5 Reasons That Can Result In Denied Takaful Claims

Table of Contents

We are very much a digital society, so let’s put our lifestyle choices in perspective: mobile penetration in the country stands at roughly 140% with 47% of Malaysians owning more than one mobile phone.

But these pale in comparison when you contrast those digits to this: the average national protection gap in Malaysia is RM200,000 and takaful covers only 14.5% of the market. Not forgetting, 89.2% of Malaysian households can’t withstand financial shocks.

Although Family Takaful coverage plays an important and essential role in our lives, it seems that most Malaysian aren’t wising up to the fact that adequate coverage goes a long way in ensuring the livelihood of you and your family.

But to fully reap the benefits, it is important to understand the pitfalls that could cause your takaful claims to be denied. So, here’s a question: Are you guilty of these five common reasons for denied takaful claims?

Myth 1: It’s okay not to thoroughly declare your medical history

Reality: Trace your medical history and be thorough with all your ailments and illnesses as well as treatments sought.

The reason is simple: Should a takaful operator get wind that there have been undeclared illnesses, it will process your claims but they will not be approved in case of non-disclosure. You’ll be made aware of this while signing up for a plan.

One way a takaful operator can sniff this out is that their claims department can conduct investigations to obtain your medical reports. So, if there’s a mismatch between your application and your medical history, the company can decide not to approve your claims.

So be as honest as possible while you are filling up those forms and answering those medical questions.

Myth 2: I can be tardy on my monthly payments

Reality: Not being prompt on your payments may result in the lapsing of your takaful certificate.

If your plan has lapsed, the company will not pay any claims made. One way to ensure that you pay on time, every time is to track your payments through credit card or direct debit.

What happens if your takaful plan has lapsed and you want to revive it?

A reminder will be sent via SMS or letter on missed payments. Ensure that your contact details are updated if there are changes to them.

Myth 3: One plan to rule them all

Reality: Well, some may sell you the idea that X plan or Y plan may cover all your needs – but that’s not true. Every takaful plan has its list of exclusions.

One common misconception is many still do not know the difference between critical illnesses plan and a medical card plan. Both are different.

A medical card protects you in the event of a medical emergency which requires hospitalisation, by covering the cost of room and board, as well as treatment.

On the other hand, a critical illness plan provides financial aid in the form of a lump sum or percentage payout, in the event you are diagnosed with a critical illness. This will not just help in covering your treatment, it will also come in handy as income replacement.

So how do you go about this? One way is to ask your takaful advisor on the nature of your coverage.

Always read the fine print before putting pen to paper. You have to know what’s included and excluded. There are two types of exclusions. The general exclusion applies to all Person Covered, be it male or female, healthy or ill. For example, pregnant women and a child below a month old.

The second exclusion is known as a specific exclusion or pre-existing condition. What this means is a pre-existing disability or illness which existed or have developed symptoms prior to effective date of coverage.

Also understand coverage varies between males and females and lifestyle also plays a role – if you are a smoker, expect to pay a higher contribution.

An important tip here is to always revise your takaful coverage to match your life stages. When you are single, your needs are different from when you are married with children. So constant reviewing ensures you have adequate coverage.

| 1. Alzheimer’s Disease/Irreversible Organic Degenerative Brain Disorders | 2. Bacterial Meningitis |

| 3. Blindness/Total Loss of Sight | 4. Brain Surgery |

| 5. Cancer | 6. Chronic Aplastic Anaemia |

| 7. Coma | 8. Coronary Artery By-Pass Surgery |

| 9. Deafness/Total Loss of Hearing | 10. Encephalitis |

| 11. End Stage Kidney Failure | 12. End Stage Liver Failure |

| 13. End Stage Lung Disease | 14. Heart Attack |

| 15. Heart Valve Surgery | 16. Major Burns |

| 17. Major Head Trauma | 18. Other Serious Coronary Artery Disease |

| 19. Paralysis/Paraplegia | 20. Parkinson’s Disease |

| 21. Primary Pulmonary Arterial Hypertension | 22. Surgery to Aorta |

| 23. Full Blown AIDS | 24. Fulminant Viral Hepatitis |

| 25. Loss of Independent Existence | 26. Loss of Speech |

| 27. Major Organ/ Bone Marrow Transplant | 28. Multiple Sclerosis |

| 29. Severe Cardiomyopathy | 30. Stroke |

| 31. Systemic Lupus Erythematosus (SLE) with Lupus Nephritis | 32. Benign Brain Tumour |

| 33. HIV Due to Blood Transfusion | 34. Motor Neuron Disease |

| 35. Muscular Dystrophy | 36. Angioplasty And Other Invasive Treatments For Major Coronary Artery Disease |

Myth 4: You do not have to fork out a single sen for medical treatment

Reality: Your takaful plan has a ceiling and you have to know that before making claims. For example, if your coverage for hospitalisation and surgery is RM50,000 but you incur a RM70,000 bill – then you’ll have to make up for the RM20,000 excess in your plan.

Not only you’ll have to know your maximum annual limit but you should also be aware of the lifetime limit. As for a Family Takaful plan, you’ll need to ensure the amount you have is sufficient for your family to live on should something untimely, such as death or an impairment, happen to you.

Myth 5: No waiting period

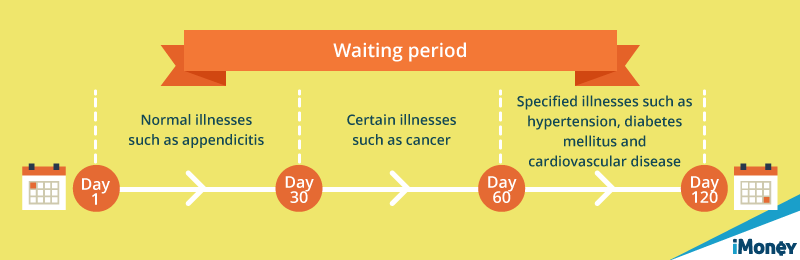

Reality: Always read and understand your coverage even after checking with your takaful advisor. When a takaful plan is inforced, there is always a waiting period for certain benefits. Some may require a 30-day waiting period while others may require up to 120 days.

What’s important to note is that the waiting period is effective for certain types of diseases and ailments such as stroke, cancer or even Alzheimer’s.

To avoid this is simple: don’t delay on signing up, so that you can wait out the waiting period with ease.

So what are you waiting for?

If you are still hesitant over signing up for a takaful plan, consider that age is always crucial. The younger you are, the more coverage you get and the lower your contribution will be.

In fact, for a 24-year-old male, who is a non-smoker, he just needs to put down RM200 a month, or even less, to get a pretty decent coverage.

Also, think about this: with debts under your name, the last thing you want to do is pass on to any living relatives – including your spouse – who might be responsible for your debt in case of an early death.

An adequate takaful plan ensures that your next-of-kin, spouse or even aging parents are not straddled with your debts when you are gone.

If death is not a motivating factor, then let’s talk about health. There are one too many reasons where you may encounter accidents that could lead to hospitalisation or worse – permanent disability.

In the event of such untoward incidents, you’ll need some financial backup to ease your burdens. That’s where a takaful coverage comes in handy.

Interested to know more about the right takaful plan for you or your family? Simply get in touch with a takaful advisor to know more about how you can be adequately covered!