7 Things I Did To Get Out Of My RM60,000 Debt

Table of Contents

It’s painful being in (seemingly) insurmountable debt. It was a nightmare, and this is the story of how I survived.

I grew up having to share things (if we had any) with my other six siblings. Fresh into the working world in 2010, I became a “hungry ghost” seeking pleasure in material possessions. Naively, I thought; a sporty car with sleek 16” rims would make me happy. Coupled with my ferocious goal setting attributes, I set out to get everything that I wanted, compiling them in a sacred list called “IIW” – Items I Want (Cute, eh?). And I got all of them at the expense of being deep in debt.

It was only when I needed to get married that I realised the terrible truth: Not only did I have no savings, my impulsive spending habits had set my net worth to be negative 60K!

How did I get into a mountain of debt? Just like anyone else — years of living mindlessly, which not only took a toll on my soul, but also ruined my personal finances too. Here’s the breakdown:

- AEON Credit for Macbook: RM3,000

- Maybank Visa Credit Card: RM28,000

- Personal Loan (3 years): RM30,000

I knew that paying a little bit higher than the minimum payment for my credit cards wouldn’t do it. And I would probably be doing that for the rest of my life (with credit cards interest at a high 17%). It would have cost me countless investment opportunities along the way too.

It took me 25 slow and painful months to finally get out of debt. The sense of achievement I felt when I successfully paid off my RM60k debt was beyond me. It became the inspiration for the first post on my blog, and with that, opened myself to opportunities I would have never imagined.

The short answer to how I did it? Scrape more money from my salary to pay the debts while reducing my expenses significantly.

The long answer? Here are 7 specific things that I did to get out of my financial living hell called, debt:

1. Identify the WHY

Knowing WHY is paramount in every endeavour. Being newlywed with a new addition to the family, the pressure to provide and having to feed another person made me realise that I needed to get my act together. I wanted to provide a stable home for my daughter because she deserved to grow up in a good environment.

Moreover, I knew I needed to start investing, be it properties or stocks to fund more experiences, as well as reduce money-related anxiety. But my gigantic debts effectively ruined my chance to get a housing loan, and affected my motivation to save my capital. How could I save, when my normal end-of-months were just survivor tales of barely making ends meet?

All these realisations led me to my why (well-being of my daughter, more financial freedom), and they became my light at the end of the tunnel. My why provided the pull factor and added edge to strengthen my resolve. If you’re about to tackle a project as big as ‘Slashing 60K Debt’, then my first advice is to know your why. The best why’s are emotional and preloaded with vivid visions of how things should unfold when you have it in the future. Write it in your journal and let it be the beacon of light and hope in your journey.

2. Envelope budgeting

The problem with budgeting, and why people don’t bother to budget at all, is due to the often unrealistic budgets we set for ourselves in the beginning. I experienced it first-hand in the first few months.

I always broke the budget (especially in what I called pure impulse spending). There’s always fancier shirts or skinny pants to buy!

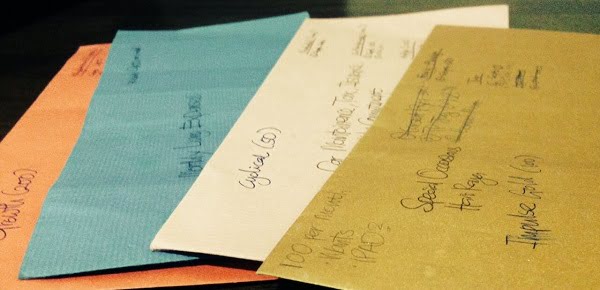

To combat this, I called upon wisdom from the ancient financial technique, called envelope budgeting.

- Withdraw all your money from the bank, every payday. All of it.

- Segregate the money into pre-specified amounts in different envelopes (Utilities, Essentials, Pure Impulse, Growth, Savings, Aafiya – that’s the envelope for my daughter, by the way)

- Transact. Only take out the money when you intend to do the transaction. For example, I would take RM50 from the Essentials envelope when I needed to refuel my car.

Simple? Well, like all budgets, it’s easier said than done. Some common questions people ask:

Kidding.

But it surely was a tense, self-imposed situation. If you’re stressed out, then the envelopes are doing their job. I often needed to shuffle the money from other envelopes (Growth and Cyclical would almost always be the victims), and then pay it back the following month. Or just let go of the books that I’d been eyeing. Stress is also an indication that you’re either living way beyond your means, or not putting in realistic money in respective envelopes in the first place.

Try it for a few months and see your personal finances wrestled back into your control.

