RM447,055 |

| Total | RM4,227,770 | RM2,494,254 | RM1,733,516 |

To simplify these numbers we made a few assumptions:

- The income of both couples are made to be identical. i.e., Akmar & Shila’s salaries will match Ng & Soo’s when they reach 34. The rate of income growth has also been fixed.

- At the age of 26, both these couple had a basic cost of living of RM2,000 and experience a cost of living inflation of 5% annually.

- Both these couples have loan commitments of car and house and do not upgrade to a bigger house or car in their lifetime.

- Expenses include child expenses, loans and living expenses.

- Both couples only have one child.

While both couples do not have a problem taking care of their child financially, we can see which couple fares better. Based on the tables above, it’s clear that Couple B, Ng and Soo have the upper hand in their finances as they have checked a lot of the initial financial goals off their list before the arrival of their bundle of joy.

Since they have a significantly larger balance in the first six years and are able to allocate more money towards both their retirement and the child’s education from day one. This is even though they do spend more (RM527,629 more) due to child care cost.

This pattern remains till the final stage when Akmar and Shila have begun to peak in their careers and are able to afford more.

2. Tertiary education costs

Although it is rarely practised, couples should start saving for their child’s university education needs even before having a child.

Both Couple A and B invested in a child education plan with the arrival of their bundle of joy as they recognise the importance of education and foresee that tertiary education will be much more expensive in the future.

For Akmar and Shila, they don’t want their child to graduate with a student loan debt like they did. Though both sets of parents have approximately 18 years to plan for their child’s college fund.

Akmar and Shila are tighter on cash flow and live more on a survival mode from one month to another, hence, they only started out with a small amount of RM5,000 while the second couple started out with RM10,000.

Who has the advantage?

As both these couples would move up the career ladder, they would definitely be able to contribute more towards their child’s education plan. On average, the rate of annual salary increase in Malaysia is approximately 5%.

In this scenario, though both couples started out with different amounts, they contributed RM6,000 to the education fund every year thereafter, plus a 3% increment in the contribution every year.

| Couple A | Couple B | |

|---|---|---|

| Initial investment | RM5,000 | RM10,000 |

| Regular annual investment | RM6,000* | RM6,000* |

| Average rate of return | 6% p.a. | 6% p.a. |

| Total number of years | 18 years | 18 years |

| Total balance | RM300,734 | RM316,718 |

* Their annual contribution increase by 3% annually, in line with their salary rate increase of 5%

Though Ng and Soo seems to be doing better with their child tertiary education savings, they will have no room for mistakes or procrastination as they would be contributing to the fund all the way to age 52. They would need to have everything well planned and use up every opportunity to their benefit. The growth of their salary can turn to stagnate or drop in their mid-40s onwards, and retirement would then be just a stone away.

A local Bachelor of Science at Monash University Malaysia cost about RM124,000 in 2015, would cost approximately RM298,420 18 years later. Both parents will likely be able to save enough to afford sending their child to a local university. If they prefer overseas tertiary education, they would definitely need to save way more than 6,000 a month.

3. Retirement

When it comes to your nest egg savings for retirement, the real key is to start socking away money as early as possible. However, most parents make the mistake of using their retirement fund such as EPF for things like buying a home or sending their child overseas.

Both these couples kick-started their retirement savings at 30. Akmar and Shila’s initial investment was RM5,000, while Ng and Soo channelled their RM50,000 savings into retirement.

Akmar and Shila started low by investing a meagre RM2,156 (this figure is derived from the balance of their income after factoring in all costs like education and living plus discretionary spend) annually into investments offering up to 10 This was because they are still in the prime time where childcare cost take up the most of their budget, causing retirement planning to slip down the priority list. Their budget is tighter as they have other financial obligations such as car loan, student loan, saving up for house down payment and costs of having a child.

On the other hand, Ng and Soo started high by investing RM18,682 annually into investments offering up to 10% returns. This is because at 30, they did not have their child yet and it would only be fair to channel their savings into retirement. Their budget is less tight as they have fewer financial obligations such as housing loan and Soo’s Masters.

In order to be able to retire with comfort, both these couples would require RM3,277,284 (based on their last drawn salary of RM20,690 and estimated life span of 20 years post-employment). Since both these couples have similar salary projection, their EPF savings at 55 would be around RM1,149,496 (based on total EPF contributions of 23%). The balance of RM2,127,788 must come from their retirement savings.

Who has the advantage?

Both these couples plan to increase their investment contributions in stages as their incomes increase, in-line with reduction in childcare costs. For now, they are investing in a higher risk investment as they are still young and are able to stomach higher risk.

As they are struggling more financially, Akmar and Shila put retirement planning in their back seat and would only go full-throttle on that when their daughter graduates from university, at the age of 44. This would leave them with 11 years to invest significantly more of their income and be aggressive towards their retirement because they still have enough time to ride out market changes.

This gives them the privilege to beef up their contributions from 45 onwards by opting for more aggressive investments. Starting from 51 years old, they are still able to contribute significantly but they would need to be more conservative with their investments risks.

This may not be the situation for Ng and Soo as they would be 52 when their child finally goes to university. They would have only approximately four years to accumulate their retirement savings. However, in their 50s, they would need to move to a less aggressive portfolio and contribute less as they have less years to make up for any investment losses.

By having their child in the 20s, Akmar and Shila would have an increasing balance that they can use for investment purposes of child education or retirement. And as their daughter becomes partially dependent at 18, they would still have a solid 12 years to fully concentrate on their retirement savings.

As for Ng and Soo, they would be in their 50s when their son enters university. If they choose to make contributions to their child post-graduation, then it would be from their savings as they would no longer have any source of income or they’d be forced to continue working past retirement age.

At the initial stages, both couples equally have increasing balance that they can dispose for investment purposes. However, at the final stage, their disposable income for investment decreases and they only have a mere four years to focus their income into their retirement fund before they leave employment.

The pressure felt by Akmar and Shila in their early years is definitely greater than Ng and Soo. We can see that they would have to sacrifice more just to stay afloat. Their investment plans for retirement and education funds also differ since they would only be able to contribute significantly later. However, their long game is better since they’d be at the peaks of their careers when their child graduates and as such will have a significantly easier time in their mid-40s onwards.

For Ng and Soo, it’s generally easier for them financially throughout since they are financially stronger from the start of their child’s life and as such make very little sacrifice when it comes to comfort and investments. However, they would also have a more difficult time later in life since they would be approaching retirement while still supporting their son and won’t have the same leeway with their finances as Akmar and Shila at that stage.

Based on their retirement savings plan projection, Akmar and Shila would end up with RM2,580,801 when they retire at 55. At the end, their retirement savings would be RM2,714,859 – which is only RM134,058 higher than Akmar and Shila. Adding up their EPF and retirement savings, both these couples would be able to retire comfortably.

We emphasise on retirement here because you want to ensure that your retirement is secure so that you don’t need to rely on your children in your golden years. This is an important but often overlooked part of planning for children.

There is no RIGHT time or way to have your child but this should give you a rough indication of what challenges you and your spouse may face when planning your family and how your retirement works into the whole picture.

Does your experience mirror this? Let us know in the comments below!