Understanding Your Credit Card Interest-free Period

Table of Contents

There is no denying the importance of making full payments if one wishes to be free from debt. The fact is that many Malaysian credit card holders don’t make full repayments every month.

Bank Negara Malaysia data shows that outstanding balances of credit cards amounted to RM35.89 billion in 2022. Besides outstanding payments, an earlier survey had also highlighted the problem of partial payments. Only 15% of Malaysian credit cardholders pay above the minimum required amount of 5% of total outstanding balance every month.

However, merely paying more than the minimum amount is not enough. In order to avoid being charged for interest, one needs to make full payment every month.

While there are many unavoidable factors that contribute to one’s inability to make full payments every month; the lack of understanding of how a credit card’s interest free period should not be one of them.

What is interest free period?

A credit card’s interest free period is a period in which if full payment is made within that period, the cardholder will not incur interest charges.

The most important point to note here is that payment must be made in full. This interest free periods do not apply for partial payments.

How long is the interest free period?

Most credit cards in Malaysia offer a 20-day interest free grace period for all retail purchases.

Let’s work out the math using the example above. The payment due date after taking the 20-day interest free grace period into account would be on August 3.

Paying off the full outstanding amount of RM3,000 before August 3 will not incur any interest charges.

But what happens when you don’t pay in full?

Sure, the amount of you decide to pay on your credit card balance is entirely up to you. There is no requirement for you to settle any individual transactions in full.

Let’s use the same example above again. Making partial payment of RM2,500 will settle the first two transactions in full but will only partially settle the last transaction (i.e. transaction 1 and 2 is settled in full but transaction 3 has an outstanding balance of RM500).

Reducing your outstanding balance in such a manner however, results in you losing your interest free period and gives rise to interest charges.

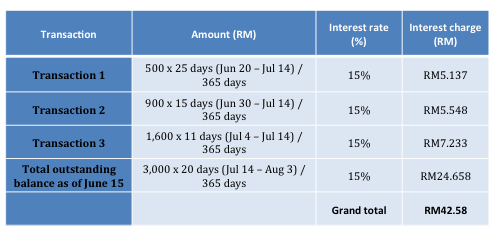

Calculation of interest is as follows:

The above calculation illustrates that when making partial payments:

- Interest free period is not applicable

- Interest of 15% will be imposed on each individual transaction. This begins from the date each transaction is posted

- Interest is imposed on the total outstanding balance as of June 15 (RM3,000) even though only RM500 remains outstanding

What can you do to minimise credit card debt?

Here are a few ways to avoid raking up huge credit card debt:

- Pay in full for small purchases (with cash, or e-wallet credits)

- Use a debit card

- Only charge a purchase to your credit card if you intend to pay in full at the end of the month

- Transfer outstanding balance to a credit card that offers a lower interest rate (fees may apply)

- If you are overwhelmed with insurmountable credit card debt, seek free debt management aid from AKPK

Source: Agensi Kaunseling dan Pengurusan Kredit

Read More:

5 Startling Things About Credit Card Interest Rates

5 Credit Card Mistakes Almost Everyone Makes