3. Track. Every. Cent.

This is hard work. I understand if you haven’t done this before, it will feel like a chore. But after five years doing it — I cannot envision my finances without knowing where the money goes. It provides feedback for how well you’re doing so you can continuously tweak your budget and your finances. Numbers don’t lie, so there will be very little room for rationalisation and assumptions.

The biggest takeaway from my earlier tracking days was that I was spending as high as RM300 a month on cigarettes. Seeing the numbers and knowing that it could otherwise be used to reduce my time in debts led me to attempt to stop smoking. Although I faltered a few times, but I did finally manage to stop permanently.

I did tracking the old school way, writing the expenses daily into my journal and consolidating it manually every month-end. It was tedious, but a few months in, I liked it because I knew exactly where my money went. Do it for a full year, and you get the nuances of cyclical and emergency spending which would definitely be missed if you just guess.

It was only in 2014 that I found a good app for this essential activity. I rave about it to everyone I meet now because of its clean and minimalist design. Hail Spending Tracker!

4. Enlist the “police”

I’m fortunate as I happened to be around friends who are very strict in their finances. Spending time with them, I couldn’t help but get influenced by their thrifty attitudes.

Two of my most stand-out friends deserve an honorary mention here:

Although I’m never going to emulate them to the T, having good examples in how you should conduct your spending is important. Remember the saying: You are the average of your 5 friends.

To step up your game even further, enlist them as your “police”.

What I did was, prior to every purchase (especially major ones), I would need to inform them and be answerable to whether I had the funds to pay for it later. This might be difficult for people with big egos, especially since you need to open up and tell others you need help. Luckily, I didn’t worry about pride, as the insights I got from them were super helpful. I ended up usually postponing my purchases, and even when I did buy, it was because I had a solid plan to pay.

5. Kiss those credit cards goodbye

I’m a huge believer that you can’t get out of big debts without dumping your credit card.

I still vividly remember how I resolved to (or at least started to) end the misery by cutting my credit cards in two and putting them on my vision board — the way ancient warriors put their fallen enemies’ skulls in their living rooms (yes, it’s a morbid example). It symbolised the triumph I achieved over beating my impulsive spending habit.

I highly suggest that if you have big debts, stop swiping altogether. Stop thinking of fancy reward points which are reserved for people with good finances. Stop extending your debt deeper as credit cards can provide a false sense of feeling that you have the money. Go 100% cash or online banking for utility fees. Of course there’ll be some inconveniences, such as travelling with too much cash or miscalculating funds, but another wrong move with your plastics could spell trouble with a capital T.

I would think of this as the ‘exorcising your past demons’ period where you just need to persevere. Think of the better future as a result of your suffering.

6. Stick it in clear sight

They say, out of sight, out of mind, hence, don’t let your goals get out of your sight. Don’t let anything dilute your resolve to kill the debt. Keep it constantly visible.

What I did was put up a table of my debts above my TV (back in the days when I used to watch TV). This way, there would never be a day when I was not reminded of how much debt I still owed. I believe it unconsciously made me more creative in earning more money and to reduce my spending. It led to funny moments too when I had guests staring at my debts, when I forgot to remove the sheet.

7. Earn more, spend less

Sounds cliché? It’s imperative. Whether you’re self-employed or salaried, the simple mantra to sane personal finance is good ol’ ‘spend less than you earn’ or ‘live within your means’.

In my pursuit of cutting debt, I strived in several ways to increase my income. I worked for a promotion for higher salary (and 100% of that increase was channeled to debt busting or savings), took up allowance-based assignments (the place I work pays allowances for offshore trips) and sold old stuff I no longer use.

Spending less, on the other hand is natural once the numbers appear every month-end when you do your tracking. You would figure out that spending RM300 on cigarettes makes no sense. Perhaps you would notice too that you’re spending too much for lunch outside. It might be better to eat at the subsidised café at your office (if there’s one) or bring your own food from home. These sorts of tweaks can only happen once you track your numbers, followed by near obsession in reducing petty spending to the bare minimum.

Getting out of a huge debt requires an overhaul of your lifestyle, not just the way you spend and manage money. Let’s face the facts, the reason why you got into a big debt is probably because of poor money habits, so until you change that, it will be a long road to redemption.

Having gone through this ordeal made me realise that it was a good thing. For me. It enabled me to become a more responsible man to my family, and the permanent changes it caused in me were essential for my growth.

Lastly, if you’re in the same boat as I was four years ago; don’t fret, this is the chance to propel yourself towards a different path and coming out a changed person. And it starts with these simple steps.

On to better personal finance.

Ilhan (or Ilhan Mansiz – an ode to Turkey’s footballing hero) sees the world as a series of projects. He swallowed the red pill, and is on his way to completing the biggest project he ever embarked on: ‘Project Freedom’. Find out what it is and how he intends to do it here.